Learning the basics regarding your money habits

In the 4-H Build A Million curriculum, one of the units is called Learning the Basics. This covers budgeting, credit cards, investing and saving early.

Youth ages 14-18 and in grades 9-12 have an opportunity to learn more about financial literacy by using the 4-H Build a Million curriculum. This online course helps young people develop an understanding of their personal finances, as well as touches on basic investing for youth. These activities can also be easily adapted for younger children in middle school.

This is the second part in a series of six Michigan State University Extension articles to share what is in the curriculum, what basic information is covered in the curriculum and give adult volunteers, parents or financial professionals materials to help teach the information for financial literacy.

The second unit is called “Learning the Basics.” This unit has four lessons that cover key concepts in the following areas:

- Budgeting and saving.

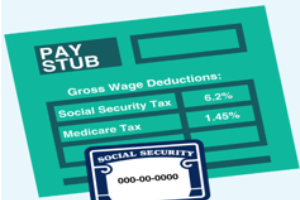

- Basic information on learning how credit cards function and understanding credit card terminology when the statement comes to review.

- Investing money.

- Saving early and the benefits to starting young.

In each lesson there is a learning objective overview to help the instructor understand what is being taught in each of the lessons. There is a given time and a list of what materials are needed to teach that unit/lesson. Additional resources are also listed to help get these concepts across to the young people.

The key concept of the first lesson on budgeting your money is to have young people understand what actually a budget is and why it is needed. An icebreaker called “How You Would Spend It?” helps youth review a situation. Then an activity follows where youth are given a chart to record their expenses for an entire week. At the end of the week, youth add up the totals and see what they spent in a given week. Discussion can follow as they explain what they used their money for, such as needs, wants, etc. This unit can be used on its own or can be followed along in the 4-H Build a Million curriculum.

The 4-H Build a Million curriculum can be downloaded for free at the 4-H Build a Million website. Be sure to check out the Michigan 4-H Youth Development website for further information regarding financial literacy and working with youth.

Michigan State University Extension and Michigan 4-H Youth Development help to prepare young people for successful futures. As a result of career exploration and workforce preparation activities, thousands of Michigan youth are better equipped to make important decisions about their professional future, ready to contribute to the workforce and able to take fiscal responsibility in their personal lives. Read more in the 2017 Impact Reports.

Print

Print Email

Email