Margin Protection program widens coverage for Michigan field crops

The Margin Protection program is an alternative to SCO or ECO options.

Tightening margins are an ongoing concern for farm producers. Even as input costs have fallen from record highs, profit margins remain at risk. Risk concerns are driven largely by market prices declining faster than input costs, especially over the next several years. If price trends continue, securing positive profit margins may be a challenge. Seeing these risks to profit margins, USDA has expanded coverage in their Margin Protection program.

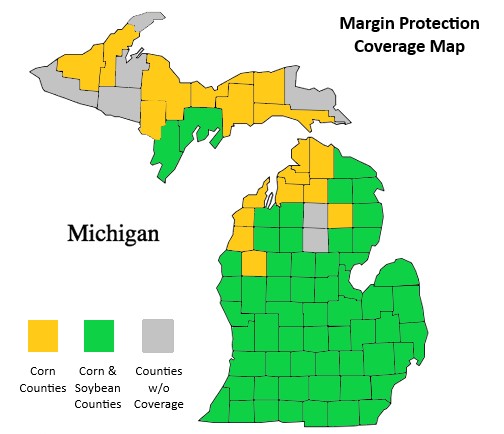

Beginning in 2024, coverage is being expanded for Michigan corn and soybean growers. Soybean policies will increase from 36 to 58 counties. Corn policies will increase from 42 to 77 counties. Figure 1 illustrates counties with coverage for corn or both corn and soybeans.

First offered in 2016, margin protection is an insurance plan offered by USDA’s Risk Management Agency. The plan protects against decreases in profit margins from reductions in yields or commodity prices. These plans also protect against increases in farm inputs that can also reduce profit margins. For more information on payment calculations, visit MSU’s article: How does margin protection offer coverage?

Margin protection is an area-based type of insurance. Area-based insurance determines yields, revenue and input costs on county-level data. County-level data often isn’t finalized until spring. This timeline places payments available in June after the coverage year.

Margin protection can be purchased by itself or with yield or revenue protection plans. Both yield and revenue protection plans are based on individual farm coverage. Premiums for individual coverage plans are reduced when purchasing margin protection. However, a trade-off is that yield or revenue loss payments will be subtracted from any loss payment under margin protection. For more information on interactions between policies, review Farmdoc’s article on Should Users of Revenue Protection Add Margin Protection?

For producers with existing insurance policies, margin protection may offer added coverage. Potential payments and premiums are important considerations. Another key consideration is similarities between your farm and county trend lines. While input costs are important factors, margin protection is largely influenced by price and yield. If your farm performs consistently along county trend lines, margin protection may be beneficial. If farm performance is significantly different, discuss with your insurance agent possible scenarios where additional coverage could be helpful.

The sign-up deadline for a 2024 margin protection policy is September 30, 2023. The sign-up date is different than other insurance policies, which use March 15 each year. Those other policies include yield or revenue protection, supplemental coverage (SCO), and enhanced coverage options (ECO).

Keep in mind that SCO and ECO are also area-based insurance options. They are not available if purchasing margin protection, since all three policies rely on county information. A major difference between margin protection and SCO/ECO are price discovery periods. Projected prices for margin protection are set between August 15 and September 14 prior to the coverage year. SCO and ECO mimic yield or revenue protection, which use February of the actual coverage year for corn and soybeans. All three programs use December Futures for corn and November Futures for soybeans as price points.

An additional option within margin protection is called a Harvest Price Option (MP-HPO). With MP-HPO, if prices at harvest exceed projected prices, margins are reset based on harvest prices. A reset margin would mean a higher level of coverage and potential payment, but at a higher premium cost. MP-HPOs are not automatically included in margin protection plans. This is different than with a revenue protection policy, where a harvest price option is automatically included. Discuss the use of MP-HPOs and their impact on premiums with your crop insurance agent. To find a crop insurance agent area, visit USDA’s Agent Locator Website.

This article is based on information supplied by USDA’s Risk Management Agency. For more information, please visit, RMA Fact Sheet on Margin Protection.

Print

Print Email

Email