Bulletin E-3416 Introduction to Grain Marketing

DOWNLOADSeptember 7, 2021 - Jonathan LaPorte and Matthew Gammans, Michigan State University Extension

The most important goal of any farm business is to be profitable. Farm managers achieve profit by generating more revenue than the farm has expenses. For a grain farm, achieving enough revenue is a combination of producing bushels and securing a good selling price. But what is a “good” selling price?

As a decision-maker on the farm, you will define what a good selling price is for your business. However, defining a grain price that is good and profitable is not an easy task. Many factors, both local and global, influence the prices available during the year. Pricing tools can help, but knowing how and when to use them adds another layer of difficulty. Understanding the complexities involved can make grain marketing a challenge for even a seasoned farm manager.

This publication will aid you in understanding the fundamental principles involved in grain marketing. It includes a review of the commodity futures market and the ways it influences the price you receive for your grain. It explains how and when to use pricing tools. Additionally, it focuses on marketing plans, including ways to develop a pre-harvest and post-harvest plan to fit your specific farm needs. These valuable concepts can build your comfort and confidence in marketing grain for your farm business.

Basics of Grain Marketing

As previously stated, the most important goal is to be profitable. To sell grain at a profit, you need to establish what a good price is and determine if it is profitable. This is important because there are times when the market will not offer a profitable price. Identifying if a good price is available is the first step in deciding what marketing strategies you’ll want to use.

One of the most common misconceptions is that a good price is the highest price the market will offer. Producers that set their goal as the highest price often wait until they think the market has peaked and then sell their grain. Pursuing the highest price often creates a tendency to ignore risk management principles. This can be harmful to your farm, especially if markets are experiencing volatility. In a volatile market, prices can move up or down very quickly. If prices continue to drop, this can lead to settling for lower profits or no profit at all.

Cost of Production

The key to establishing a price and protecting against profit loss is to have a clear understanding of the farm’s cost of production. Knowing what costs went into producing the grain establishes a minimum price that must be met. Identifying your cost of production requires good, accurate details in your farm records. It also requires an understanding of what costs should be included in establishing a minimum price. For more information on cost of production, review the Michigan State University (MSU) Extension DEMaND bulletin Introduction to Cost of Production and Its Uses (E3411) at https://www.canr.msu.edu/resources/bulletin-e-3411-introduction-to-cost-of-production-and-its-uses.

Every farm differs in how it produces grain and operates the business. This difference means that your cost of production and minimum price will be different from your neighbor’s. As a separate operation, your concern is ensuring your marketing strategies meet or exceed your minimum price. However, you also want to know what the neighbors and the industry need to cover costs. If your minimum price is significantly higher in comparison, the likelihood is that your business is paying too much to operate. No amount of market planning or strategizing can make up for inefficient and expensive operating costs. To determine if your farm has a higher minimum price, compare it to industry standards and then identify the expense areas needing more management. To review industry standards and compare them to your costs of production, visit the Farm Financial Management Database or FINBIN at https://finbin.umn.edu/.

Commodity Futures & Cash Markets

The commodity futures market trades crops, livestock, oils, fuels, and metals on a global scale. It serves several economic functions for buyers and sellers of commodities. One of the primary functions is to transfer risk. Sellers can have risk in storing their crop or volatility causing price changes. Buyers have the risk of supply shortages and similar concerns about pricing changes. The market allows for price discovery and flexibility in determining a final price for a product. It can also aid in coordination of economic activities and market stabilization. For the purpose of this publication, we will focus on how the futures market influences selling your grain.

The most direct way to interact with the futures market is to take out a future contract. This is an obligation to buy or sell a fixed quantity of a commodity at some point in the future. The centralized marketplaces where buyers and sellers of these commodities meet is called the futures exchange or market. The price that is agreed to within the contract is called the futures price. Think of the futures price as the world price for each commodity in the market. It is set by the world supply and demand and can be quoted at various points in the future (March corn futures price, July corn futures price).

Your farm’s grain isn’t sold on the futures market, but at a local (domestic) price to a nearby cash market (grain elevators). The local price is called the cash price. This is the value agreed upon for immediate delivery of your grain or for accepting the current price for grain delivered earlier but not sold. There is no commitment to deliver a specific amount and it is an easy way to get cash quickly. The downside to a cash price is that timing of delivery can be inconvenient, especially at harvest. The cash price is also influenced by the futures price and basis on the date of sale. A common equation to calculate cash price is:

Cash Price = Futures Price + Basis

Basis is the difference between the current cash price and futures price with the nearest expiration date. For example, the basis on February 1 for a grain elevator in Webberville, Michigan, is the difference between the elevator’s cash price and the price listed on a March futures contract (as of February 1). The difference between cash and futures prices is often a negative value and based on conditions at local grain elevators. These conditions can include transportation, storage and interest costs, and local supply and demand. Some examples of local supply and demand factors in Michigan include ethanol plant locations and geographic variations in yields.

A basis can be described as either strong or weak based on its relationship to futures and cash market prices. A strong basis is when the difference between cash and futures is very small or narrow. A narrow or strong basis is less negative or even positive. A weak basis is where the difference between cash and futures is very large or wide. A widening or weak basis is more negative. To better understand the relationship, the previously shown common equation for a cash price can be reformulated to focus on basis:

Basis = Futures Price – Cash Price

Basis can also be defined as strong or weak through comparison. One option to compare basis would be to look at local elevators. Is the basis at one elevator more or less negative than a second elevator in your area? An option to identify the basis is the local grain bid reference tool offered through DTN and Progressive Farmer located at https://www.dtnpf.com/agriculture/web/ag/markets/local-grain-bids.

Another option to compare basis is through Purdue University’s Crop Basis Tool. The tool provides historical basis values averaged over selected years compared to current regional basis values on corn or soybeans. This is helpful for understanding how basis varies seasonally. Find the Purdue Center for Commercial Agriculture Crop Basis Tool at https://ag.purdue.edu/cropbudget/multi.php.

Market Environment

Understanding the relationships between futures prices, cash prices, and basis are key in establishing a price for your grain. Another key is in understanding the market environment that prices and basis are being based on. Are production risks creating concerns about enough supply to meet market demand? Have situations either at local or global markets changed so that demand isn’t nearly as strong as it was before? Or has demand dramatically increased?

The market is constantly adapting to new information that tries to answer these questions. Depending on what the answers appear to be, prices, the basis, or both can be affected as the market reacts. Sometimes this information is unclear, and this creates speculation. This can create a volatile and risky environment in which to price grain.

As a grain producer, you don’t want to base decisions entirely on speculation. Staying informed about changes in local or global supply and demand is critical to your role as a farm manager. To help producers better understand the market environment, the U.S. Department of Agriculture provides a monthly report called The World Agricultural Supply and Demand Estimates (WASDE). This provides an estimate of supply and demand for commodities based on analysis of domestic and foreign sources. To read a copy of the latest WASDE report, visit https://www.usda.gov/oce/commodity/wasde.

Historical Pricing Patterns

Although the market can be volatile and risky at times, patterns or trends can be seen year after year. To understand these patterns or trends, it helps to start with an understanding of the marketing season. The marketing season is the period where prices focus on the current production (old crop) before shifting to expectations on next year’s production (new crop). New crop begins on the first delivery month the market lists a price for following the start of harvest (Table 1). The marketing season then carries forward to the last delivery month before the harvest of next year’s production.

|

Table 1: Marketing Seasons for Grain Commodities |

||

|

Crop |

Start of marketing season |

End of marketing season |

|

corn |

December |

September |

|

soybeans |

November |

September |

|

wheat |

September |

July |

One of the key aspects of the marketing season for your current crop is that it overlaps with the planting of next year’s crop. This means that you can be making marketing decisions for both your old crop and new crop bushels at the same time. This overlap also helps to explain the pricing patterns that are historically seen in the market.

Based on estimates throughout the growing season, the market tends to have a good idea of what harvest production will be for most commodities. In most seasons, there is an ample supply of the commodity at harvest time. The abundance of supply often means that prices begin to decline from harvest through the months to next year’s crop planting. This period of decline would be November/December to April/May for corn and soybeans.

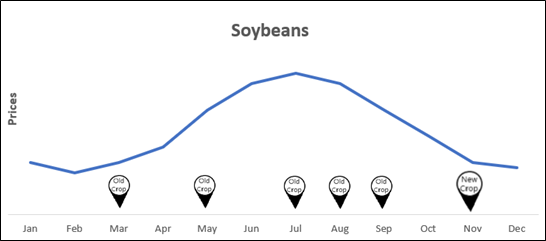

Figure 1. Typical market price pattern of soybean.

Prices then tend to increase from planting (April/May) and continue upward over the summer months through July. The increase seen in this period is based on the uncertainty of new crop yields and remaining old crop supply. As Figure 1 outlines for soybeans, the market begins to receive information about the potential of the new crop being grown about July. The expectations of an increase in availability of bushels at harvest starts to drive prices back down to traditionally normal prices for that period.

Wheat prices tend to decline in the spring toward the final harvest month of July. Following harvest, prices slowly, but steadily increase until about November or December, once planting is completed. At this time, the prices increase a bit more sharply until the next spring period when the pricing cycle repeats.

Understanding pricing patterns is important to determining when the best prices typically are available. You can use this understanding of pricing patterns to provide some target periods to help you evaluate your decision options. It also helps to understand when the market environment is reacting differently than it normally would be in a period. Prices higher or lower than expected indicate supply and demand impacts that are shifting the market environment. The expected short- or long-term effects of those impacts may change the direction of your marketing decisions.

Carrying Charges

Futures prices are offered on the month of intended delivery. For example, the price of wheat for March might be $5. This is the futures prices offered if the wheat were to be delivered in that month. A price for May delivery of wheat is offered at $5.15. The difference between the two delivery months is $0.15 and is also known as a carrying charge. Carrying charges provide an indicator of whether you should store grain or price it and ship right away.

You can also think of carrying charges as market determined storage costs. The futures market decides whether it wants to take the sale of grain now or will pay to wait for a later delivery. The cost of waiting is the difference between the prices of the two delivery months. This cost is considered what the market is willing to pay for storage. If the market is willing to wait for the commodity and pay for storage, carrying charges are often large. If the market is unwilling to wait for delivery and not pay storage costs, carrying charges are often small.

Your Farm’s Storage Costs

The storage cost determined by the market can be different than the cost of storage for your farm. If you are using commercial storage, the monthly cost can range from $0.01 to $0.10 per bushel.

If you have on-farm storage, the cost of the investment to purchase the structures and equipment are not part of the annual marketing decision. However, the cost of storing the grain for any length of time is part of your decision process. This includes the interest on your grain inventory, extra drying costs, extra shrinkage, aeration of grain, and extra handling.

For more information on calculating the cost of storing grain, view the Iowa State University publication outlining these costs and how to calculate them at https://www.extension.iastate.edu/agdm/crops/html/a2-33.html.

Delivery Basis: Strong or Weak?

There are two periods that basis needs to be evaluated. The first is at harvest time and the second is at the alternative delivery period you are considering. Both periods may appear to have a strong or weak basis as you compare cash and futures prices. To help decide which period provides the best opportunity, consider the market’s carrying charges.

For example, the market shows a carrying charge of $0.35 per bushel between December and May futures prices on corn. The December futures price is $5 per bushel, while the cash price is $4.50. There is a $0.50 basis for a December sale. The May futures price is $5.35 per bushel, but the cash price is $4.25. There is a basis of $0.90 per bushel. The carrying charges indicate that the futures market is willing to wait for delivery. However, the local cash market has a weaker basis for May than it does in December, indicating it wants the grain now. What is the correct choice in this scenario?

The answer has to do with understanding what is considered a “normal” historical basis for the cash market. Purdue University’s crop basis tool provides an option to identify the historical basis for your local area averaged over selected years compared to current regional basis values on corn or soybeans. You can select Michigan and your county to compare local information. Find the Purdue Center for Commercial Agriculture Crop Basis Tool at https://ag.purdue.edu/cropbudget/multi.php.

Another option is the DTN–powered market tool through Progressive Farmer. It provides information on futures prices, local grain bids, and the national cash index for corn, soybeans, and wheat. The national cash index chart illustrates current futures and basis compared to historical averages. Access the tool at https://www.dtnpf.com/agriculture/web/ag/markets/national-cash-index.

If the basis is weaker than normal, it might be worth storing the grain and waiting to see if it improves. If the basis is already at normal levels and you are concerned it won’t change or could get worse, it may be worth selling the grain now. This is where your understanding of the local cash market and your own adversity to risk are important factors.

Adversity to Risk

The market environment can sometimes provide mixed signals, such as in the case of carrying charges and basis levels. These mixed signals can elevate the amount of risk that you have to contend with, making grain pricing decisions more difficult. How much risk you are willing to take is an important consideration. One simple way to manage risk is to sell throughout the year using a handful of different marketing tools.

If you are risk averse, you may not want to wait for potential price changes, especially if the price available now covers your cost of production. It may not be the best price down the road, but it’s an acceptable price given your operation. On the other hand, if you are less averse to risk, you may be willing to pass on a good price for the potential of a better price.

You don’t have to sell all of your grain at once, especially if you have on-farm storage. In most cases, the logistics involved to sell and haul grain to market takes time and planning. You also have the option to use pricing decision tools to help spread out your grain sales.

Consider an example farm with 750 acres of soybeans averaging 40 bushels per acre at harvest. Storage is available for the total 30,000 bushels, although some grain is sold at harvest to establish a starting price. The remaining bushels will be stored and sold along typical market price patterns. Table 2 outlines the farm’s proposed timeline of grain sales. It considers the typical market price pattern and uses on-farm storage to spread risk out over several delivery periods.

|

Table 2: Using Typical Market Pricing Patterns and On-Farm Storage |

||||||||

|

Sale month |

November |

December |

January |

February |

March |

April |

May |

June |

|

Bushels sold |

3,000 |

3,000 |

0 |

2,000 |

2,000 |

6,000 |

7,000 |

7,000 |

|

Bushels stored |

27,000 |

24,000 |

24,000 |

22,000 |

20,000 |

14,000 |

7,000 |

0 |

The proposal attempts to reduce risk by selling grain during peak marketing months but presents a logistical challenge as well. The majority of planned sales overlap during the months of new crop planting (April through June). Most farms seldom have enough personnel and equipment to deliver large amounts of grain at the same time as planting activities. In many cases, all farm personnel are focused on planting the new crop. In this situation, the use of price decision tools can help develop an alternative plan.

|

Table 3: Using Marketing Tools and On-Farm Storage |

||||||||

|

Sale month |

November |

December |

January |

February |

March |

April |

May |

June |

|

Bushels sold |

3,000 |

3,000 |

6,000 |

6,000 |

6,000 |

3,000 |

3,000 |

0 |

|

Bushels stored |

27,000 |

24,000 |

18,000 |

12,000 |

6,000 |

3,000 |

0 |

0 |

Table 3 illustrates an alternative plan for grain sales. This new proposal focuses on sales during months between harvest and planting. Prices may be lower during these months, but farm personnel and equipment are more readily available. The risk of not having grain to sell during potential price increases can be offset by pricing decision tools. The question is: which tool should the farm use?

Pricing Decision Tools

Pricing decision tools can help to mitigate the risks that prices move in opposite or unfavorable directions for your farm. In some cases, you can use multiple decision tools together to provide the best protection against risk.

Storing Unpriced Grain

Though it is not often thought of as a pricing decision tool, the decision to store unpriced grain is often the most common choice made by producers. The expectation is that market prices in the coming months are going to follow their normal patterns of futures prices going up and basis strengthening. This provides an opportunity to capitalize on cash market prices if the grain is present. However, by itself, it provides no protection against the risk of futures prices dropping or basis weakening.

Delayed Pricing Contracts

A delayed pricing contract is an agreement to deliver grain that you will price at a later time. The grain is owned by the elevator while you are charged for storage and service. This provides flexibility in pricing the grain when a better opportunity exists. There are no minimum or standard amounts to the contracts, so the amount of grain to sell is negotiable. These contracts are generally easy to understand and oftentimes you work with local grain elevators you are familiar with. The downside to this type of pricing tool is that there may not be a better opportunity to price grain. Additionally, most delayed pricing contracts are made prior to planting, so there is no price established before deciding to produce the crop.

Forward Contracts

A forward contract establishes a set cash market price for your grain at a future date. It is an agreement to deliver a specific quantity of a commodity to a grain elevator. The contract outlines the delivery period, location, and required quality of the grain for a specified price. There is no standardized amount of the commodity that must be delivered, which provides some opportunity for negotiation on contract size. The forward contract is a common tool for producers with limited on-farm storage or who wish to lock in cash prices ahead of the harvest season. It locks in both futures and basis simultaneously to establish the cash price.

Hedging

Hedging is defined as taking equal but opposite positions with regard to cash and future markets. By taking an opposite position within one market, you can offset the risk that exists in the other market.

As a grain producer, you start out having already taken a position within the cash market by producing your crop. The cost of production not only establishes a minimum price to market, but also establishes the price you’ve paid to own the bushels. The opposite position would be to sell on the futures market. Owning your bushels is referred to as being “long in the market.” Alternatively, selling your bushels at the time of harvest would be referred to as being “short in the market.” If you sell your grain, you are exiting the cash market. The opposite position would be to buy a futures contract and enter the futures market.

Future Contracts

A futures contract is a contract traded on the futures exchange market. In the U.S., this is typically the Chicago Mercantile Exchange (CME). It provides the opportunity to sell or deliver a standardized amount of grain during a particular month for a specified price. For corn, soybeans, and wheat, the number of bushels to be sold or delivered is exactly 5,000 bushels per contract.

To establish and maintain a futures contract, a brokerage firm is used. Brokerage firms track the progress of the market across the lifetime of the contract. Brokerage firms also handle the tracking of the futures margin needed to maintain the contract in good standing.

The initial or origin margin is the amount deposited to establish the contract. This is often a small percentage of the total value of the futures contract plus brokerage fees.

A maintenance margin is the minimum amount of money that needs to remain available to cover any losses if prices fall. Since the initial margin is only a percentage of the total value, the market needs assurances that the contract can be fulfilled. If price changes cause the margin to fall, additional money may need to be deposited to re-establish the maintenance level. For example, the maintenance margin on a corn futures contract is $1,000. If the price of corn drops 5 cents or $250 (5,000 bushels x $0.05), an additional $250 must be supplied to the brokerage firm to maintain the available funds at $1,000.

A margin call is when the value of the account falls below the maintenance margin level. The value of the account is based on the total value of the futures contract. For example, a 5,000-bushel contract valued at $3.50 per bushel is worth $17,500. The maintenance margin is $15,000 and the futures price falls until the account is worth $14,000. A margin call is made by the brokerage firm requiring $3,500 be paid to bring the account back up to the initial margin level.

The use of a futures contract is not very common for farm operations that are limited on available cash to maintain margin levels. Many farm operations are also not equipped to handle delivery to market locations or storage to receive 5,000 bushels of grain. Most grain producers focus instead on using options to buy or sell futures contracts as a means of gaining some additional value.

Put or Call Options

Another set of pricing decision tools are options on the futures market. Options provide the right, but not the obligation, to buy or sell a futures contract. A put option provides you the opportunity to sell a futures contract on the futures market. A call option provides you the opportunity to buy a futures contract.

When buying or selling options, there is a set of predetermined price levels called strike prices. These strike prices are your starting or entry point into the futures market regardless of the current futures prices. For example, if you have a corn option with a strike price of $3.50 per bushel and the futures market is $3.75 per bushel, your futures contract to buy or sell is for $3.50 per bushel. Each commodity has a list of strike prices you can choose from when purchasing an option: every 25 cents for soybeans, 10 cents for corn, and 5 cents for wheat.

Some common terminology marketing economists use frequently with strike prices follows:

In-the-money is when there is a positive value to be gained by exercising the option. For a call option, the futures prices would be above the strike price. This means you have the option to buy the commodity at a lower price. For a put option, the futures prices would be below the strike price. This means you have the option to sell the commodity at a higher price.

Out-of-the-money is when there is no value to be gained by exercising the option. For a call option, the futures price is below the strike price. This means that the cost of buying the commodity would be higher than what is currently available on the market. For a put option, the futures price is above the strike price. This means that the price of selling is lower than what is currently available on the market.

At-the-money is when the strike price of your option and the futures price are exactly the same. If the futures prices were to change by even one cent, the option would be either in-the-money or out-of-the-money.

To exercise that option, you will have to pay a premium. This is the only part of your futures contract that is negotiable between you and the seller of the option. All other terms are already standardized in the futures contract itself. The premium also establishes the most you can lose if you exercise the option at-the-money. A premium is also required even if you let the option expire. An expired option has no value other than the cost of the premium. This fixed cost is an important consideration in the use of options as a marketing strategy.

Once you’ve entered the futures market, you will need to consider your exit strategy. One choice is to fulfill the contract by delivering or taking receipt of the bushels. Delivering contracted bushels is complex to arrange and generally not advised. One commonly used method is to lift the hedge by taking the opposite position used to enter the futures market (for example, buying futures contracts to offset those you've sold). Alternatively, you can sell futures contracts to offset those you've bought. You could also use put options or calls to enter or exit the market. Work with your brokerage firm when developing a plan to execute a hedge.

For more information on futures options, view the Iowa State University publications outlining their uses. They include Grain Price Options Basics at https://www.extension.iastate.edu/agdm/crops/html/a2-66.html and Options Tools to Enhance Price at https://www.extension.iastate.edu/agdm/crops/html/a2-68.html.

Minimum Price Contract

In a minimum price contract, a minimum sale price is established. You are guaranteed either the current cash price or the minimum sale price, whichever of these two prices is greater. To use this contract, you will pay a fee similar to an option premium.

This type of contract provides risk protection against lower prices by establishing a price floor. Upside price potential still exists if the current price at the time of delivery is greater. This is an alternative to working with futures contracts or options, and there are no margin calls. As with a forward contract, the number of bushels to be priced in the contract are also negotiable.

Hedge-To-Arrive

A hedge-to-arrive is a cash contract that allows you the opportunity to lock in the futures price for the delivered quantity. The basis is not set at the time of the contract being written. As the contract holder, you set the basis at some later date prior to delivery of the grain.

This provides an opportunity to take advantage of marketing periods when the basis is unusually getting weaker (widening) when normally it would be stronger (narrowing). Hedge-to-arrive contracts are notably helpful when there is a significant amount of volatility, and market prices can rise or fall almost without warning. As with option premiums, there are fees to establish a contract. These fees offset the use of margin calls. As a result, the elevator handles the margin calls rather than the farmer. Not having to worry about margin calls is one of the biggest benefits of a hedge-to-arrive contract.

Basis Contracts

A basis contract is similar to a hedge-to-arrive contract except that the basis is now locked in instead of the futures price. The basis is selected relative to a specific futures contract. At a later date, you indicate the date that you wish to establish the futures price. The difference of the futures price and basis sets the cash price you’ll receive for the grain. This provides some flexibility to lock in a futures price if it is better at a later date. There are no standardized quantities, and the contract terms are generally easy to understand. The downside of a basis contract is that futures prices may not be better later on, and futures are often more difficult to forecast than basis.

Market Expectations & Decision Tools

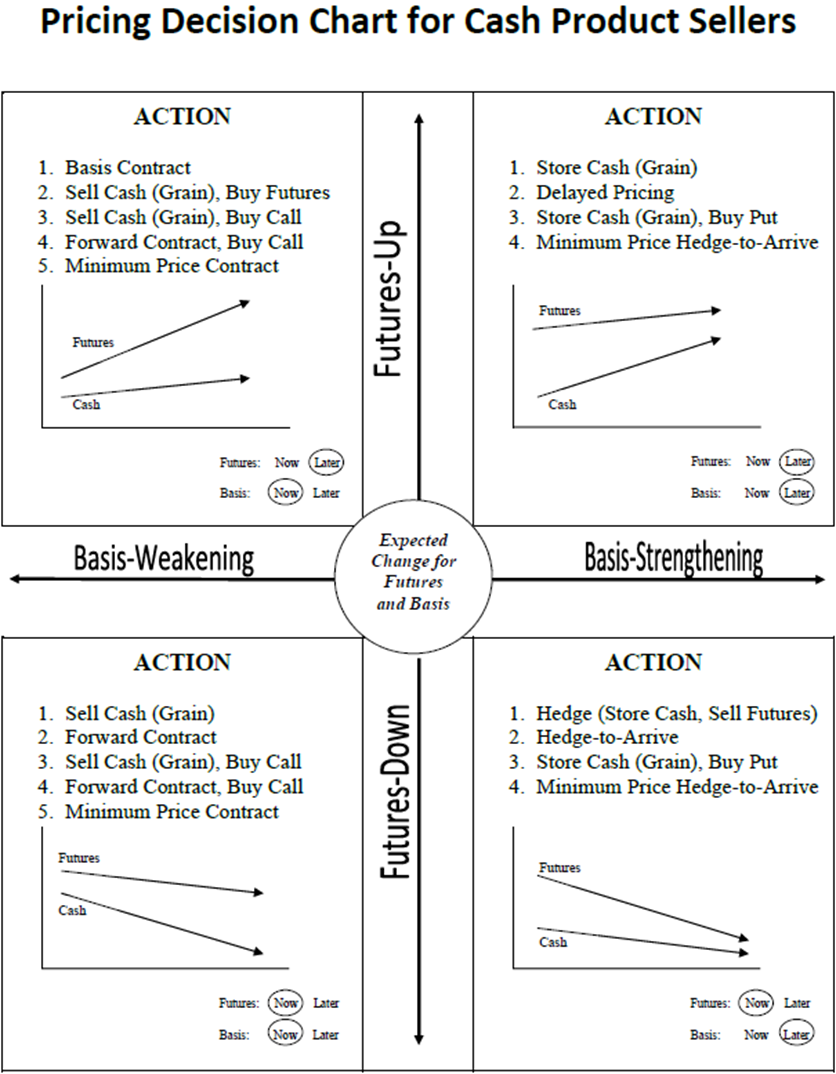

Understanding what the pricing decision tools are is just one part of the marketing process. The second part is knowing what marketing conditions are expected and which tools can provide the most benefit. The key is to establish expectations on what basis and futures prices will do. Figure 2 illustrates four different market scenarios related to futures prices, basis, and cash prices. Each scenario outlines which pricing decision tools are best suited to help maximize the potential revenue for your grain sales.

Figure 2: Chart outlining the pricing decision tool options based on the expected market direction of basis and futures prices.

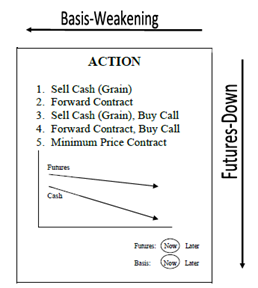

Basis Weakening, Futures Prices Down

When basis is expected to weaken and the futures prices to go down, expect the cash price to trend downward as well. This trend indicates you want to lock in both the basis and the futures price now. You can take a number of actions, including using pricing decision tools (Figure 3).

The first option is to be “short in the market” and sell the grain, often referred to as selling cash. With a cash price that is trending downward, the indication is that it is not in the farm’s best interest to store or hold onto grain long-term.

Another action is to use a forward contract. The logistics involved to move grain can make it difficult to haul all of your production to the elevator at once. The use of a forward contract allows you to lock in a cash price at a time and location that is more advantageous to grain hauling. It also allows you to lock in the grain elevator’s deferred cash price, locking in futures and basis. This is often used to establish a new crop selling price.

Buying a call while either selling grain or using a forward contract provides some risk protection if the futures price unexpectedly goes back up. You can use the call option to “re-enter” the market, purchasing a contract at a lower price than it is currently valued, and sell the contract for a profit.

A minimum price contract provides an alternative to the use of futures options while still offering the opportunity to capture profit from an unexpected price increase. You still pay a fee for its use but it may be easier to understand and use with your grain elevator.

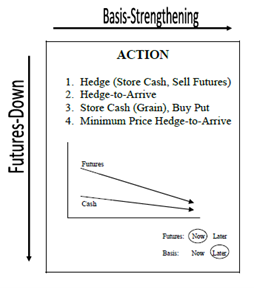

Basis Strengthening, Futures Prices Down

When basis is expected to strengthen and the futures prices to go down, expect the cash price to trend downward. However, in this scenario, you only want to lock in the futures price now. The basis should be left to lock in later, because the expectation is that it will be better later on. With this change in expectations, the pricing decision tools you want to use also change (Figure 4).

The first option is to simply hedge the market: choosing to stay “long in the market” by storing your grain and selling a contract on the futures market. The futures contract locks in the futures price at the time of sale. At some later date, as the expected prices continue to move downward, you exit the market with the purchase (buying) of an offsetting futures contract. This allows you to “buy low and sell high” with some measure of profit. At the same time, you still have the grain to sell on the cash market. The combination of futures profit and cash grain sales is often better than simply selling grain alone in this scenario.

A hedge-to-arrive (HTA) contract is another option to consider in this scenario. If basis strengthens as expected, you get the benefit of the higher futures price from this period and the stronger basis later on, yielding a higher net cash price.

Another option is to store the grain and buy a put option. You can store the grain for a later sale on the cash market. The put option provides the opportunity to sell a futures contract at the price that exists currently and buy an offsetting futures price at a later date. Similar to the hedging option, this allows you to “buy low and sell high” with some measure of profit.

One option that is also available is a combination contract of a minimum price HTA. This is a contract that combines the ability to lock in the futures price and also set a minimum price floor. The upside potential for the cash price effectively allows for the opportunity to capture a stronger basis. At the same time, the risk of prices falling are offset by the price floor.

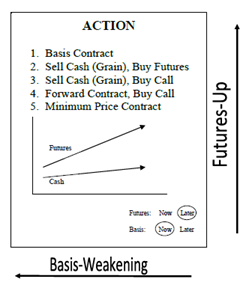

Basis Weakening, Futures Prices Up

When basis is expected to weaken and futures prices to go up, cash prices are also expected to rise. In this scenario, you want to lock in the favorable basis now, but hold off on locking in the futures prices. A number of pricing decision tools can help you to achieve this goal. In many cases, you can use a combination of tools (Figure 5).

A basis contract is the first and most obvious choice to lock in a favorable basis. You still have the option to lock in the futures price at a later date.

There is also the option of selling grain and buying a futures contract. Selling the grain allows you to exit the cash market and take the cash price received. By itself, this would lock in both the futures price and basis. However, by purchasing a futures contract, you re-enter the futures market with the opportunity to sell the contract for a higher price at a later date. The downside to this option is that prices may fall, and margin calls become required to maintain the contract.

If you are averse to holding onto a futures contract, you can use the sell grain and buy a call option. This provides you with the opportunity to buy a futures contract at a later date if prices continue upward as expected. If prices do not go up, the cost of holding the call option is the most money you would stand to lose. You also have the option to forward contract and buy a call option for the same reasoning. The main difference in this case is that you are locking in the cash price with a later delivery date. This may be a more advantageous option for operations with a lot of grain to move or limited ability to make immediate deliveries.

A minimum price contract is another obvious option in this scenario. If prices do go higher, you gain the benefit at the time of sale. However, if prices unexpectedly fall, you are protected with the floor of the minimum price.

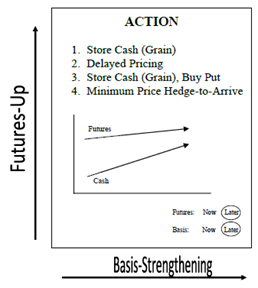

Basis Strengthening, Futures Prices Up

When basis is expected to strengthen and the futures prices to go up, cash prices are also expected to rise. This scenario is very different from the first three we’ve reviewed. In this situation, you do not want to lock in either the basis or the futures prices. Instead, use pricing tools that provide the potential to capture the best possible cash price for your grain (Figure 6).

Since you already own your grain at the time of harvest, the most common pricing tool in this situation is to store the grain. You have control of the quantities that you wish to sell and can even decide to make multiple sales as prices go up.

Another option is to use a delayed pricing contract. If you have limited or no storage, this provides the next best alternative to storing grain. The elevator takes ownership of the grain while you cover the charges for the storage and service fees of handling the grain. You also still have the opportunity to take advantage of more favorable prices at a later date.

Another option is to store the grain and buy a put option. The grain can be stored for a later sale on the cash market. The put option provides the opportunity to sell a futures contract at the price that exists in case prices unexpectedly fall. If prices do not go down, the cost of holding the put option is the most money you would stand to lose for the added price protection.

The combination contract of a minimum price HTA is another option as well. The upside potential for the cash price captures the expected stronger basis. The disadvantage of this option is that it will require setting a futures price, which limits the upward potential in that market. At the same time, the risk of prices falling are offset by the price floor.

Marketing Plans

A marketing plan is defined as a proactive strategy to price grain. It takes into consideration financial goals, cash flow needs, crop insurance coverage, anticipated production, storage capacity, and your appetite for risk (Usset, 2017).

There are two types of marketing plans that are recommended when pricing grain: a pre-harvest plan and a post-harvest plan. A pre-harvest plan is considered to be more strategic in nature, because the window to begin pricing grain before harvest is so large. The futures market by definition is looking to the future sales and expected production over the course of multiple years. This provides an opportunity to price grain several seasons before you intend to grow it. A post-harvest plan is considered more tactical in nature because you have to respond to the market environment. Carrying charges, local basis, and size of the local grain harvest can influence the pricing opportunities in your area. This is information that you won’t have available prior to harvest and your strategies to respond to these situations will be different.

In both cases, a pre-harvest and post-harvest marketing plan are intended to focus on proactive strategies. Even if all of your grain is unpriced and in storage post-harvest, you want to have a plan of how to respond to market conditions. If you wait for the market to determine what options are available, the chance to capitalize on a pricing opportunity is often missed.

Pre-Harvest Market Plan (Strategic)

A pre-harvest marketing plan needs to start with a description of the plan goals. The goal of your marketing plan should not be to sell at a good price. Rather, the intent of your plan is to determine how to achieve a good price with your marketing strategies. For example, you plan to plant 550 acres of corn and have an actual production history, or APH, of 155 bushels per acre. With the combination of yield and acres, you expect to have 88,000 bushels to market. How much of the expected production should be pre-harvest marketed?

The goals can be as short as a single sentence or a longer, more thought-out statement. Your goal may be to sell 25% or 50% of your entire expected production. If you have crop insurance with revenue protection, your goal may be to sell a quantity that matches the guaranteed bushels covered in the policy. For more information on crop insurance and revenue protection policies, review the MSU Extension DEMaND bulletin Introduction to Crop Insurance for Field Crops (E3415) at https://www.canr.msu.edu/resources/bulletin-e-3415-introduction-to-crop-insurance-for-field-crops.

Bushel objectives and pricing targets are the next part of the marketing plan. Once you’ve identified how much of your production will be pre-harvest marketed, break the total number down to smaller amounts. If you plan to consider futures contracts or options, using marketing totals in increments of 5,000 bushels would be recommended. If you don’t plan to use those pricing decision tools, 1,000-bushel increments are the most commonly used.

To set a pricing target, first determine the average price you want to reach and then create price targets around that average. This includes setting a minimum price objective and a maximum price objective. A minimum price objective sets the floor for what you are willing to price grain. This price target should be no less than the cost of production for your farm, including your cash flow needs. The maximum price objective is the highest price you reasonably expect to achieve in this marketing season.

You should set realistic price targets and avoid target prices that are too high or too low. For example, the average price you want to obtain is $3.75 per bushel. If you have five equal quantities to sell, you could set price targets at $3.55, $3.65, $3.75, $3.85, and $3.95.

Note: There are times where the market will not offer a price equal to or above your cost of production. If prices are close to your production costs, consider if there are opportunities to reduce costs. If prices are too low or production costs can’t be reduced, your marketing strategies should be to minimize losses as much as possible. Remember, selling grain at a profit is not guaranteed.

Setting decision deadlines is the next step in your marketing plan. If prices do not meet your price target, the deadlines ensure you are proactive about pricing. Target prices and decision deadlines work together to help you make sales throughout the year. Be conscious of seasonal pricing patterns and correspond your decision deadlines to when prices are traditionally highest. Your cash flow needs are another consideration when selecting decision deadlines. Plan ahead and meet cash flow needs by setting decision deadlines ahead of payment dates.

Pricing decision tools help to decide how you’re going to price grain once you reach a decision deadline. You can choose from a number of decision tools as outlined in this publication. For the first few sales, start out simple and use more complicated tools as you get closer to harvest or the latter half of your decision deadlines. The simple pricing decision tools include forward contracts, HTA contracts, or a basis contract.

For an example pre-harvest marketing plan and a template to use on your own farm, visit the University of Minnesota Center for Farm Financial Management website on grain marketing plans at https://www.cffm.umn.edu/grain-marketing-plans/.

Post-Harvest Market Plan (Tactical)

Goals are an important part of a post-harvest marketing plan as well. The difference is that your marketing strategies are to sell the remaining grain production that was not priced or delivered at harvest time.

Pricing targets are also different in a post-harvest plan. After harvest, you want to set targets above the price you could have obtained at harvest, plus cover the cost of storage. Additionally, consider other costs of bin rental, insurance on grain in storage, and additional interest expense on operating notes. If you own the storage facilities, consider factoring in a return on investment as well. Calculating a per bushel charge with actual costs would be considered the best method. However, a useful method is to set price targets at least 10% above the prices your received at harvest.

After harvest, take notice of what the carrying charges are in the market and use that in your marketing strategies. Earlier we reviewed that if the market has large carrying charges, it is willing to wait for delivery and pay for storage. Alternatively, if the market has small carrying charges, it is unwilling to wait for delivery and not pay storage costs. This allows you an opportunity to “size up” the market and determine what pricing decision tools you will want to use.

The main difference between a pre-harvest and post-harvest marketing plan is the inclusion of an exit strategy. Your ultimate goal is to sell all of your grain production. Ideally, no grain should be held in storage after July 1. As outlined in our review of historical pricing patterns, the month of July is when new information becomes available about the current year’s production. This tends to cause prices to decline as the market considers the additional availability of new crop bushels. Use a combination of price and basis targets along with decision deadlines to implement your planned exit strategy.

For an example post-harvest marketing plan and a template to use on your own farm, visit the University of Minnesota Center for Farm Financial Management website on grain marketing plans at https://www.cffm.umn.edu/grain-marketing-plans/.

A Word on Tax Management

When creating your pre-harvest or post-harvest marketing plans, consider the need for flexibility in your tax planning. There may be years when you may experience higher-than-expected income (either from prices or production). In those years, you may wish to push some of that income into the next tax year. One option to do this would be to use a deferred payment contract.

A deferred payment contract is a sale of grain with payment set at some time in the future, usually the following tax year. For the payment to be deferred, it must be written into the contract between buyer and seller. The agreement outlines the quantity, price, quality, and timing of the payment. As the seller, you have no right to the proceeds until the date specified in the contract, also known as a no constructive receipt clause. Work with your local grain elevator to determine if a deferred payment contract can be written into one of the pricing decision tools (that is, forward contract or HTA).

Grain Marketing Conclusions & Recommendations

Market components, market environment, and pricing decision tools may be simple to understand once you are familiar with them. However, a lot of unknowns still exist throughout every marketing year. You will face a lot of difficult decisions throughout the season, and none of them are 100% guaranteed to work as intended. Those decisions may lead to prices that are profitable, break-even, or merely an attempt to minimize losses. This is why marketing is not easy for even the most seasoned of grain producers. One simple guideline is to use a couple of different marketing tools and sell at a couple of different times throughout the year.

Grain Marketing Is Simple: It’s Just Not Easy

This MSU Extension publication is designed to provide you with a basic understanding of grain marketing. It is not intended to be the sole resource in your arsenal of developing marketing strategies for your farm. Time, effort, and study of the market is an ongoing effort. Studying the market needs to become a routine part of your management habits. Get familiar with marketing plans and pricing decision tools, and learn how to read the market. One such resource for marketing education is a book by University of Minnesota grain marketing specialist Edward Usset titled Grain Marketing Is Simple (It’s Just Not Easy) (https://www.cffm.umn.edu/simple/). This publication offers an advanced level of study and understanding of the market, pricing tools, and considerations for those looking to elevate their marketing skills.

But don’t let perfect be the enemy of the good! Pay attention to trends in the two components of market price—futures price and basis, and make a marketing plan that uses a few different marketing tools. These two simple rules can help you better manage your risk and improve your chances of locking in profitable prices. Once you have your pre-harvest and post-harvest marketing plans completed, don’t hesitate to share them, and ask for input. The list of reviewers should include your management team, spouse, grain merchandiser, and even your lender. These individuals will help keep you accountable to your marketing goals and ensure they are reasonable. This is especially true as marketing plans can become more complex with a lot of grain or pricing decision tools being involved. Remember that the goal of your marketing plan is to keep you on track to achieve your pricing goals. Keep your plans reasonable, achievable, and simple.

Print

Print Email

Email