Mindfulness money

Learn to manage financial stress.

In the Stress in America study of over 3,000 Adults aged 18+ living in the U.S., the American Psychological Association (APA) discovered 72 percent of adults reported feeling stressed at least some of the time about money. One in five participants considered skipping or have skipped going to the doctor because of financial concerns. Forty six percent (46 percent) said they felt depressed or sad due to the financial stress.

How do you improve your health and decrease your stress levels due to financial concerns? Find emotional support, the APA study showed. On a 10-point scale, participants had a two-point drop in stress level if they had emotional support. Twenty-six percent of the participants with emotional support reported an increase in stress as opposed to 46 percent of those who did not have support. Of the participants with emotional support, only 10 percent stated they did not make a lifestyle change due to stress compared to 21 percent who lacked the support.

How do you get the emotional support you need? Be open with family members. Don’t be afraid to talk openly about financial issues you and your family may be facing. Do not be afraid to ask for help and support from outside sources. To alleviate stress levels, take time for yourself. Don’t ignore health issues. Family wellness is important and needs to be a priority.

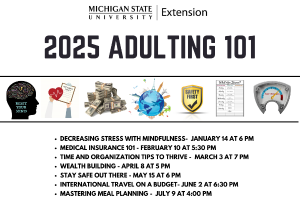

Lastly, connect with Michigan State University Extension’s Health and Wellness team to learn mindfulness techniques that help to reduce emotional stress and the Financial/Homeownership team to learn money management techniques to assist you with your financial situation.

Michigan State University Extension has HUD/MSHDA certified housing counselors on staff to assist with the difficult process of foreclosure. To find a counselor near you visit www.mimoneyhealth.org or call your county extension office. Michigan State University Extension has released a new toolkit for homeowners who are experiencing or have previously experienced foreclosure. This toolkit will equip these individuals and families with tools to help them recover their financial stability, in the case that a recovery of their home is not possible. The toolkit is available to download free at MIMoneyHealth.org.

Michigan State University Extension offers financial management and home ownership education classes. For more information of classes in your area, go to either http://msue.anr.msu.edu/events or www.mimoneyhealth.org.

Print

Print Email

Email