2018 Financial Capability Education Program Impacts

DOWNLOADJanuary 10, 2023

Financial Capability Education

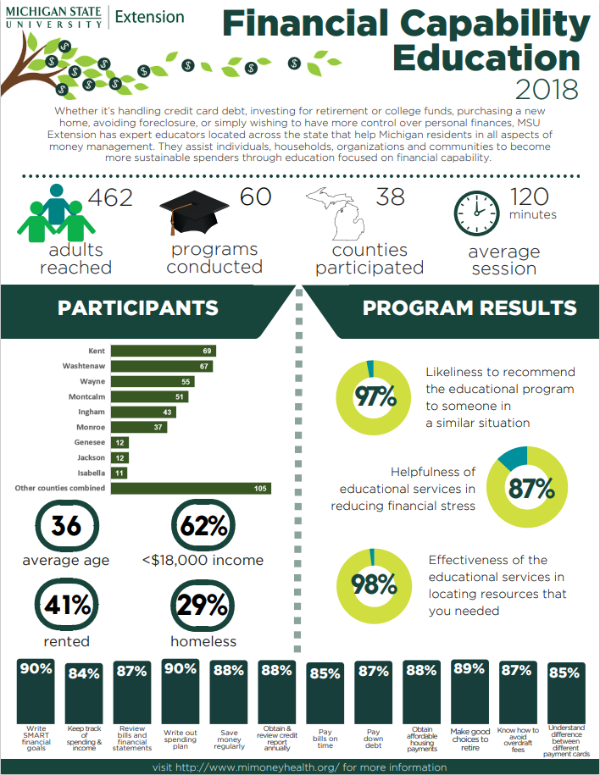

Whether it’s handling credit card debt, investing for retirement or college funds, purchasing a new home, avoiding foreclosure, or simply wishing to have more control over personal finances, MSU Extension has expert educators located across the state that help Michigan residents in all aspects of money management. They assist individuals, households, organizations and communities to become more sustainable spenders through education focused on financial capability. MI Money Health is a website that provides Michigan residents with access to non-commercial, easily accessible, and reliable personal financial information.

Dollar Works and Money Smart

Money management courses offer different topics over several weeks. These courses utilize two curriculums: Dollar Works and Money Smart. Dollar Works topics include setting financial goals, creating a spending plan, using credit wisely, pumping-up savings, keeping spending records, and protecting against identity theft. Money Smart topics include making money decisions, credit use, paying off debt, spending plans, keeping records, and money issues.

eMoney

eMoney is the online version of the Money Management course. The course is interactive, informative and low-cost. It contains the same financial management topics as the workshops. Participants take the online course at their own convenience, at their own pace, and on any computer. It is approximately five hours in length and a printable certificate of completion is provided. Available at http://ehomemoney.org/msue.

Impacts

During 2018, MSU Extension reached 462 adults with educational programs on managing personal and household finances. Program delivery ranged from 120 minutes to 240 minutes per session, with the average session lasting 120 minutes. Number of sessions ranged 1 to 3. Average age of participants was 36 years and 63% were women. Annual income was less than $18,000 for 62% of the participants. Participants employment status was 12% unemployed and 30% employed part- or full-time. Most (41%) rented, 18% lived with family, and 29% were homeless. Ten percent had experienced home foreclosure in the past few years. 43% expect to purchase a home in the next 3 years. Participants self-reported their race/ethnicity and the program reached 63% white, 18% black, 8% Hispanic, and 2% Native American. Two percent were Veterans.

Pre- and post- program evaluations revealed participants improved and maintained knowledge on ten learning objectives and behavioral indicators of program outcomes.

As a result of the program (n=368):

- 90% write SMART financial goals

- 84% keep track of spending and income

- 87% review all credit card bills and financial statements

- 90% write out a spending plan

- 88% save money regularly

- 88% obtain and review credit report annually

- 85% pay bills on time

- 87% pay down debt or pay off new credit card charges each month

- 88% obtain a housing payment that fits within a budget

- 89% make choices today that will make retirement a reality

- 87% Know how to avoid overdraft fees

- 85% Understand the difference between a debit, credit and pre-paid card

In 2018, residents in 38 counties were reached. Number of participants per county are in parentheses.

- (69) - Kent County

- (67) - Washtenaw County

- (55) - Wayne County

- (51) - Montcalm County

- (43) - Ingham County

- (37) - Monroe County

- (12) - Jackson County

- (12) - Genesee County

- (11) - Isabella County

- (11) - Muskegon County

- (10) - Hillsdale County

- (10) - Oakland County

- (7) - Midland County

- (5) - Lenawee County

- (4) - Livingston County

- (4) - Macomb County

- (3) - Ottawa County

- (2) - Barry County

- (2) - Grand Traverse County

- (2) - Kalamazoo County

- (2) - Manistee County

- (2) - Otsego County

- (2) - Shiawassee County

- (1) - Allegan County

- (1) - Arenac County

- (1) - Bay County

- (1) - Calhoun County

- (1) - Charlevoix County

- (1) - Clare County

- (1) - Clinton County

- (1) - Delta County

- (1) - Eaton County

- (1) - Ionia County

- (1) - Marquette County

- (1) - Mecosta County

- (1) - Oceana County

- (1) - Saginaw County

- (1) - Sanilac County

- (23) - Refused to Answer

- (1) - Out of State

Nine staff reporting: Terry Clark-Jones, Bill Hendrian, Khurram Imam, Teagen Lefere, Brenda Long, Beth Martinéz, Scott Matteson, Jinnifer Ortquist, Rob Weber and Laurie Rivetto.

Evaluation questions (below) show participants are highly satisfied with MSU Extension’s programs.

How effective were the educational services in locating resources that you needed?

- 61% Very Effective

- 13% Effective

How helpful were the educational services in reducing the stress you felt regarding finances?

- 50% Very Helpful

- 37% Helpful

If you knew someone who was in a situation similar to yours, how likely would you be to recommend the educational program?

- 60% Definitely

- 34% Probably Would

Print

Print Email

Email