Dairy Market Update, April 2011

Dairy market fundamentals and prices remain seasonally strong, but risk remains in the market.

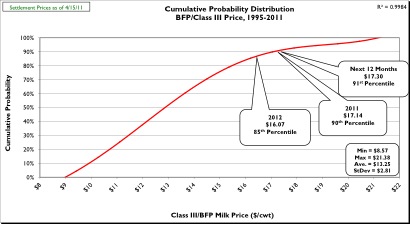

Prices: On Friday, April 15, 2011 spot cheddar cheese blocks and barrels at the Chicago Mercantile Exchange (CME) settled at $1.6275/lb and $1.6250/lb, respectively. CME cheese prices have decreased since late March (3/28/11) with blocks down $0.0725/lb and barrels down $0.0275/lb. Over the same time period the CME Class III futures averages for 2011, the next 12 months, and 2012 are mixed at -$0.01/cwt, -$0.03/cwt, and +$0.20/cwt, respectively; to $17.14/cwt, $17.30, and $16.07/cwt, respectively. These Class III futures averages correspond to potential USDA Michigan mailbox prices for 2011, the next 12 months, and 2012 of $18.13/cwt, $18.29, and $17.06/cwt, respectively. Since late March (3/28/2011) the CME spot butter price has decreased (-$0.0800/lb) to $2.0000/lb. Figure 1 is a cumulative probability distribution of all USDA BFP/Class III monthly prices from 1995-present. The figure shows the current (4/15/11) CME Class III futures averages for 2011, the next 12 months, and 2012 are at the 90th, 91st, and 85th percentiles, respectively.

Supply: U.S. milk production

continues to increase above trend (+1.6%, 1995-2011) with February milk

production +2.0% versus February 2010. February marked the ninth

consecutive month milk production was at or above trend increase. February

production in Michigan was up versus February 2010 by +2.7%. The size of the

U.S. dairy herd remained the same in February compared to January at 9.160

million head, but is up 68,000 head versus February 2010. Dairy cow slaughter

numbers in 2011 continue to run well ahead of last year, up 66,000 head compared to the same time frame last year (through 3/19/11). Milk production per cow in January and February were below

trend increases. The USDA

reported a nearly 38%

increase in dairy feed prices in March versus

March 2010; however, income over feed costs are up over 37% (+$2.35/cwt) due to

an increase of $1.30/cwt in the “All-milk” price.

Supply: U.S. milk production

continues to increase above trend (+1.6%, 1995-2011) with February milk

production +2.0% versus February 2010. February marked the ninth

consecutive month milk production was at or above trend increase. February

production in Michigan was up versus February 2010 by +2.7%. The size of the

U.S. dairy herd remained the same in February compared to January at 9.160

million head, but is up 68,000 head versus February 2010. Dairy cow slaughter

numbers in 2011 continue to run well ahead of last year, up 66,000 head compared to the same time frame last year (through 3/19/11). Milk production per cow in January and February were below

trend increases. The USDA

reported a nearly 38%

increase in dairy feed prices in March versus

March 2010; however, income over feed costs are up over 37% (+$2.35/cwt) due to

an increase of $1.30/cwt in the “All-milk” price.

Demand: The USDA reports that total commercial disappearance in 2010 increased 3.1% over 2009 which is well-above the 1995-2009 average increase of 1.6% per year. All categories of wholesale dairy products showed above trend increases in disappearance for 2010 except fluid milk products. Disappearance of fluid milk products fell 1.5% in 2010, the largest decline since 1982. U.S. dairy exports for 2010 totaled $3.71 billion in value, up 63% from 2009. U.S. dairy exports in 2010 represented a record of 12.8% of total U.S. milk production on a total solids basis. Dairy imports in 2010 were the lowest since 1997. U.S. dairy product exports in 2010 represented the following percentages of national production: NDM/SMP, 47%; dry whey, 55%; lactose, 68%; cheese, 3.7%; butterfat, 7.9%. U.S. dairy exports continue strong in 2011 with January and February 2011 totaling $331.7 million and $343.0 million, +49% and +52% versus January and February 2010. January imports were equivalent to only 2.5% of U.S. total milk production (total solids basis), the lowest in four years.

Dairy Product Inventories: The latest USDACold Storage Report showed inventory increases in February for American cheese (+3.9% at 622.2 million lbs.) and total cheese (+4.0% at 1,036.0 million lbs.) compared to February 2010. Both cheese inventories set all-time February highs, but were the lowest increases versus the same month in the previous year in many months (American cheese, June 2009; total cheese, November 2008). February butter inventory was 31.7% below February 2010, marking the fourteenth consecutive month butter inventory has been below the same month last year.

Outlook:Wholesale dairy product prices have declined over the past month, but remain well-above historical averages for this time of year. Chicago Mercantile Exchange (CME) Class III futures prices remain very strong and have not dropped in proportion to the decline in cheese prices. In fact, the 2012 average price has strengthened $0.20/cwt. April through June marks the spring flush of milk production in the U.S. which typically results in the lowest dairy product and milk prices of the year. However, all dairy product wholesale prices and milk class prices should remain well-above historical averages for all of 2011. High feed and record cull cow prices should limit the growth of the U.S. dairy herd in 2011 and keep milk per cow growth at or below trend. As long as the U.S. dairy export market retains its current strength, dairy producers will be rewarded with milk prices well-above historical averages. The current CME Class III futures average ($17.14/cwt) for 2011 is at the 90th percentile of historical Class III prices (1995-present). This means that only about 10% of the time from 1995-present has any monthly actual Class III price been higher than $17.14/cwt. Although a crash in Class III prices is not anticipated, there is risk in the market. Most of this risk is on the demand side.

Recent history has shown us that world events, whether natural, political, or economic; can have dramatic negative effects on commodity markets. With this in mind, dairy producers should consider using price risk management tools (e.g., futures contracts, forward contracts, put options) to market some of their 2011 milk production and reduce their milk price-risk exposure. Producers should calculate their latest cost of production and market milk in proportion to their risk attitude and degree of overall financial risk. Producers should also remember that milk marketing is about price-risk management first and profit enhancement is only a secondary consideration. For a full report and other dairy marketing information go to my website.

For help calculating cost of production email Craig Thomas, MSU Extension dairy educator.

Print

Print Email

Email