Bulletin E-3428

Bulletin E-3428 Farm Loans and Credit Underwriting: The Five C's of Credit

DOWNLOAD

November 28, 2023 - Jonathan LaPorte

Starting any business often means making cash investments. For a farm business, those investments can require more cash than you have available, especially if your operation needs capital assets such as supplies, equipment, livestock, or real estate. Obtaining a farm loan is one option to help you make those investments and grow your business.

Loans give you the ability to grow your business – whether it’s for purchasing land, building, increasing your livestock herd, or even obtaining better, more efficient equipment. When used as part of your financial management plan, a loan can allow you to make necessary business purchases while retaining your cash. Retained cash can cover routine expenses such as operating costs, improvements or repairs, marketing, or purchasing supplies. You may also consider a loan to help build cash reserves, rebuild after a natural disaster, or refinance older loans to make cash more available. Loans can help manage business risks.

Applying for a loan can be an important part of managing your farm. It is also something that can cause you, as a beginning farmer, a lot of anxiety. You are asking to be loaned funds on credit. Credit is the act of borrowing with a promise that you’ll repay funds in the future. To obtain those funds, you need a lender to recognize that your business can be successful. The key to achieving that recognition begins with understanding what a lender is looking for in a loan request.

Throughout this publication, we will review what a lender looks for in a loan application, and we’ll explore how lenders look for assurances that approving a credit request is a good decision. Lenders use a process called credit underwriting in which they evaluate whether the risk involved with a loan request is worth taking on. You’ll learn that this process involves more than just financial numbers and projected profits.

The Five C's of Credit

Lenders don’t want to simply see the “right numbers” put in front of them. What they also need to understand is what type of farm manager you are and how your business operates. They realize that providing a loan impacts your business. By knowing more about you and your business, they can decide if that impact will be beneficial to your farm.

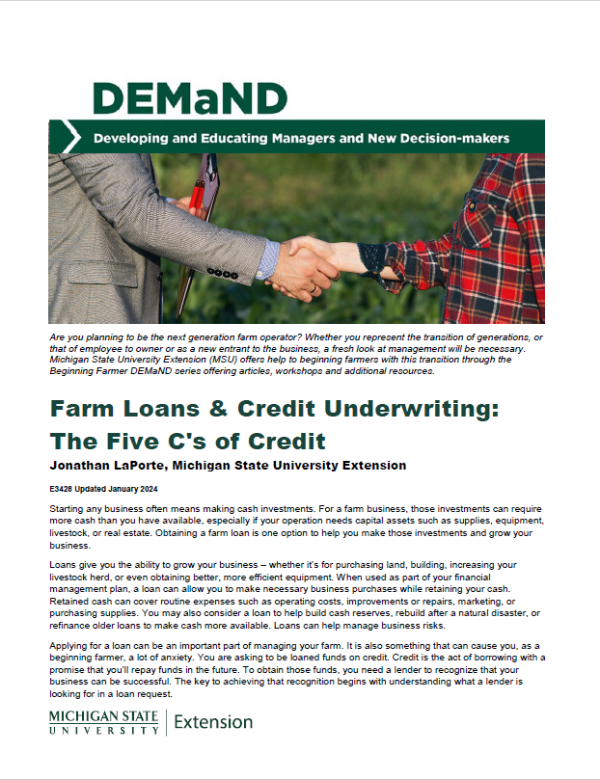

To learn more about you and your farm business, lenders look at your request from several viewpoints. They want to know about your character, or reputation, as a farm manager; whether your farm has any capital of its own to offer toward operations or investments; and what your capacity is to repay a loan, including if any assets (collateral) exist that can help secure a loan. They also look at potential risks (conditions) to your business and ways those may need to be addressed. These viewpoints are commonly referred to as “the Five C’s of Credit.” (See Figure 1.)

Figure 1. The 5 C’s of Credit: character, capital, capacity, collateral, and conditions.

Graphic by Jonathan LaPorte, MSU Extension

Five C's of Credit: Character

Character focuses on your reputation or historical record not just as a loan borrower but also within your community and as a farm manager.

Your reputation within the community is important. Your lender may recognize you or your farm name from others referencing you. As with any reputation, community perspectives speak to your character – both positively and negatively. Your behavior, contributions, and respect shown to others are part of your character and not only align with your personal relationships, but also suggest a business partner, such as a lender, can expect a similar experience working with you.

Your record as a borrower is directed toward your credit history. Credit reports provide that history and act almost like a statement of recommendation. In some ways, it can even imply a confirmation of your reputation. Lenders look at an individual’s history to see how that person has treated other creditors and to predict future repayment habits. Records of late payments, collections, judgments, or even tax liens are indicators of poor habits. Get a copy of your credit report and familiarize yourself with its contents. If you find a debt isn’t listed on a credit report, obtain a repayment record from your creditor. Lenders will want to verify all debts listed on your balance sheet to determine credit worthiness. Knowing what is in your history ahead of time prepares you to discuss any problem areas or concerns that may come up.

To obtain a copy of your credit report, go to www.annualcreditreport.com, call 1-877-322-8228, or write to Annual Credit Report Request Service, P.O. Box 105281, Atlanta, GA 30348-5281. Be sure to obtain a credit report from each of the three bureaus (Experian, Equifax, and TransUnion). Each bureau reports differently and may contain information the others do not have available.

Lenders also want to know about your skillset and management experience. Experience focuses on decisions that directly affect your farm’s success or failure. It’s also a reflection of your willingness to learn and challenge what you know or don’t know about your business.

If you are a young or beginning farmer, many lenders will recognize that you will not have the same level of experience as those who have been farming for years. Your ability to showcase what decision-making you have contributed thus far will be valuable to the lender.

For more information, review the Michigan State University (MSU) Extension bulletin Farm Management Experience Resource Guide (E3423) (www.canr.msu.edu/resources/bulletin-e-3423-farm-management-experience-resource-guide).

Character in Action:

Character may be more difficult to display to lenders because it’s not always shown in a financial record on paper. Credit reports help, but it’s not always obvious what else should be shared. The best approach is to provide examples of your character in action. You can even support those examples with information from your farm records.

Consider the following scenario. After several years of low yields, you decide to soil test your fields. Test results indicate pH is out of balance. Your nutrient levels are also deficient. To resolve this problem, you develop a nutrient management plan. This plan applies lime and re-balances soil pH levels. It also calls for additional nutrients to offset the deficiency levels. Maps are created to indicate which field(s) need(s) lime and how much. A local retailer is hired to apply lime. They also provide maps confirming when and what amounts were applied.

How does this communicate your character? Your plan illustrates your efforts to improve production and reach farm goals. Your actions are verified by maps indicating nutrient needs and when they were applied. You have purchases of lime and fertilizers captured in your financial records. An explanation of the actions you took, combined with these records, helps to communicate your character. These documents also serve as great references for how you’ll fine-tune future decisions.

Five C’s of Credit: Capital

Capital focuses on your ability to invest in your own business. A loan won’t cover all expenses and lenders will need to see what you can offer for an investment. These offerings can be down payments, available working capital, or even collateral.

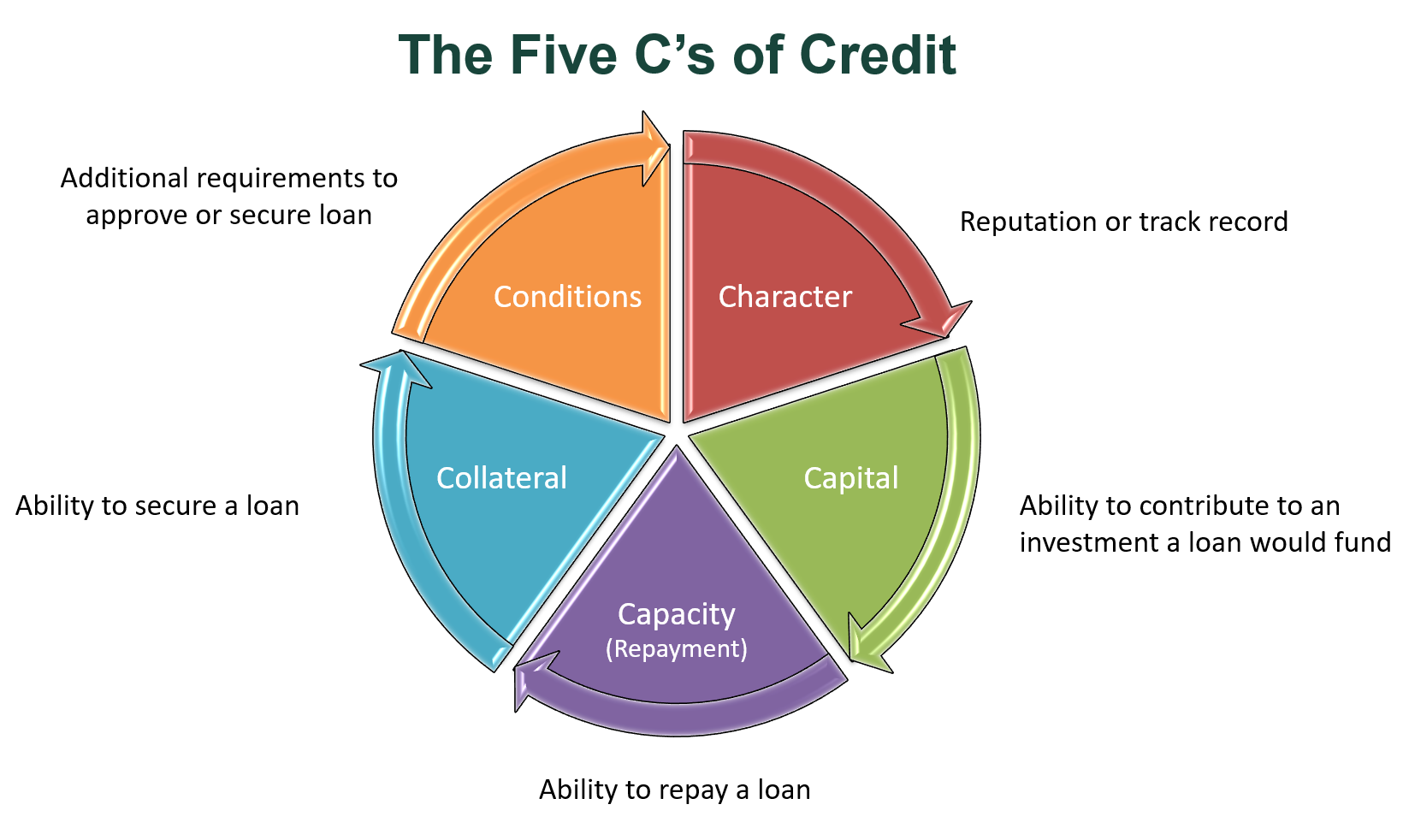

The amount of loan funds lenders will provide depends on what is being purchased. The amount also depends on each lender's criteria.

Figure 2. The amount of loan funds that lenders will provide depends on what is being purchased.

Graphic by Jonathan LaPorte, MSU Extension

In a typical example as shown in Figure 2, loan funds may be available to cover 75% of production or input needs (operating), 80% to 90% of real estate, and 100% of equipment or livestock. A potential loan borrower is required to meet all remaining farm needs and show loan repayment ability (capacity).

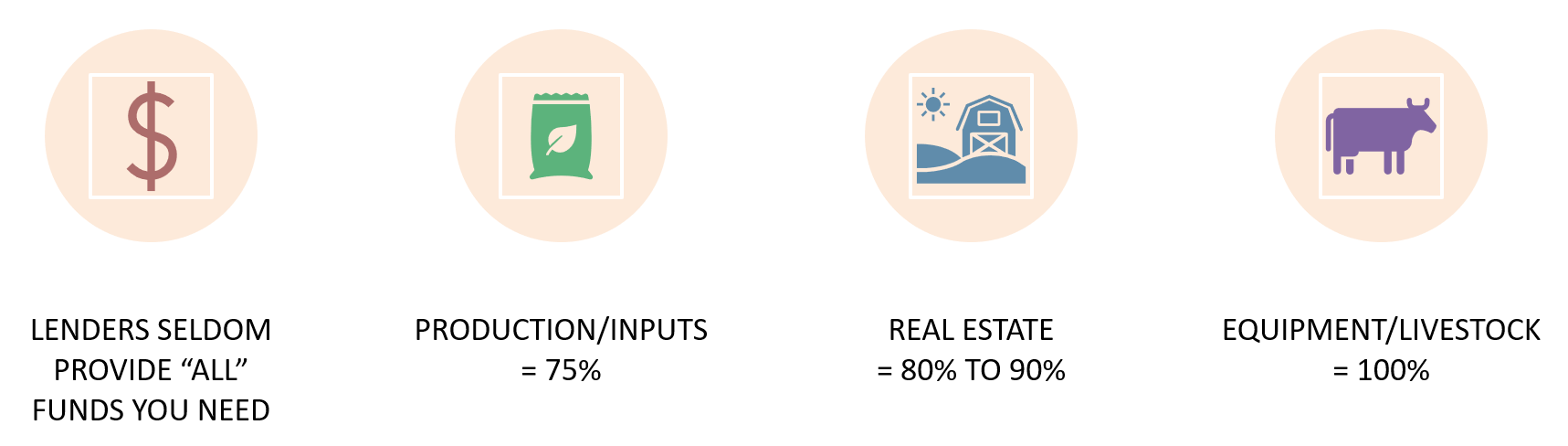

The ability for your farm to contribute to an investment depends on its financial health. Financial health is a measure of the farm’s financial situation, which describes how profitable and productive the business currently is. Analyzing your farm’s financial health requires three important documents: a balance sheet, an income statement, and a statement of cash flows.

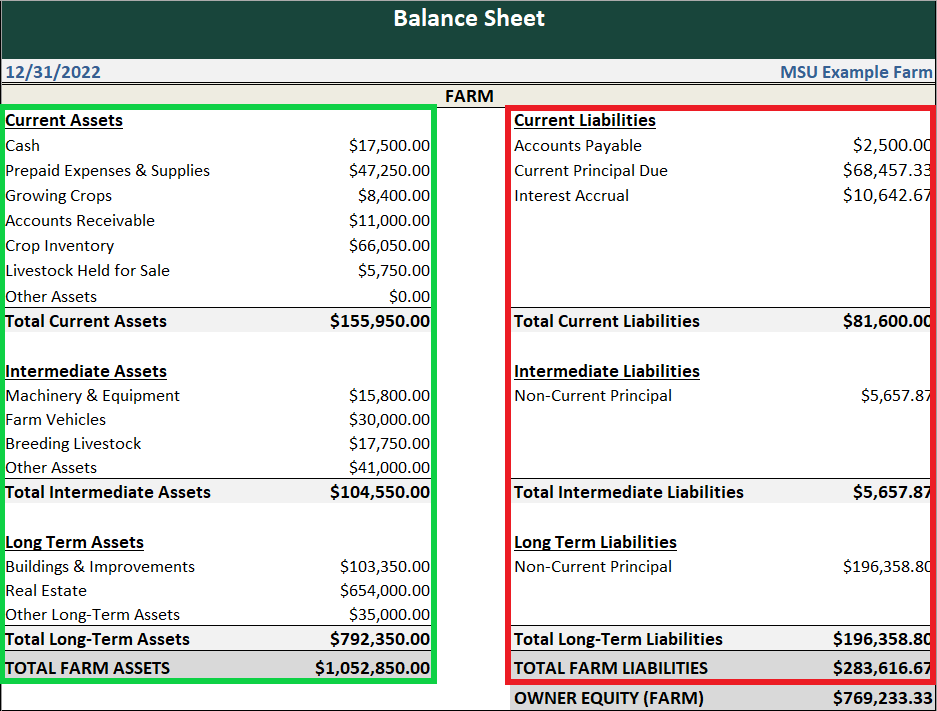

A balance sheet is a snapshot in time of a farm’s overall value. It indicates what you own (assets) and what you owe (liabilities). The difference between assets and liabilities indicates how much your farm business is worth (net worth).

- To learn more about balance sheets, view this series of short videos at the MSU Extension Farm Management website: https://www.canr.msu.edu/resources/balance-sheet-walkthrough-videos

- To download a balance sheet template, visit the MSU Extension Farm Management website: https://www.canr.msu.edu/resources/farm-balance-sheet-template

The income statement provides a measure of profitability over a specific time period. Income statements can be created based on operating activities within a calendar year. These income statements are often called a “tax-year” version because they focus on transactions within a calendar year. However, the preferred income statement version is based on your farm’s production year. A production year includes values from inventory changes between years (pre-paid expenses) and operating activities.

- To learn more about income statements, view this series of short videos at the MSU Extension Farm Management website: https://www.canr.msu.edu/resources/creating-an-income-statement-for-your-farm

- To download an income statement template, visit the MSU Extension Farm Management website: https://www.canr.msu.edu/resources/msu-income-statement-template

The statement of cash flows outlines how financial activities affect your farm’s overall cash position. It combines information from your income statement and balance sheets. It analyzes how cash was used to meet financing, investing, and operating activities during a specific period. It is often used to answer the question of, "Where did cash come from and where did it go?"

- To learn more about statement of cash flows, view this series of short videos at the MSU Extension Farm Management website: https://www.canr.msu.edu/resources/creating-and-understanding-the-cash-flow-statement

- To download a statement of cash flows template, visit the MSU Extension Farm Management website: https://www.canr.msu.edu/resources/statement-of-cash-flows-template

Financial statements provide insight into your farm’s financial health (see Figure 3). Knowing your farm’s financial health provides knowledge about where efficiencies already exist, and where improvements could be beneficial.

Figure 3. Financial statements are individual parts of your farm’s financial health story.

Graphic by Jonathan LaPorte, MSU Extension

Another way to think about your farm’s financial health is to compare it to soil health. Financial health relies on financial statements similar to how soil health relies on soil tests. We know that soil test results can tell us a lot about a field. Each section of a soil test provides an individual part of a field’s soil health story – from available nutrients to soil structure and even overall soil condition. We use this information in shaping fertilizer programs, chemical uses, irrigation scheduling, and even yield goals. However, these tests will also help us to discover unknown problems or challenges that may be holding back or limiting success (LaPorte, 2018).

For more information, review the MSU Extension bulletin Understanding the Farm’s Financial Health (E3387) (www.canr.msu.edu/resources/understanding-the-farm-s-financial-health-basic-components-to-a-successful-business).

Five C’s of Credit: Capacity

Capacity focuses on your ability to repay a loan. This is where your farm’s historical cash flow and future projections are important. But, while capacity tends to be more financially driven, it does rely on understanding more than just numbers.

A cash flow projection is an opportunity to demonstrate potential success as well as address risks to your business. A projection can help answer a lot of important questions:

- Where is your money coming from? (income sources)

- Where is your money going to? (expenses, debt)

- Are numbers reasonable and realistic? (based on past success or forecasts)

Answering those questions is essential to showing your farm’s capacity for repayment. But at the same time, there is another important question that projections try to answer. What does “good” repayment look like? The answer to that question depends on your farm’s historical cash flow.

Lenders want to see a projection that is consistent with historical production, revenue, and expenses. To ensure consistency, be sure to start any projection using your farm records. Then consider any changes you are going to make for the coming year. Are you anticipating lower costs to inputs than in the past? Are production volumes (yields or livestock sold) expected to be higher? Are you using prices consistent with what is available on the market? (LaPorte, 2020)

A common misconception about cash flow is that it stops at farm profits. But profit only covers operating costs. As a manager, you still need to evaluate investments, financing, and even nonfarm transactions. A lender will also look at these areas in their capacity review.

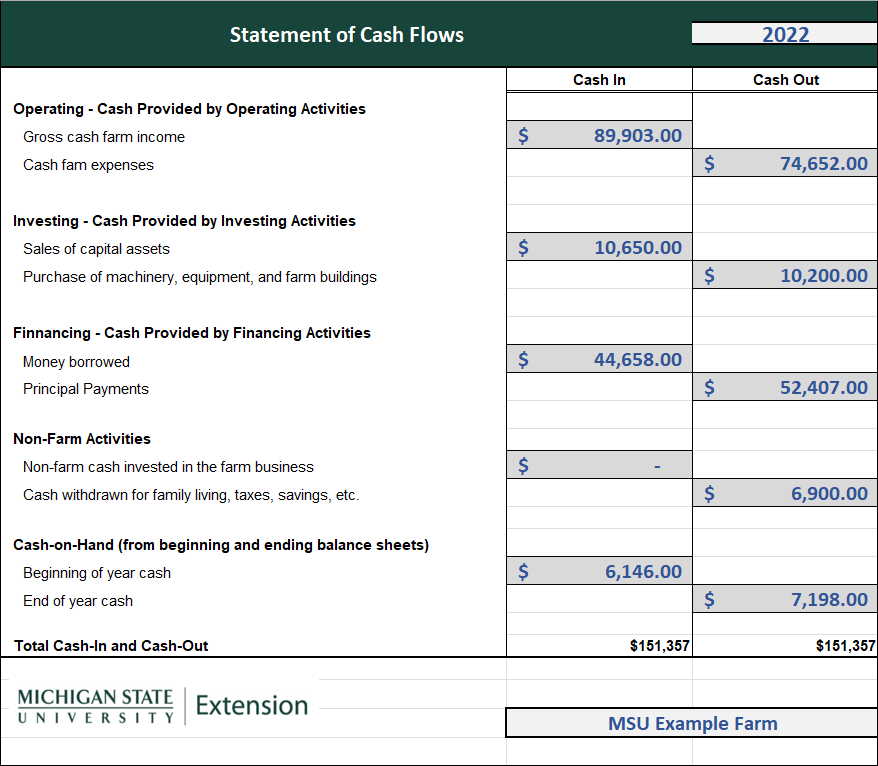

When building a projection based on farm records, it helps to compare projections to previous cash flow statements. The statement displays all cash received (cash in) by your business and where it went (cash out). Do you notice any significant differences between your projection and statement of cash flows? If there are differences, you should understand what is driving them. Both you and the lender want to see that your farm will end the year better than it started (see Figure 4).

Figure 4. A statement of cash flows shows cash received (cash in) and where it went (cash out).

Table by Jonathan LaPorte, MSU Extension

Figure 4 displays an example statement of cash flows. The example farm had positive profits with more cash in ($89,903) than cash out ($74,652). Even investments were positive with more asset sales ($10,650) than purchases ($10,200). But more principal was paid out ($52,407) than borrowed ($44,658) in financing. Plus, money was drawn out for nonfarm expenses ($6,900). If we were to only focus on farm profits, we would expect end-of-year cash to increase by $15,251 ($89,903 – $74,652). In reality, end-of-year cash only increased by $1,052 ($7,198 – $6,146).

The increase is still positive when comparing beginning of year cash ($6,146) to end of year ($7,198). What is important is connecting historic cash flow to future cash flow projections. Will funds from a loan lead to increased yearly revenues? Will efficiency be gained that reduces costs? Are other changes expected unrelated to a loan request (nonfarm income)?

For help creating a projected cash flow, MSU Extension offers a number of resources including budgeting tools, cash flow estimators, and reports on cost of production. For all available resources, visit the MSU Extension Farm Business Cost of Production website at www.canr.msu.edu/tag/farm-cost-of-production. Go to the “Publications” tab.

Five C’s of Credit: Collateral

Collateral focuses on your ability to secure a loan. A loan is not simply a source of funds but an investment in your farm business. For lenders to agree to such investments, they need to offset their risk concerns (LaPorte, 2022, June).

The primary risk concern to lenders is nonpayment by a farm due to limited cash. The best form of risk management for a loan is to secure an interest in your farm’s collateral. Collateral is a term that describes assets that serve as a second source of funds to secure repayment (LaPorte, 2022, June). Also called loan security, collateral can be any farm or personal asset you own that is available to a lender. The most common types of assets used are farm production, equipment, breeding livestock, buildings, and real estate (LaPorte, 2022, June). (See Figure 5.)

Figure 5. Collateral includes the most common types of assets: farm production, equipment, breeding livestock, buildings, and real estate. Breeding Livestock photo by Martin Mangual, Michigan State University Extension, other photos by Jonathan LaPorte, MSU Extension. This graphic also appears in Loans & Security: An Introduction to Farm Collateral (E3425), June 2022.

An important aspect of obtaining a loan is whether you have assets that will exist throughout a loan’s repayment period. To ensure loan security, lenders will seek assets that have a useful life similar to a loan’s expected lifetime or terms (LaPorte, 2022, June).

The act of securing collateral involves establishing a lien, or a legal claim over an asset. These claims outline how assets can be obtained and sold to repay existing debts. Farm assets can have more than one lien placed against them. Different lenders can each have their own lien on an asset. The same lenders can likewise file multiple liens, if needed, for different loans (LaPorte, 2022, June).

Figure 6. The number of liens on assets (green) associated with liabilities (red) impact how much collateral is available to secure new loans. Table by Jonathan LaPorte, MSU Extension

The number of liens on your assets is an important consideration of any proposed loan (see Figure 6). The fewer liens that exist means more assets are available to protect a loan investment. A large number of liens makes it more difficult for a lender to feel confident a loan can be secured (LaPorte, 2022, June).

Equally as important as the number of existing liens is the priority, or position, they are in. Many lenders want to secure a first lien on assets that are equal in value to a proposed loan amount. These first lien assets are often referred to as one-to-one (1:1) security. Some lenders may even require additional assets, potentially up to 150% of a proposal loan amount. However, a first lien is often not needed to meet additional security requirements.

If you are falling on difficult financial times, a lender committed to your success will work with you to establish a repayment plan that works for you before resorting to using your assets as payment.

For more information, review the MSU Extension bulletin Loans & Security: An Introduction to Farm Collateral (E3425) (www.canr.msu.edu/resources/bulletin-e-3425-loans-security-an-introduction-to-farm-collateral).

Five C’s of Credit: Conditions

Conditions focus on additional efforts to offset potential risks and ensure your success. Risks can take on many different forms, both internal and external to your business. These risks can impact your repayment ability of a loan. Lenders may add conditions to provide guidance or require actions on your part to mitigate those risks. Because, when a lender approves your loan, your risks become their risks, too!

Internal risks are specific to you or your business. Your level of management experience may be a concern. There may be limited collateral or working capital. Start-up costs may limit income in early years due to the current size or scope of your farm. Examples can include farms with newer fruit trees or those transitioning to organic.

External risks focus on situations typically outside of your control. Situations can include the state of the economy, the agriculture industry, local economic conditions in your community, market volatility within markets, or adverse weather.

To offset risks, lenders may require a variety of different conditions. Internal risks like limited experience may call for additional training or education. External risks may lead to crop or livestock insurance being taken. If markets are volatile, a marketing plan or insurance policy that involves price protection may be needed.

Common conditions are yearly reviews of financial statements and farm meetings. Lenders occasionally do a security check to update inventories and values on assets. Joint checks or assignments on income can be used for both internal and external risks.

The following is an example condition for borrower training based on requirements in the Code of Federal Regulations:

The applicant must agree to complete production and financial management training, unless the Lender provides a waiver, or the applicant has previously satisfied the training requirements. The Lender has determined that production training is required. The applicant must agree to complete course work covering production management in each enterprise outlined in their projected plan. The Lender has also determined that financial management training is required. The applicant must agree to complete course work covering all aspects of farm accounting. Course work will include integrating accounting elements into a financial management system. At loan closing, the applicant must agree in writing to complete all required training within 2 years.

The following is an example of a requirement for crop insurance based on requirements in the Code of Federal Regulations:

The applicant must obtain and maintain insurance. Growing crops used to provide security must be covered by crop insurance, if available. The Lender must be listed as loss payee for the insurance indemnity payment.

(Direct Loan Making, 2004)

Communicating the Five C’s of Credit

Communication is sometimes considered the sixth C of Credit. That’s because explaining how your farm is worthy of approval is an important aspect of obtaining credit. The 5 C’s of Credit help reassure lenders that investing in your farm is worthwhile. But that reassurance isn’t found solely through a loan application. It requires additional effort, or sometimes a combination of efforts, to help exhibit that you meet each area of credit.

Farm Records

Farm records illustrate your skillset as a farm manager. Records that are unorganized and have missing or incomplete details could indicate a lack of priority on, or awareness of, business management. Records that are organized, up to date, and reconcile to inventories or bank statements indicate focused management skills and provide the foundation needed to make decisions.

The best way to know what your records say is to review them. Focus on a major area of your farm’s production practices. Consider a question you are likely to be asked when reviewing your farm records and determine if your records provide enough detail to showcase your decision-making process. If they do, then you might consider your records to be detailed and well organized (LaPorte, 2022, February).

For example, a lender may want to know production, prices, and revenues for crops you grow. Your farm raises watermelons, tomatoes, and sweet corn. Well-organized records can tell how much was sold, how much money was received, and when sales occurred for each crop (LaPorte, 2022, February) (see Table 1).

Table 1: Sweet Corn and Watermelon Detailed Records Example

|

Crop |

Dates sold |

Amount per acre |

Unit |

Price per unit |

Total |

|

Sweet corn |

7/1 |

150 |

dozen |

$3.50 |

$525.00 |

|

Watermelon |

7/1 |

320 |

20 lbs each |

$3.50 |

$1,120.00 |

|

Sweet corn |

7/8 |

200 |

dozen |

$3.50 |

$700.00 |

|

Watermelon |

7/8 |

340 |

20 lbs each |

$3.50 |

$1,190.00 |

|

Sweet corn |

7/15 |

175 |

dozen |

$3.65 |

$638.75 |

|

Watermelon |

7/15 |

360 |

20 lbs each |

$3.50 |

$1,260.00 |

|

Sweet corn |

7/22 |

225 |

dozen |

$3.65 |

$821.25 |

|

Watermelon |

7/22 |

380 |

20 lbs each |

$3.60 |

$1,368.00 |

|

Sweet corn |

7/29 |

200 |

dozen |

$3.70 |

$740.00 |

|

Watermelon |

7/29 |

400 |

20 lbs each |

3.65 |

$1,460.00 |

You can then calculate average prices, total revenue, and total products raised (see Table 2).

Table 2: Production and Sale Averages of Sweet Corn and Watermelon

|

Crop |

Total production |

Unit |

Average price |

Total revenue |

|

Sweet corn |

950 |

dozen |

$3.60 |

$3,420.00 |

|

Watermelon |

1800 |

20 lbs each |

$3.55 |

$6,390.00 |

Ineffective records are unable to provide answers to questions like this and can therefore provide a negative impression of your management abilities. Remember, even if you’ve hired an accountant or bookkeeper to manage your records, you’re still responsible for the information that goes into them. This is true of both financial and production records.

Business Plans

A common misconception is that business plans are developed primarily to obtain financial assistance. This is referred to as the “business plan trap.” Lenders benefit from better understanding what it is you intend to do and how their assistance might be best suited. However, the main purpose of a business plan is to help guide your farm.

To be successful, you must first know if market opportunities exist. Before you take any other step within a business plan, you must establish what market you’ll operate in. Your farm cannot be profitable raising something customers are unwilling to buy.

The initial operating section of your business plan overviews how you will manage raising your chosen product. This overview includes how you will produce it, manage it, and define the risks involved.

Financial plans outline whether a business plan is viable and should be pursued. This includes current financial statements of a balance sheet, income statement, and cash flow projection. A financial plan should also include historical performance (if available) and capital needs of your farm.

Writing a business plan is not intended to be a one-time event. You will want to reference back to it as a guide over time and determine if it is still relevant. The need for updates depends largely on production and the financial situations your farm is facing. If you are experiencing changes to goals, marketing opportunities, or even financial viability, it may be time to review and update your business plan.

(LaPorte, 2022, February).

Narration

As outlined earlier, being able to talk about your farm is just as important as any record or statement you can provide. People want to work with you and get to know your passion for farming. They want to know what success will look like from you directly. Your knowledge and understanding allows you to describe how your plans and experience make your farm successful (LaPorte, 2022, February).

Lenders also expect you to lead the loan request conversation. You’re requesting they provide funds to your farm business. Treat them like a trusted partner and help them to feel confident about making that investment.

Talk to them about your farm’s financial health. Outline plans for your farm’s future. Address challenges head-on by discussing obstacles that exist or are potentially on the horizon. Focus on your plan, not the problems, to move your business forward, as well as how their financing can help you to achieve those plans.

By sharing your knowledge and understanding of your farm business, you can effectively communicate that you meet the 5’s of Credit.

References

Direct Loan Making, 7 C.F.R., pt. 764 (2004). https://www.ecfr.gov/current/title-7/subtitle-B/chapter-VII/subchapter-D/part-764

LaPorte, J. (2018). Understanding the farm’s financial health. Basic components to a successful business. Michigan State University Extension. https://www.canr.msu.edu/resources/understanding-the-farm-s-financial-health-basic-components-to-a-successful-business

LaPorte, J. (2020). What is the lender looking for? Michigan State University Extension. https://www.canr.msu.edu/news/what-is-the-lender-looking-for?

LaPorte, J. (2022, February). Farm management experience resource guide. Michigan State University Extension. https://www.canr.msu.edu/resources/bulletin-e-3423-farm-management-experience-resource-guide

LaPorte, J. (2022, June). Loans and security: An introduction to farm collateral. Michigan State University Extension. https://www.canr.msu.edu/resources/bulletin-e-3425-loans-security-an-introduction-to-farm-collateral?

Print

Print Email

Email