Not all milk-to-feed ratios are created equal (Part 3)

For decades the USDA milk-to-feed ratio has been touted as a predictor of dairy farm profitability.

The first article in this series of Michigan State University Extension news articles pointed out by using actual milk-to-feed ratio data for May 2009 and March 2012 that not all milk-to-feed ratios are created equal. The milk-to-feed ratio in May 2009 was 1.49 and was nearly identical at 1.48 in March 2012. The milk-to-feed ratio is promoted as a proxy measure for dairy farm profitability. Thus, conventional milk-to-feed ratio wisdom would conclude profitability for dairy producers would be the same in those two months because of the nearly identical milk-to-feed ratios. However, it clearly showed that such is not the case with income over feed costs (IOFC) in March 2012 48 percent higher (+$2.35/cow/day) than in May 2009. Since the milk-to-feed ratio is indeed a ratio it fails to take into account the size of the pie represented by a specific milk-to-feed ratio. Income over feed costs is able to take this into account and is thus a better indicator of potential dairy farm profitability.

In the first article we also noted that conventional wisdom predicts when the milk-to-feed ratio is above 3.0 milk production is more profitable and dairy producers, as an industry, will tend to expand production by adding more cows, decreased culling, and increased milk per cow by feeding more concentrates. When the milk-to-feed ratio drops below 2.0 conventional wisdom says milk production is less profitable and dairy producers, as an industry, will contract by some producers going out of business, increased culling, and/or decreased milk per cow by feeding less concentrates. If this conventional wisdom is true it holds important implications. If accurate, the magnitude and direction of the milk-to-feed ratio should help dairy producers predict what will happen to future trends in national milk production and milk prices. If conventional wisdom is wrong, producers should beware of making milk and feed marketing decisions based on the magnitude and direction of the milk-to-feed ratio.

The second article proved conventional milk-to-feed wisdom was not accurate by comparing 2009 to 2011. The profitability of dairy producers was dismal in 2009 and very robust in 2011 despite the fact that the average annual milk-to-feed ratios for both years were both below 2.0 and 2011’s average milk-to-feed ratio was only 0.10 higher than 2009. In 2009 national milk production was lower than 2008 and the national dairy herd lost over 250,000 cows, which conventional milk-to-feed ratio wisdom would have predicted. However, the exact opposite occurred in 2011 with national milk production increasing above trend and the national dairy herd gaining almost 100,000 cows thus defying conventional milk-to-feed ratio wisdom.

The first two articles in this series pointed out the major deficiency in using the milk-to-feed ratio to predict dairy farm profitability or dairy industry behavior. Below are several other reasons we need to be cautious when interpreting the milk-to-feed ratio:

- The feeds used to make the 16 percent protein-mixed dairy feed probably do not represent the actual ration of any dairy producer in the U.S., therefore, the 16 percent protein-mixed dairy feed is not a good representation for typical dairy cow rations.

- Dairy producers today manage rations and feeding programs much better than in years past by using a wider variety of feeds including silages and by-product feeds; decreased feed shrinkage in storage and in feed bunks, etc. These increased efficiencies in the feeding program make it easier today to produce a higher IOFC at the same milk-to-feed ratio.

- Since the vast majority of dairy producers feed quite different rations than the 16 percent protein-mixed dairy feed, dairy producers should be careful in trying to use the milk-to-feed ratio to assess the profitability of their own dairy farm or to use it as a predictor of future dairy industry expansion or contraction.

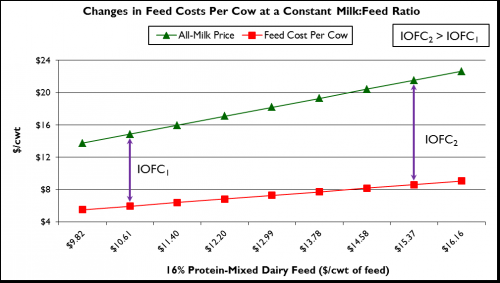

- At a constant milk-to-feed ratio, IOFC’s will increase despite the increasing cost of the 16 percent protein-mixed dairy feed because a cow’s daily feed consumption is constant regardless of feed price. This is shown in Figure 1 and can be seen by comparing the slopes of the two lines. The red line representing feed costs per cow per day goes up more slowly than the green line representing milk price, because feed consumption per cow is constant regardless of the price of the 16 percent protein-mixed dairy feed. This means that at a constant milk-to-feed ratio IOFC’s will increase (distance between the red and green line, i.e., IOFC2 > IOFC1) despite higher prices per unit of the 16 percent protein-mixed dairy feed at successively higher milk prices.

- The milk-to-feed ratio published in the USDA-NASS Agricultural Prices report is an average milk-to-feed ratio for the entire U.S. Feed and milk prices in any given month vary greatly from one region of the U.S. to another, therefore, the U.S. average milk-to-feed ratio will under or overestimate the true milk-to-feed ratio of a specific dairy farm depending upon its location in the U.S.

- The milk-to-feed ratio assumes 100 percent of a dairy farm’s feeds are purchased. In many dairy areas of the U.S. most of a farm’s feeds are homegrown and in other areas of the U.S. very little if any feeds are homegrown. Depending upon a number of factors, homegrown feeds may cost much less than if those feeds were purchased. The opposite may also be true in other cases.

- Since individual dairy farmers may use a greater variety of feeds, especially homegrown and by-product feeds; their feed quality may vary significantly from the feeds used in the 16 percent protein-mixed dairy feed.

Figure 1. Change in daily feed costs per cow at a constant

milk-to-feed ratio.

I am not advocating that dairy producers should pay no attention to the USDA’s milk-to-feed ratio. I believe there is value in following it from month to month as long as one is aware of its shortcomings. However, in order for dairy producers to more accurately assess profitability on their own farms I recommend they regularly calculate IOFC’s or milk margin (MM) using data specific to their own farm. Next time, we will investigate how to calculate farm specific IOFC’s and MM’s and suggest how dairy producers can use this information in their milk and feed marketing program to decrease risk.

Related articles:

Print

Print Email

Email