Financing capital investments, capital improvement program: Part 3

Usually the wish list of things to build, repair, and replace is longer than the cash on hand for government to do. So consideration is given to various different financing options, reviewed in this article.

Seldom do local governments have the cash on hand to finance the capital projects in a Capital Improvement Plan. Therefore, governments resort to the system of setting money aside for anticipated replacement and major maintenance projects or borrowing to finance capital improvements.

This article is part three on capital improvement programs (CIP). For a quick review of what a CIP is, see part one of this series. Part two focused on ranking projects in a CIP in order of priority.

There are many options are available to local governments in how capital projects are financed. Understanding the options available and when to use the various options is a critical step for a successful CIP. This is one of the reasons why the chief executive of the local government and key finance/budget people (the finance officer) are directly involved in the CIP process.

But as a matter of practice, some local governments are hesitant to borrow money for capital projects. The perception is that a local unit should save the necessary resources for a project and once the total amount needed is available then proceed with construction. While this approach is doable, if the unit has the capacity and discipline to save and the capital project can be postponed, then the savings approach works.

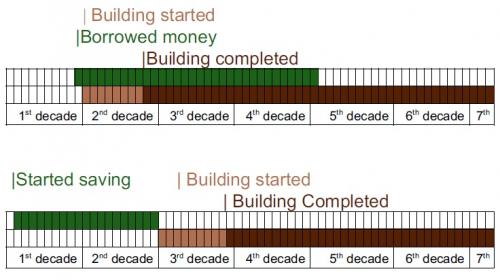

However, in most cases, the need for the capital project may leave the unit no choice but to borrow or bond for the project. For capital projects with a long life (roads, buildings, sewer and water systems) borrowing funds makes both economic and public policy sense. Let's assume that a local government abhors borrowing money but rather believes one should save the necessary amount before purchasing. Further assume that the desired investment is a new municipal building. But the building will have a long and useful building life

Saving until the amount needed is achieved essentially asks current residents of the community (taxpayers) to bear one hundred percent of the cost before the building is built. Those taxpayers may or may not be in the community to enjoy the new building that they paid for. And residents that are in the community, using the new building, are relieved from bearing any cost for the building because they were not around paying taxes when the money was put aside for the building.

Borrowing or bonding on the other hand recognizes the durable nature of the investment (building) and allocates the cost shares of the building to those using the building during the first years of the life of the building.

So the public policy question to consider is whether or not it is right for taxpayers from yesterday to be paying for a benefit the taxpayer of tomorrow gets the service from? Different types of CIP projects will have differing “correct” answers to this question. What is important is the question is asked, discussed and decided upon. In very simplistic terms one might compare both approaches by understanding:

- If one does not borrow, the community saves interest costs, but those who pay may not be those who benefit from the project

- If one does not borrow, the community needs to have cash available, or the ability to save up the cash. There will be some projects where this may be the appropriate approach.

Financing capital improvements can prove to be a drain on a local unit if necessary funds have not been set aside for projects. Budget discipline is required to annually appropriate funds to the capital improvement fund to cover both depreciation and future capital projects.

A simplistic listing of borrowing or financing capital improvement means follow:

- using fund reserves

- levying special assessments

- borrowing from other funds in the local unit

- borrowing in the capital markets by selling bonds.

The Government and Public Policy team at Michigan State University Extension are currently developing curriculum for an intense Fiscal Sustainability training for local government officials which includes more on this topic. We expect to pilot the training in the first half of 2014, with general availability later in 2014. If interested please contact Eric Scorsone or the author of this article.

Other articles in this series:

Print

Print Email

Email