How the Inflation Reduction Act Can Save You Money on Home Energy Costs

DOWNLOADOctober 18, 2023 - Jenny Abel and Sherrie Gruder, University of Wisconsin-Madison Division of Extension; Erica Tobe, Ph.D, and Marie Ruemenapp, Ph.D., Michigan State University Extension

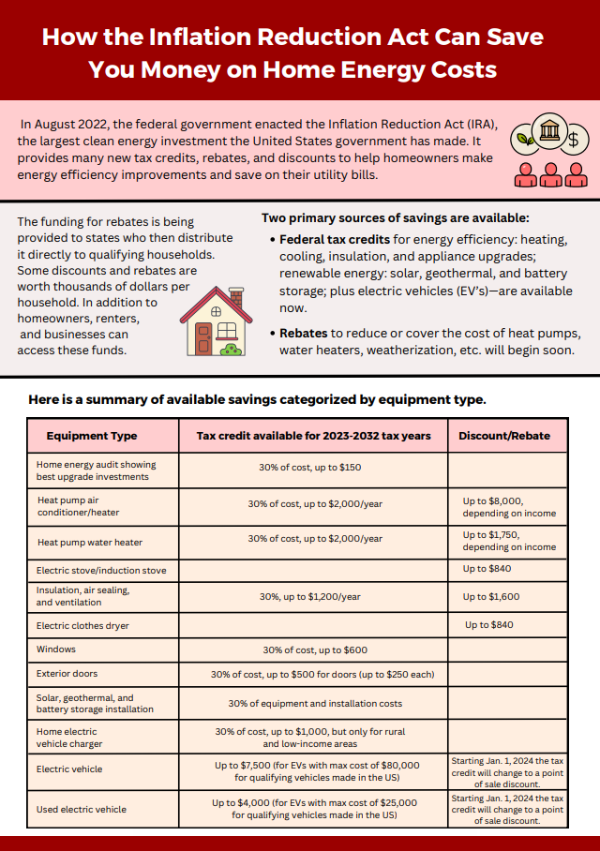

In August 2022, the federal government enacted the Inflation Reduction Act (IRA), the largest clean energy investment the United States government has made. It provides many new tax credits, rebates, and discounts to help homeowners make energy efficiency improvements and save on their utility bills.

The funding for rebates is being provided to states who then distribute it directly to qualifying households. Some discounts and rebates are worth thousands of dollars per household. In addition to homeowners, renters, and businesses can access these funds.

Two primary sources of savings are available:

- Federal tax credits for energy efficiency: heating, cooling, insulation, and appliance upgrades; renewable energy: solar, geothermal, and battery storage; plus electric vehicles (EV's) are available now.

- Rebates to reduce or cover the cost of heat pumps, water heaters, weatherization, etc. will begin soon.

Print

Print Email

Email