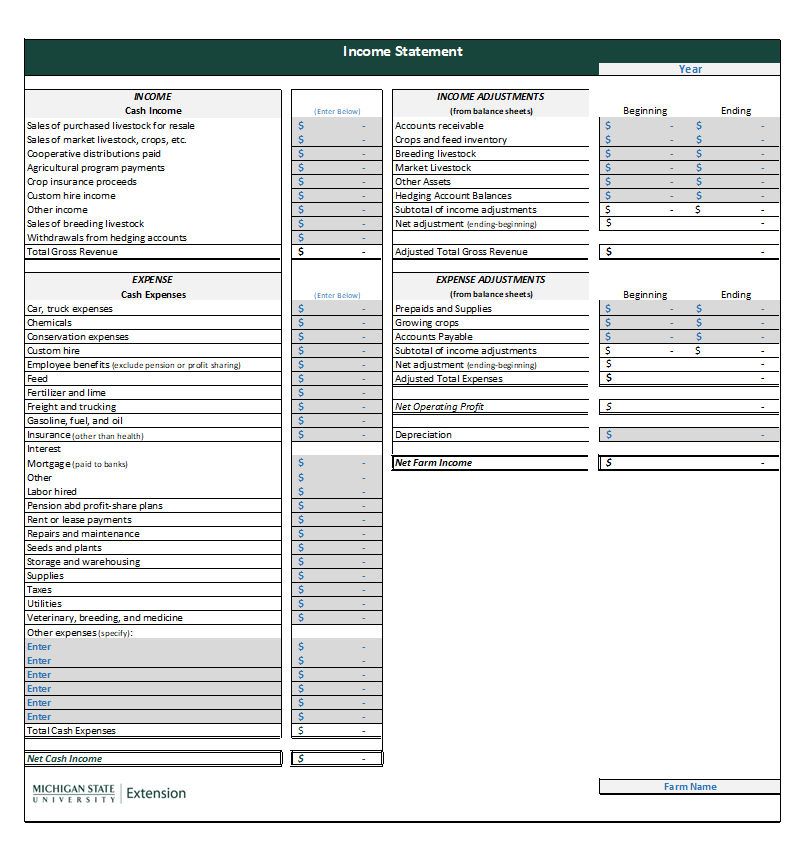

Creating an Income Statement for Your Farm

April 16, 2022 - Jonathan LaPorte, Michigan State University Extension

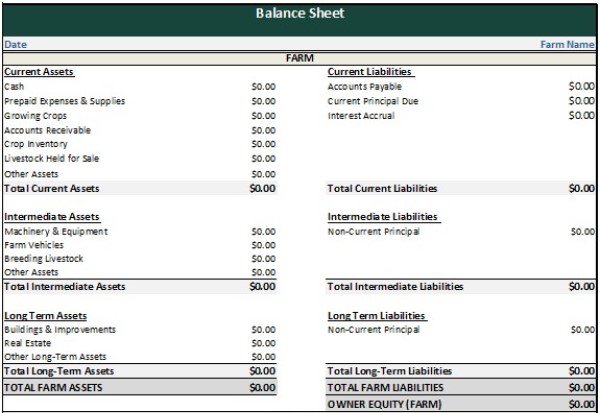

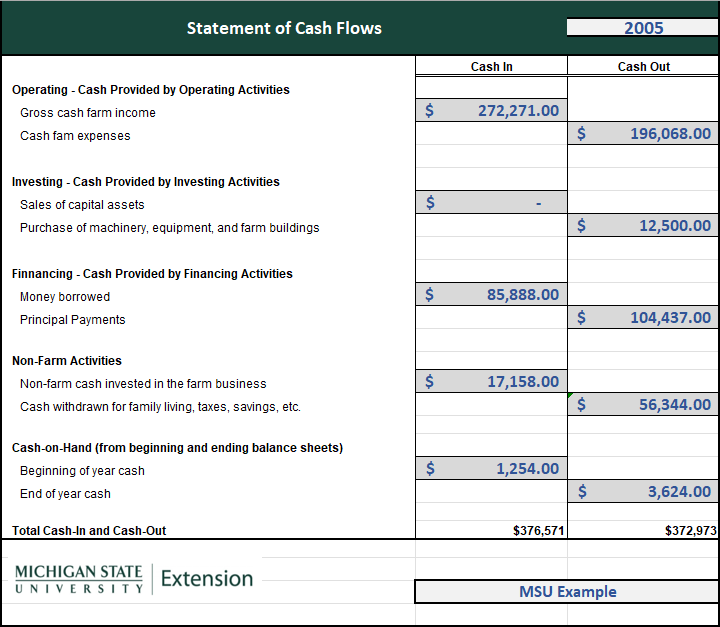

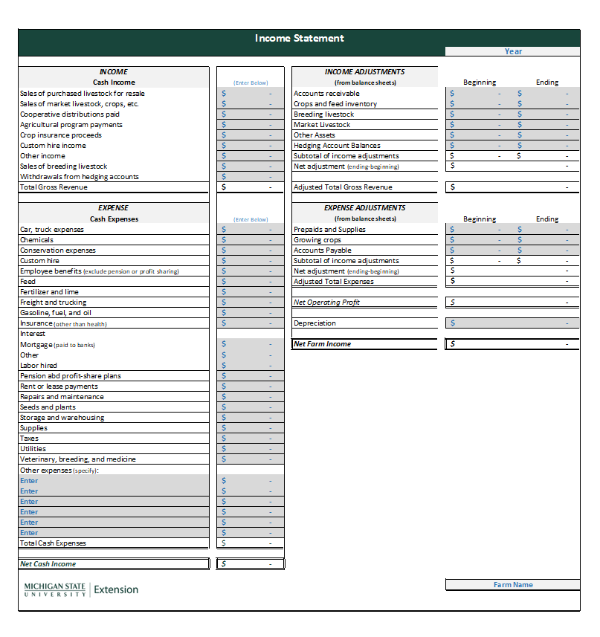

The income statement provides a measure of the profitability of a farm or business over a specific period of time. While a tax year income statement can be created, the preferred version is based on the farm’s production year. A production year income statement shows all of the income and expenses from inventories and cash transactions for your farm.

The following videos outline differences between tax year or production year viewpoints and how to create an income statement:

Income Statement: Tax Year View – 1:42 minutes

A short video outlining how an income statement based on tax year information can be created.

Income Statement: Tax vs. Production Year View – 5:23 minutes

A video showcasing differences between tax and production year viewpoints and an example of how that information can be useful to farm managers.

Income Statement: Revenue Section (Production View) – 5:49 minutes

A walkthrough of how to take the "revenue" section of an income statement based on tax information and convert it to a production view.

Income Statement: Expenses Section (Production View) – 5:55 minutes

A walkthrough of how to take the "expenses" section of an income statement based on tax information and convert it to a production view.

For more information on income statements and fillable forms available for your farm, visit: Beginning Farmers DEMaND - Farm Financial Statements Page

Print

Print Email

Email