Youth can build credit history through positive use of credit cards

Credit cards can aid in building a credit score if you use them wisely.

Today’s young adults are a major contributor to the economy and are poised to be the nation’s next biggest spenders. It seems logical to help them use their spending in a way that will positively impact their future and help them build a solid credit history. While there are a variety of ways to establish a solid credit history, one useful and effective method can be through credit cards.

EVERFI and AIG Retirement Services recently surveyed more than 30,000 college students about their financial behaviors and knowledge. According to the 2019 research, the percentage of students using credit cards in college has increased from 28% in 2012 to 46% in 2019. The percentage of students with more than one card has also increased from 25% of college students to 45%. While using credit cards can help build positive credit, the research also found that the percentage of those students who never paid a credit card bill late decreased from 91% in 2012 to 78% today.

In addition, for students with credit cards, 36% already have more than $1,000 in credit card debt. While percentage changes could be influenced by a variety of factors, it does demonstrate the importance of education around the proper use of credit.

First, it is important that young people recognize good credit is a privilege to be earned. It takes time to build a good credit history that can then benefit them for years to come. They must also understand that debt is easy to get into, hard to get out of and if not managed, can result in a poor credit rating that will negatively affect them for 10 years or more. As indicated by the research, unfortunately, many young people do not understand the implications of spending beyond their means with credit cards.

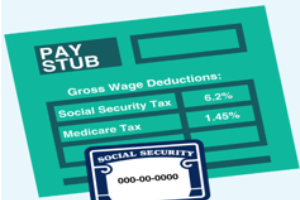

A credit card is a form of borrowing money. When a young person signs a credit card application, it is binding. It represents an agreement to repay dollars borrowed through the privilege of using a card to pay for something instead of cash. If payments are made prior to due dates on bills received, over time the youth creates a history of consistent, timely repayments and a good credit score is built. A higher credit score will make it easier in the future for students to rent an apartment, take out a home mortgage and command better interest rates on insurance policies or loans. It may even help them to secure a job.

Michigan State University Extension recommends a few steps to help youth on the right path to positive credit:

- Help youth research credit cards and choose one that is right for their needs and situation.

- Establish a system with youth for tracking their charged monthly expenses. This provides a visible picture of how much debt they are incurring.

- Have youth be accountable for paying their bill each month out of their personal checking account. By doing this, they will become accustomed to bill paying procedures and track any remaining account balance.

- Teach youth how to pull a credit report through the agencies of TransUnion, Experian and Equifax. One report is available free of charge from each of these agencies on an annual basis. Youth and adults should access their credit report using AnnualCreditReport.com, a federally authorized website that provides free access to a credit report every 12 months.

Michigan State University Extension and Michigan 4-H Youth Development help to prepare young people for successful futures. As a result of career exploration and workforce preparation activities, thousands of Michigan youth are better equipped to make important decisions about their professional future, ready to contribute to the workforce and able to take fiscal responsibility in their personal lives. For more information or resources on career exploration, workforce preparation, financial education, or entrepreneurship, contact 4-HCareerPrep@anr.msu.edu.

Print

Print Email

Email