How much should PLC reference prices be raised? – Part two

Part 2: Considering if Price Loss Coverage (PLC) reference prices matched cost of production estimates.

The Farm Bill has often been a source of support to farms in managing risk. For commodity growers, that aid has centered on reducing risks to production and market prices. Market volatility and tightening margins have made price risk a major concern in recent years. As discussions on a new Farm Bill continue, many calls are being made to reform the Price Loss Coverage (PLC) program to offer more aid. Specifically, several have proposed raising reference prices that act as a trigger for support payments. The question is, how far should reference prices be raised?

In part one of our series, we explored what a 10% increase to reference prices would look like. In part two, we will now look at matching reference prices to cost of production estimates.

Proposal 2: Raise Reference Prices to Match the Cost of Production:

Another suggestion for adjusting reference prices is to base them on cost of production. USDA’s Economic Research Service (ERS) puts together an annual report and forecast of costs and returns for several commodities, including corn, soybeans, and wheat. If based on the 2018 Farm Bill period (2019-2023), cost of production averages would be:

- Corn at $4.39 (based on $781.60 per acre costs and 178.2 bushel yield)

- Soybeans at $10.47 (based on $552.70 per acre costs and 52.8 bushel yield)

- Wheat at $7.97 (based on $372.23 per acre costs and 46.6 bushel yield)

If reference prices were to match cost of production averages, support from PLC would be greatly enhanced. But would support be enhanced enough compared to USDA ERS baseline price projections?

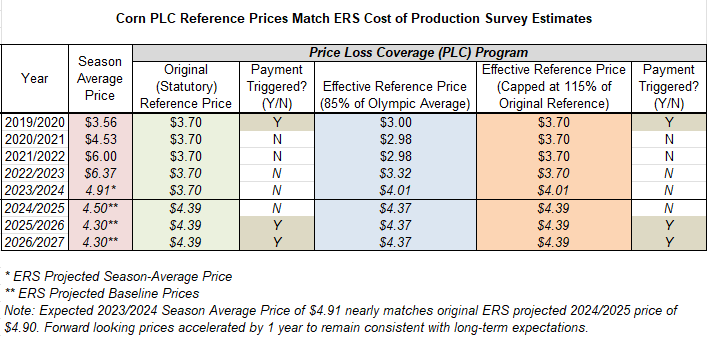

Figure 1 outlines that a reference price at $4.39 for corn would trigger PLC support payments. However, support would not be seen until 2025/2026 and 2026/2027. At a 10% increase, reference prices would only be $0.02 per bushel higher than the effective reference price at $4.37. This makes an increase in reference prices, on their own, relatively ineffective at offering additional support.

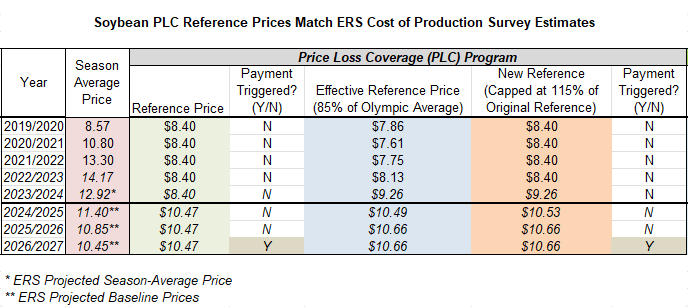

Figure 2 outlines that a reference price at $10.47 would trigger PLC support payments for soybeans. However, support would not be seen until 2026/2027. Payments would also be limited to only $0.02 per bushel if baseline projections are realized. A key difference from corn is the escalator clause would be a factor. At $10.66 this value exceeds a $10.47 reference price, boosting a potential payment to $0.21 per bushel.

Note: A chart for wheat is not shown as a $7.97 reference price would readily exceed projected baselines and trigger PLC support payments.

These charts outline that increasing reference prices based on cost of production does offer slightly more price support. However, payment triggers for corn would be largely indifferent to the effective reference price. For soybeans, an effective reference price is needed to reach a meaningful support level. That would indicate that this proposal would be largely indifferent to a 10% increase in reference prices.

Both proposals in this series outline the difficulties that exist by simply raising reference prices. With current market price projections, reference prices must be raised high enough to trigger support. Price must also be high enough to offer more meaningful support compared to the escalator clause. But with congressional budgetary restraints, raising reference prices to those levels may be challenging to get passed. Such challenges will require alternative options for Congress to consider in improving support.

Print

Print Email

Email