Corn

So how much corn will the U.S. harvest this fall? The honest answer is we don’t know, too many unknowns. This does not mean projections are not important. We just have to understand there is more risk around them given the very different year we have had. In the USDA August 12th Crop Production Report NASS updated the projected 2019 corn acres planted after resurveying 14 states. The projected numbers of all corn planted was put at 90 million acres, up 1% from last year. While this surprised the market, this number is probably pretty accurate, the question is how many acres will be harvested for corn, versus harvested as silage, cover crop, or abandoned. The farmer survey indicated that 82 million acres would be harvested for grain, about the same as a year ago. If those acres had enough moisture from early August through mid-September, have enough heat degree days, and can reach black layer before the first frost, and have nice dry down weather we could harvest 82 million acres.

The August report is also the first time each season that the USDA uses a farmer survey to project the yield. The objective yield survey along with the farmer survey will begin in September. At 169.5 bu/acre, this also surprised the market. But again, if there is enough moisture from early August through mid-September, if there are enough heat degree days, and if we can reach black layer before the first frost, and have nice dry down weather, we may reach 169.5 bu/acre. So to me, the 169.5 bu/acre is much closer to upside potential than downside potential. This puts projected 2019 corn production at 13,900 million bushels, down 3.6%. Again, I would put that as possible, but more downside risk with little if any upside potential.

Michigan planted 2.0 million acres of corn, down 300,000 acres from the June estimate after the resurvey. Planted acres were also down 300,000 acres from last year in Michigan. Projected harvested acres for Michigan were down 240,000 acres from last year. Projected yield was 155 bu/acre, up 3 bu from last year, but below trend. As with the rest of the Corn Belt, we will likely need ideal weather through harvest to reach the harvested acres and yield estimates.

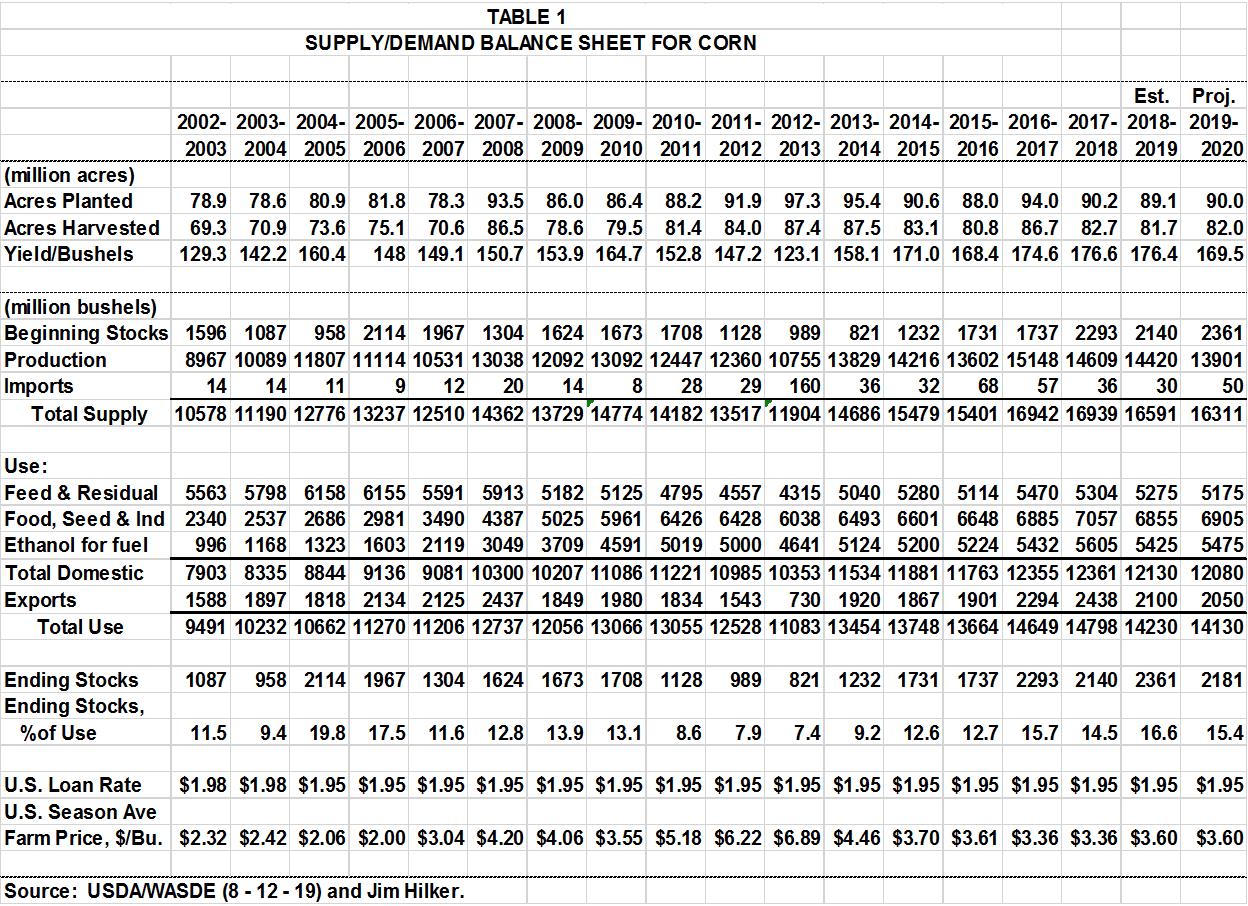

World corn production is expected to be down 1.3%, mostly due the U.S. production being down 3.6%. The rest of the world production is expected to be about the same as last year. U.S. 2019-20 corn exports are expected to be down 50 million bushels, feed and residual down 100 million with projected corn for ethanol up 50 million, putting total use down 100 million bushels. See Table 1 for all the numbers, and a comparison across the past three marketing years.

This puts projected ending stocks at 2,181 million bushels, down 179 million, but still somewhat burdensome. And puts the stocks to use ratio at 15.4%. Given these numbers the USDA projected the 2019-20 U.S. price to be $3.60/bu, the same as last year. But as discussed earlier, this crop has a ways to go. Final production has a higher chance of being lower than higher, but use likely has higher odds of being lower as well unless South American corn crops struggle the winter and spring.

Where does this leave us with respect to pricing corn? A Couple of thoughts. One, the situation varies widely across farms. We have farms with 2018 crop left and are looking at decent 2019 yields, to farms that will have little sell, and may even be short already priced corn. So pricing plans will by definition be different. Second, given my reading of all the information to date, we may see a rally just before harvest begins, then as fields begin to be harvested the markets will react, up or down given the results. And we are unlikely to really know the size of this crop until the January report. Consider looking at pricing opportunities for your 2020 corn crop as much or more than your 2019 corn crop on rallies.

Wheat

The USDA August 12 World Agricultural Supply and Demand Estimates showed 2019-20 projected world wheat production up 5% year to year. The USDA Crop Production report release the same day, showed the projected U.S. crop at 1,980 million bushels, also up 5% relative to last year. The high plains where much of our wheat is grown loved the extra moisture. While planted acres were down 2.2 million acres, harvested acres were down only 1.2 million acres, with yield being up 4.0 bushels per acres.

Michigan harvested 490,000 acres up 20,000 from last year. Michigan’s projected 2019 yield came in at 77 bu/ac, up 2 bushels from the July projection and 1 bushel from last year. Both years a little below our trend yield. This put Michigan projected wheat production at 37.37 million bushels, up two million bushels from last year.

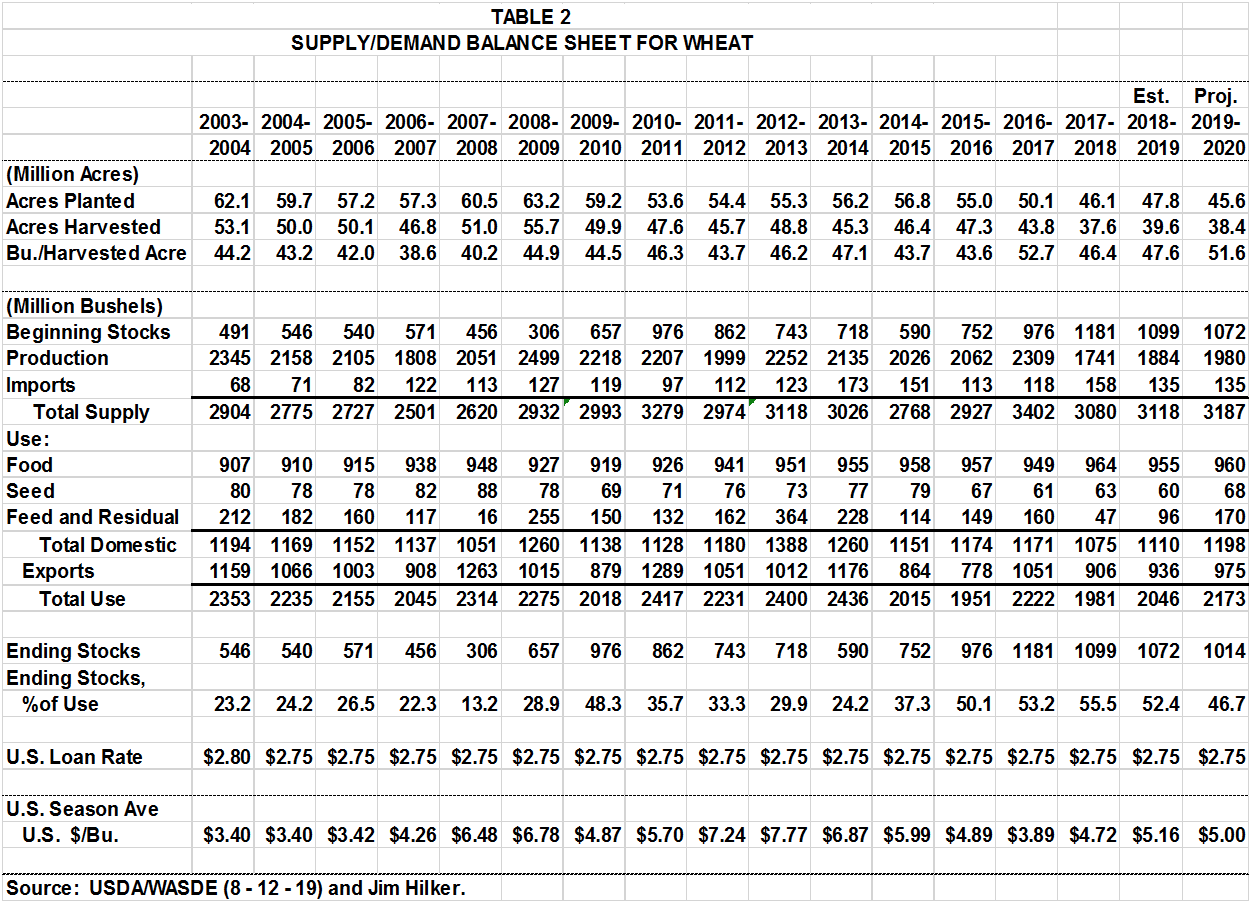

Projected U.S. wheat use for 2019-20 was put at 2.173 million bushels, up 6%. This lowered projected ending stocks 58 million bushels relative to last year. Bigger use, lower ending stocks, bring a lower stocks to use ratio. The stocks to use ratio is projected to be 46.7% versus last year’s 52.4%, which is going in the right direction. But with world stocks going up, it still means continued low wheat prices. The projected USDA all wheat prices for 2019-20 is $5.00/bu. See Table 2, the U.S. wheat Supply and Demand for a comparison of all the numbers over the three most recent years.

Soybeans

And then we have soybeans…. While the market was surprised that corn plantings came in around intentions given the wet planting season, the lower soybean plantings more than made up the difference. After the resurvey of 14 states, plus considering the FSA reported plantings, 2019 soybean planted acres came in at 76.7 million acres. This was 4.2% less than the June acreage report indicated, as less of the intended to plant got planted, and 14% less than last year. So total corn and soybean acreage is down 11.6 million acres, 6.5%. The amount of unplanted acres one field after another as you drive through northwest Ohio is shocking. Not that you can’t drive through Michigan and get a sick feeling at the amount of unplanted acres.

Harvested 2019 soybean acres is projected to be 75.9 million acres with the survey indicating a yield of 48.5 bushels per acre. And like with corn, these numbers could happen, but a lot will have to go very well between now and the completion of harvest. This puts projected production at 3,680 million bushels, down 19% from last year

Michigan is expected to harvest 1.72 million acres, down from last year’s 2.28 million acres, down 560,000 acres, planted acres were down about the same. Add that to the 300,000 less corn acres planted and corn and soybean total plantings were down about 18.7% in Michigan. The projected survey yield was 45 bu/ac, down from 48 bu/ac last year. This put projected 2019 Michigan soybean production at 77.4 million bushels, down from 109.4 million last year.

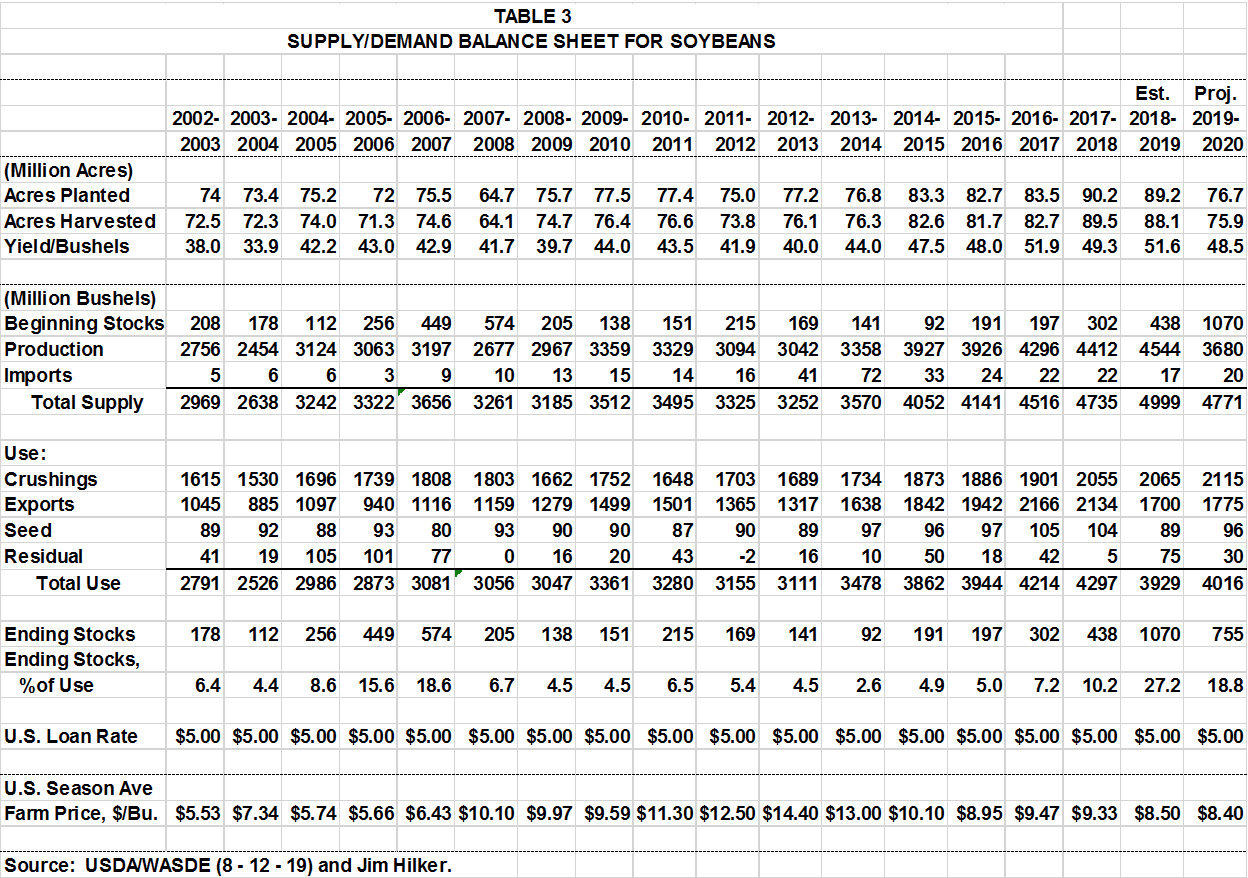

Given the huge cut in production year to year, on the surface you would expect a big price jump…. However, the rest of world’s production is expected to be up a bit, subject to the South American crop this next winter and spring. And the beginning stocks will be massive given the huge drop in soybean exports in 2018-19 due to the tariffs and hog production cutbacks in China due to disease. Expected U.S. exports are projected to go up in 2019-20 relative to this past year, and that increase pretty much sums up the increase in total use, but I would argue that number is suspect without a major breakthrough in the trade war with China. And even then, a big crop in South America and little to no growth in China hog numbers will make it tough.

So while stock to use will be down sharply from last year, it will still be a very burdensome 18.8%. With a projected price being about the same as last year. See Table 3 to see a three year comparison in the numbers discussed above.

My thoughts on possible soybean pricing opportunities is the same as corn. But the unknowns are still huge at this point.

Print

Print Email

Email