Don’t sleep on fertilizer news: Start looking to future needs now

As impacts on fertilizer supply continue to evolve, higher prices may be on the horizon.

Is it too early to start talking about fertilizer costs and needs? Typically, fertilizer costs and availability may not seem like large concerns during the summer months. Most U.S. farmers have already paid for or secured fertilizer for the season. For those farms needing to buy, higher prices are common due to the demand from post-emergent or side-dressing applications. But the discussion on fertilizer hasn’t seemed to decrease as much as it usually does this time of year. A large reason for that is due to supply and demand around the globe.

Recent reports indicate that reductions in phosphate exports and higher demand have impacted global supplies. Concerns also exist over nitrogen production due to supply disruptions from the conflict between Israel and Iran. Adding to these concerns is how fertilizer supplies will be impacted by ongoing uncertainty related to tariffs and trade relations. These types of topics continue to keep fertilizer at the forefront of many input cost discussions.

As impacts on supply continue to evolve, higher prices may potentially exist this fall. Those prices may also carry over into spring purchases. With that potential in mind, it is not too early to start talking about costs and fertilizer needs. Which fertilizers warrant the most attention?

Phosphate fertilizers

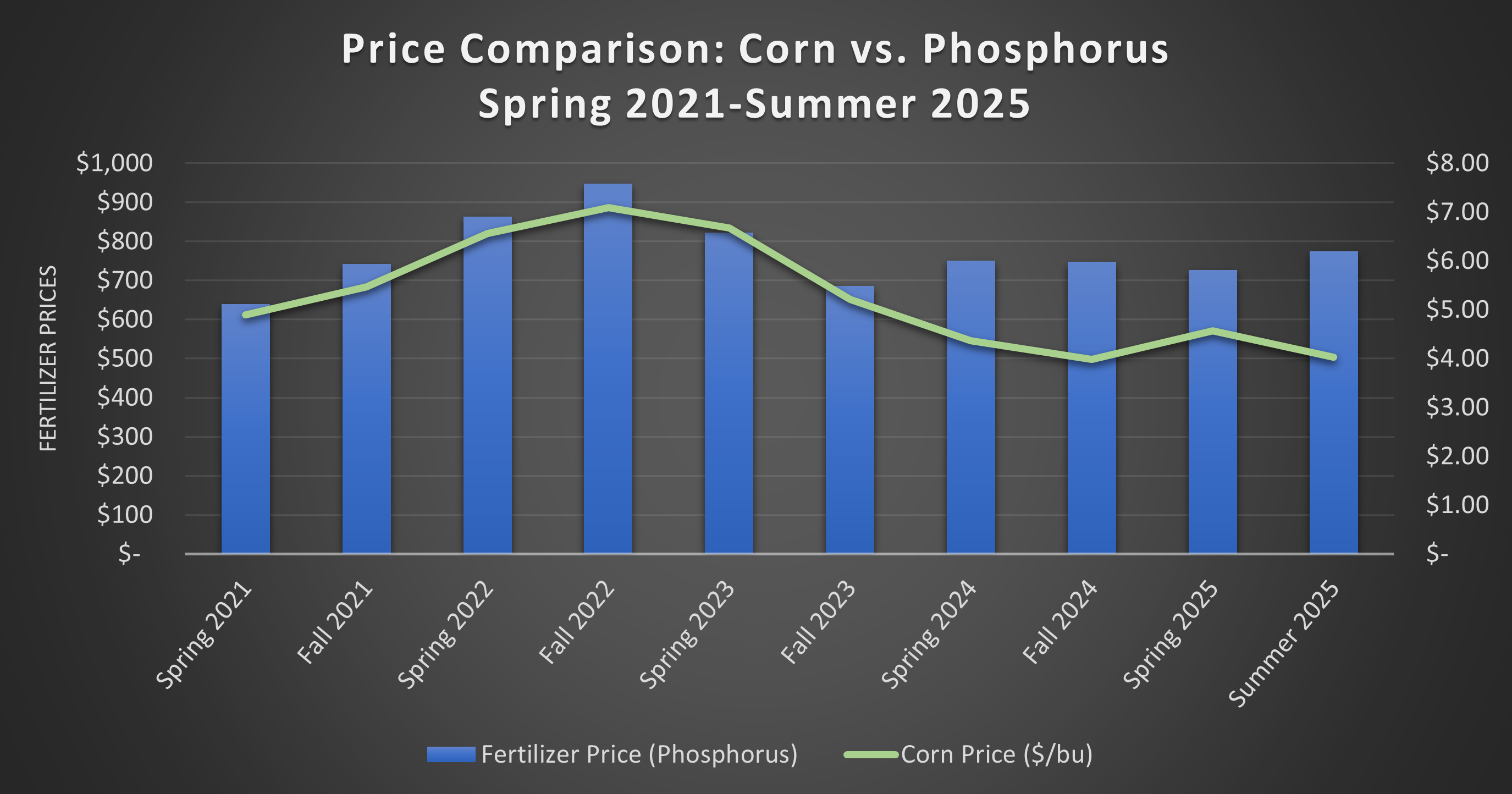

Phosphate warrants the most concern because supplies are already tight for this nutrient. Supply reductions began long before this year’s planting season began. Phosphate fertilizer costs have also stayed high over a multi-year period (Figure 1).

Figure 1 highlights that phosphate prices have continued to fluctuate since the spring of 2021. In recent years, prices have tried to stabilize at levels similar to the fall of 2021. Global supply has played a factor in keeping prices higher, despite reductions in commodity prices (corn shown in Figure 1). Recently, a noticeable price increase was seen between the spring (March) and summer (June) periods of 2025. March through April are common months for phosphate applications. However, May and June applications tend to fall off and lower demand as planting season concludes. The price increase is associated with global supply reductions to due fewer exports from countries like China. Higher demand in countries like India, a large consumer of phosphate, are also factors to higher pricing.

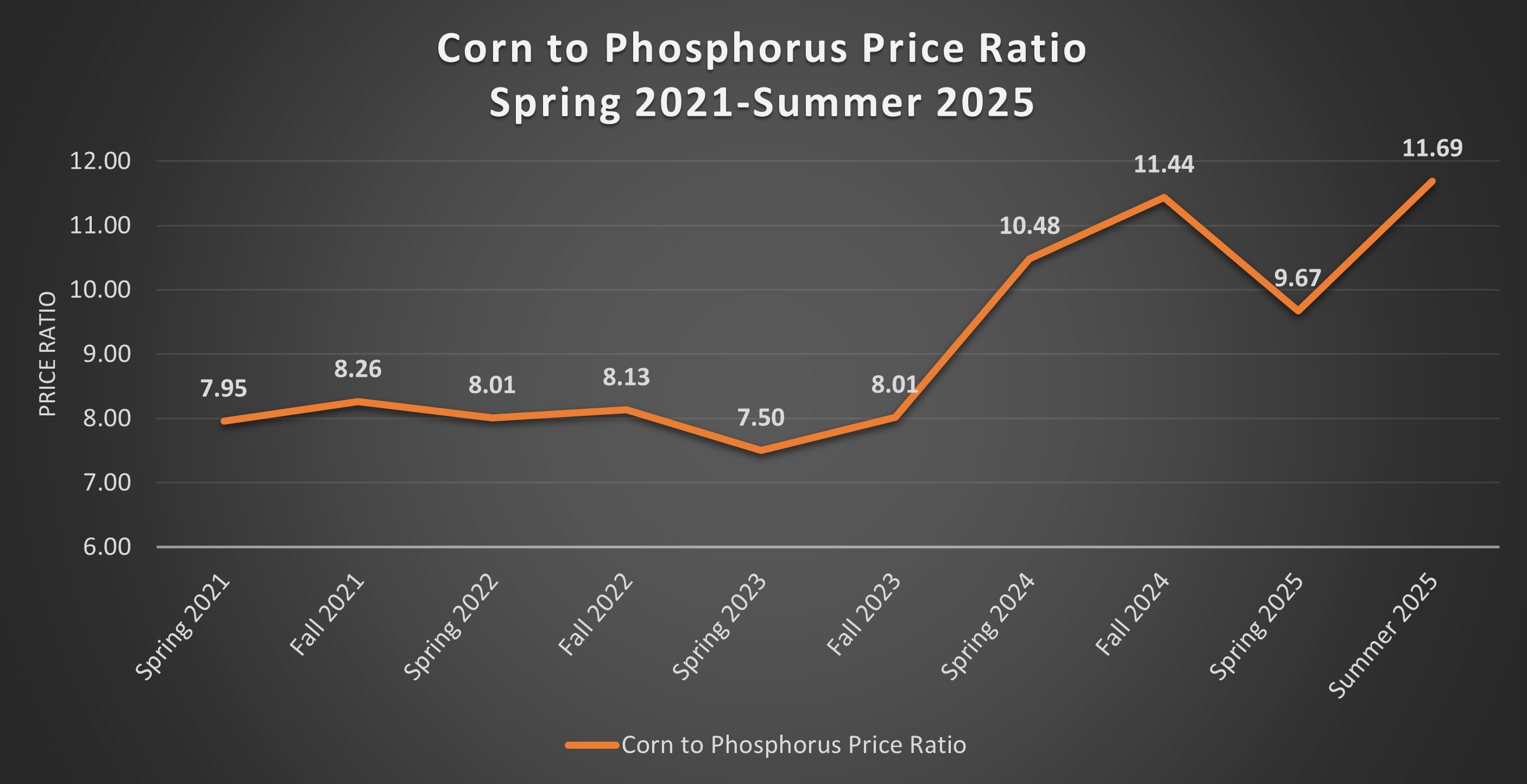

Long-term impacts to higher phosphate prices are best illustrated with direct comparisons to commodity prices (Figure 2). In Figure 2, a corn-to-phosphorus price ratio highlights the cost of phosphate fertilizers relative to corn prices. As fertilizer prices continue to increase and commodity prices decrease (see Figure 1), a higher ratio is calculated. A higher ratio indicates that for every bushel sold, more of its value must go towards the cost of each pound of fertilizer. Right now, phosphate fertilizers are the most expensive they’ve been during the past four-year period, a status that is unlikely to change in the near future.

Increases in fertilizer production do not happen overnight, which means that it takes time to increase phosphate supplies. In cases where countries are simply reducing exports, there needs to be an incentive for production increases to begin. If global supply and availability continue to be a concern, phosphate costs will continue to increase. Those increases should be expected to carry into the fall and even next spring.

Nitrogen fertilizers

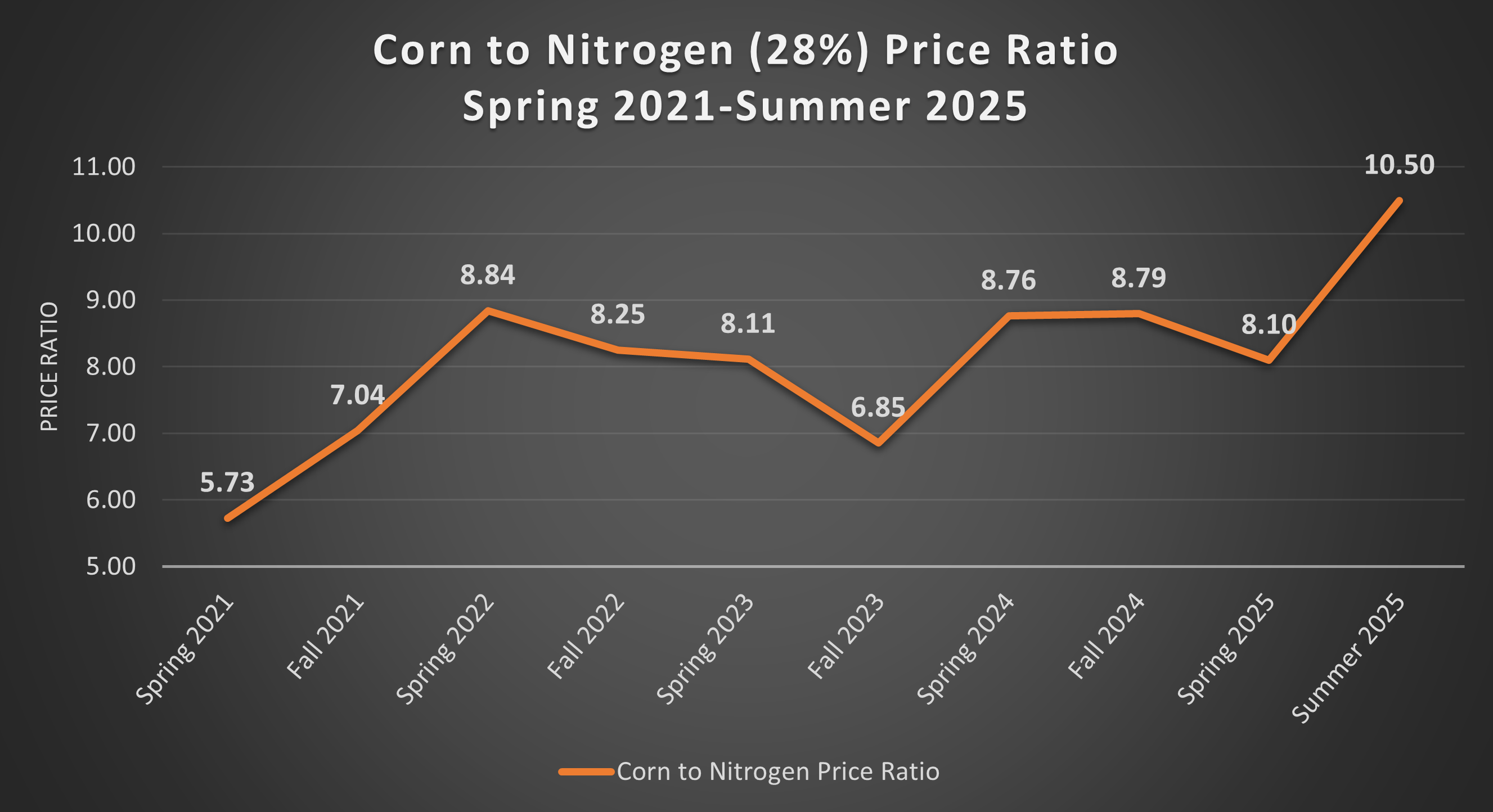

Figure 3 outlines the current corn-to-nitrogen price ratio. That ratio illustrates that nitrogen fertilizers are the most expensive they’ve been during the past four-year period. The current price ratio for nitrogen looks remarkably similar to the price ratio for phosphates. A key distinction is the timing of domestic demand. The summer period is when a significant amount of nitrogen is applied to corn acres. Nitrogen fertilizers have increased in range from $30-$50 per ton since spring pricing. In that same period, cash corn prices have also fallen approximately $0.50 per bushel due to future prices and basis changes.

Nitrogen supplies continue to be reported as stable. However, nitrogen availability has the potential to be similar to phosphate, especially if conflicts in the Middle East begin to directly impact production facilities in key exporting countries. If production is affected, the price ratio we see currently from domestic and seasonal demand could become a new norm or get worse.

Potassium fertilizers

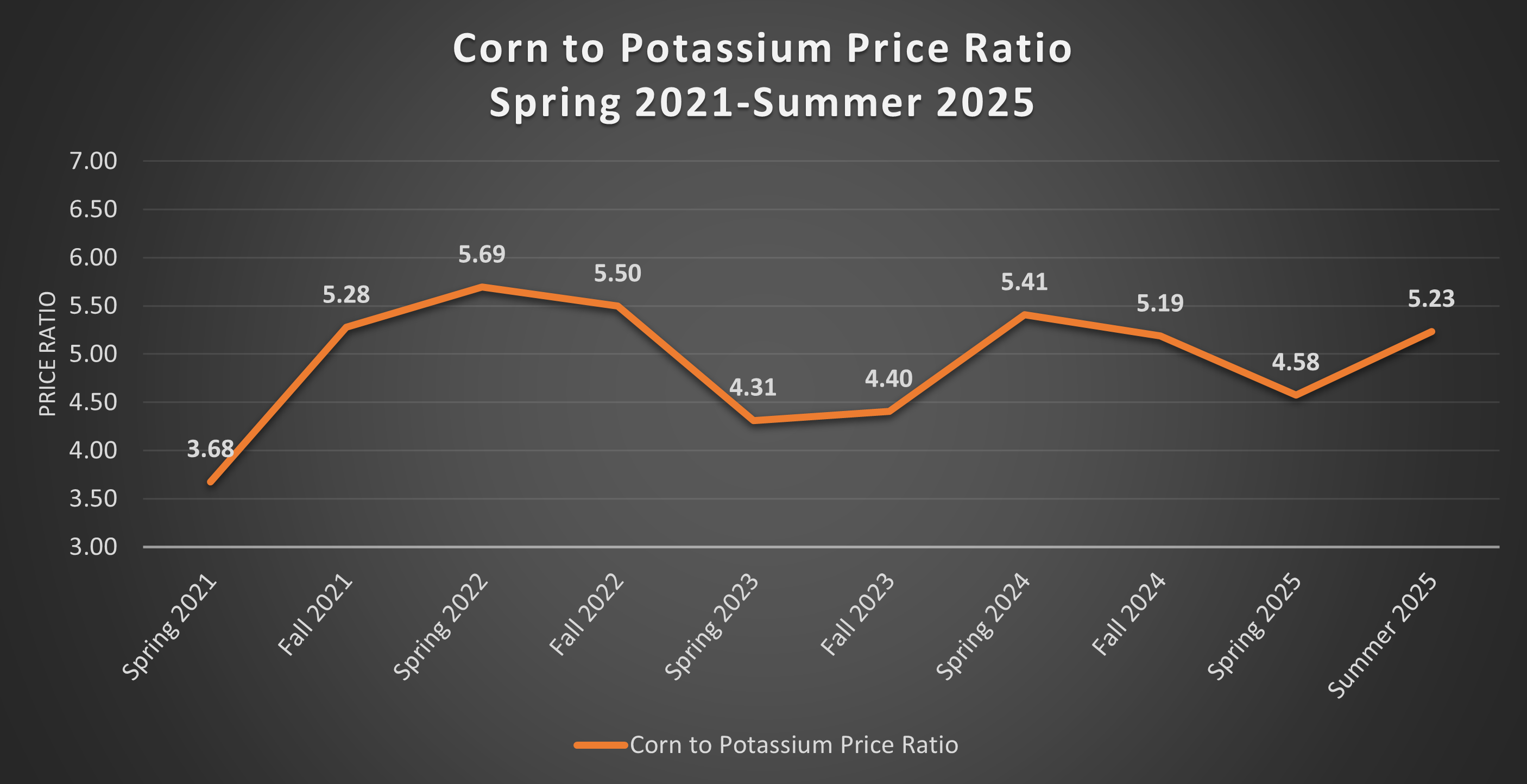

The change in corn prices is also noticeable when considering potassium. As Figure 4 illustrates, the corn-to-potassium price ratio saw a decline to 4.58 in spring of this year, only to jump up to 5.23 over the summer period. Corn prices have been up and down since the fall of 2024. Potassium prices have been relatively stable over the past year.

Potassium supplies also continue to be reported as stable. Similar to nitrogen, conflicts in the Middle East could negatively impact global production supplies. Of greater concern for U.S. agriculture continues to be trade relations with Canada. Over 85% of all U.S. potassium imports come from Canada. Those imports account for 80% of total potassium use in the country.

Identifying fertilizer needs

As the growing season continues and more news hits the airwaves, understanding market conditions will be essential to buying fertilizer. Knowing which nutrients may be the most expensive is only part of identifying your farm’s potential future needs.

Another consideration is your farm’s crop plan. Even now, many farms have an idea of what they will plant next year. If that plan were to become reality, there are several questions you’ll want to have answered:

- What products are needed in higher amounts? Targeting large purchase products early maximizes your use of cash to secure them.

- When can you begin to purchase and are there any minimum quantity requirements? More purchases, with smaller quantities, are recommended to spread potential risk.

- Once you can begin to buy, what cash do you have available? Cash availability may be a significant concern, especially during summer or prior to harvest.

- Do you have on-farm storage? Don’t be afraid to use product storage if early sale opportunities become available. Physical possession means input needs are met.

As you get closer to harvest, there are many strategies to consider when buying farm inputs. To learn about more strategies, review the MSU Extension article on Best Practice for Buying Farm Inputs.

Print

Print Email

Email