Bulletin E-3411: Introduction to Cost of Production and Its Uses

DOWNLOADApril 20, 2020 - Jonathan LaPorte, Michigan State University Extension

Every decision made on the farm involves cost. Sometimes these costs are seen immediately through dollars spent. Others are not easily visible until their impacts to production are known. Understanding what these costs of production are, how to identify them, and what role they play in decision-making are important to you as a farm manager.

Having more knowledge about the farm’s operations enables producers to make more well-informed decisions. Knowledge about the farm’s cost of production is invaluable to those decisions. Within those numbers lies information about a farm’s strengths, areas of concerns or weakness, and impacts to crucial activities, such as land rent negotiations or purchases of inputs. These issues can have large impacts on the current or future success of the business.

To apply this information, you must understand each cost that goes into cost of production. This can be challenging as many concepts and measures of cost are used throughout the industry. In this publication, some of these concepts and their implications for management decision-making will be clarified.

Variable Costs

Variable costs are purchases that can vary based on the farm’s production volume. Examples can include increasing fertilizer rates to obtain higher levels of yields or purchasing seed with genetics that allow the use of specific chemical products. Other examples can include purchased feed, chemicals, labor, plastic bedding, fuel, and other items. These types of costs are influenced by the level of production the farm seeks to achieve and market conditions (that is, supply and demand) in that year.

These costs are often some of the largest the farm will incur during the year. Producers will often seek to obtain a large quantity of them at one time. These “pre-paid” or “locked-in” purchases may include the entirety of the farm’s needs for a specific input. By doing this, farm managers attempt to limit the risk that the price may significantly increase for a particular item of need.

One type of input particularly challenging for farm managers is fertilizer, which is commonly needed in large quantities. The timing of its purchase can have a great influence on its price. For example, many retailers will offer a more favorable price for UAN (28% or 32%) nitrogen in the fall versus the spring. This is because many moderate to large farms that use this product often have on-farm storage.

Storage can provide opportunities to secure needed inputs at favorable prices and offset any concerns of availability that may exist in the spring. Farmers without access to storage should pay attention to market trends and product availability. This allows farms to identify when the best times are to make purchases and determine how much to buy at one time. Often the best time to purchase most inputs is well in advance of when the farm intends to use them, such as planting time.

Labor is another variable cost that can be difficult for operations to work through. There are many factors that can influence the manager’s decision-making. These factors can include wage and benefit requirements, employee training and development, comparisons of hiring locally or pursuing migrant labor, among others. All of these can have short- and long-term impacts on the future of the business.

One resource to help begin to understand this area is the MSU Extension bulletin Labor Laws and Michigan Agriculture (E2966) at https://www.canr.msu.edu/farm_management/farm-labor-human-resources. As the bulletin outlines, laws and practices around farm labor are important for all farm managers to be aware of and understand.

Fixed Costs

While variable costs can be influenced by the production volumes, fixed costs are generally the same each year regardless of that volume. They are often considered basic necessities to produce goods or commodities and can be foundations from which the business operates.

Land is one of the most common examples of a basic necessity. Without land, crops cannot be grown, cattle grazed on pastures, or buildings raised to farrow hogs and milk cows. More importantly, farm businesses simply cannot grow without adding land in some way, shape, or form.

That is why farm property is so highly sought after. Acquisition of land is a challenge for every farm. The rate of renting or buying ground has continued to increase over the last few years, especially when it is highly productive or reasonably located to another interested farm. This raises the question: how much is too much for a basic necessity such as land?

Negotiations for land often begin with a focus on the highest yielding and most profitable crop to be grown. However, managers need to take into consideration all years that the property will be farmed.

Table 1. Example of a Farm for Rent

|

Farm profit/loss example

|

Year 1 (corn) |

Year 2 (soybeans) |

Year 3 (corn) |

Year 4 (soybeans) |

Year 5 (corn) |

|

|

Farm revenue |

|

$750 |

$540 |

$675 |

$510 |

$750 |

|

Variable costs (seed, fertilizer, chemicals, etc.) |

|

-$350 |

-$200 |

-$350 |

-$200 |

-$350 |

|

Fixed costs (farm insurance, real estate tax, etc.) |

|

-$75 |

-$75 |

-$75 |

-$75 |

-$75 |

|

Farm profit/loss (before rent) |

= |

$325 |

$265 |

$250 |

$235 |

$325 |

|

Rent cost |

|

-$250 |

-$250 |

-$250 |

-$250 |

-$250 |

|

Farm profit/loss (after rent) |

= |

$75 |

$15 |

$0 |

-$15 |

$75 |

The asking price of rent has been separated from fixed costs to emphasize its impact to profitability.

Table 1 illustrates an example of a farm for rent where the owner is asking $250 per acre every year. The contract is for 5 years on irrigated ground. The farm’s corn yield averages 200 bushels per acre on this type of ground and the market is offering $3.75 per bushel or $750 of expected income. After covering expenses and the rent payment, the farm plans to make a profit of $75 per acre in the first year. This contract agreement looks very favorable to both parties.

How appealing is the contract in Year 2 when the operation rotates to a crop such as soybeans? The average soybean yield is 60 bushels per acre and the market price is $9 per bushel for an expected income of $540 and profit of $15 per acre. Should the farm agree to take on the property? What if the corn yield in Year 3 drops to 180 bushels? Or the market price for soybeans falls to $8.50 per bushel in Year 4? What if both yields and prices fall in the same year?

As the example illustrates, fixed costs do not carry the sharp swings of increases or decreases seen in some years that variable costs do, but they still have a significant impact on a farm business. Understanding how these affect the cost of production year after year is important if a farm is to successfully and consistently reach its goals.

Depreciation: Another Type of Fixed Cost

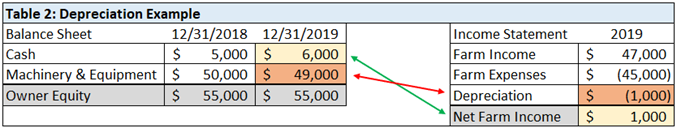

Depreciation is used routinely in evaluating profitability and is a helpful tool for farm managers. It can also be one of the most misunderstood and confusing topics for newer decision-makers, since it is not something you will find in the farm’s checkbook.

Specifically, we are speaking about economic depreciation, which is different from taxable depreciation, which will be covered in a later publication. Economic depreciation focuses on calculating the lost value of farm equipment, buildings, and even vehicles from age and use. This is important both from a profitability viewpoint and to the overall net worth of the farm business itself.

Think about a newly purchased skid steer on a livestock operation. At the time of its purchase, it was worth $10,000 and added this value to the overall net worth of the business. Used routinely throughout the year, it received regular maintenance and was repaired when any breakdowns occurred. At the end of the year, it may be worth only $9,000 to a potential buyer. How does this change in value impact the business?

As Table 2 illustrates, the net worth of the business has declined by $1,000, even though the equipment is fully functional and even considered in “like-new” condition. To offset this, the farm’s cost of production calculation includes the depreciation value ($1,000 per our example) in order to determine if enough revenue is being generated to cover this loss.

Cost of production includes depreciation deductions to determine if the farm is generating enough revenue to cover the lost value of assets.

Depreciation also has an added benefit of assisting managers in deciding if a capital asset should be replaced. As they continue to decline in value from use and age, farm assets will eventually require greater amounts of repairs to keep them functional. By comparing these impacts to variable and fixed costs, depreciation helps managers to understand if they are maintaining or growing the overall profitability and net worth of their businesses—making it a vital part of the farm’s cost of production.

Direct vs. Variable and Fixed Costs

Direct costs or operating costs are those that vary in proportion to the size or scope of each farm’s enterprises (that is, every type of crop or livestock produced on the farm). This is important as a farm manager begins to think about each production area and the costs associated with them.

For every acre grown or added animal raised, the costs associated with a production activity will change. These include a combination of variable and fixed cost items as they are used specifically or more often for one enterprise or another. Examples include livestock feed, irrigation costs, and land rent.

Consider a vegetable farm that raises zucchini and yellow squash (see Table 3). The farm has annual labor costs of $14,000 or an average of $35 per acre on 400 acres. This amount covers full- and part-time employees. This past year, approximately 60% of work hours were spent in the fields of yellow squash. Heavy rains led to increased weed pressure and also higher than anticipated production. The remaining 40% was spent in the zucchini fields. This meant that $8,400 of the total labor costs were directly tied to yellow squash while $5,600 was tied to zucchini. If each enterprise had 200 acres, then the direct cost of hired labor for yellow squash would be $42 dollars per acre and $28 for zucchini.

Table 3: Labor Cost Example

|

Crop |

|

Total Cost |

Cost Per Acre |

|

Labor cost to yellow squash |

|

$8,400 |

÷ 200 = $42/acre |

|

Labor cost to zucchini |

+ |

$5,600 |

÷ 200 = $28/acre |

|

Total annual labor cost |

= |

$14,000 |

÷ 400 = $35/acre |

Direct costs vary based on production and include both variable and fixed costs.

Farm managers use this process of enterprising to determine each production area’s specific costs of production. This allows them to evaluate the success of each component of the business on an individual basis separate from the whole farm. Frequently, they will learn that one production area is more effective and profitable compared to another.

This process can then be taken to the next level by comparing the whole farm and cost of production against other farm operations. Using national benchmarking databases, such as FINBIN (https://finbin.umn.edu/), managers gain valuable information about best practices, areas of improvement, and overall performance. Producers that enterprise and utilize benchmarking information often discover ways to improve profitability and long-term sustainability.

To ensure accuracy, make sure that the net profits for all individual enterprises added together equal the whole farm’s total net profits. For more information on enterprising, check out the MSU Extension bulletin Understanding Enterprise Budgets and Economic Profit (E3410) at https://www.canr.msu.edu/farm_management/DEMaND-Series/

Agronomics and Nutritional Inputs

Agronomic and nutritional needs are a critical component to achieving production goals. This also makes them a significant, though often silent, part of what drives a farm’s cost of production.

Plants and animals need nutrients and water as well as appropriate environments to grow within. If any of these are lacking, then the production the farm hopes to achieve will be diminished. How might this impact variable costs?

Livestock have specific nutritional needs that influence their rate of growth and overall productivity. The availability of feed sources and their nutritional values influence how these needs are met. Livestock also have different nutritional needs as they mature. This makes feed one of the largest and most variable input costs on a farm.

For example, a farm manager decides to raise corn silage as feed for their dairy livestock. They understand that poor quality feed significantly reduces the digestibility and energy output on a dairy cow (https://www.canr.msu.edu/dairy/dairy_production/nutrition-and-feeding). This results in fewer pounds per day of milk. It also affects the quality of that milk and the components paid for with the milk (such as butter fat and milk protein).

To obtain high-quality feed with the desired nutritional values, the crop being harvested must be in good health. MSU’s Nutrient Recommendations for Field Crops in Michigan (E2904) (https://soil.msu.edu/wp-content/uploads/2014/06/MSU-Nutrient-recomdns-field-crops-E-2904.pdf) outlines that one ton of corn silage requires 9.4 lbs of nitrogen, 3.3 lbs of P2O5, and 8 lbs of K2O to meet crop needs. If the yield goal is 30 tons per acre, that means the total fertilizer program needs 282 lbs of nitrogen, 99 lbs of P2O5, and 240 lbs of K2O. How much and what types of these nutrients will be provided to the plant? Will soil tests from these fields result in different fertilizer requirements? The answer to these questions greatly influences the fertilizer purchases for the farm.

Impact on Costs

How do agronomic and nutritional inputs impact fixed costs?

This question can be answered by considering the land discussion from earlier. As outlined, land is often one of the larger costs of production for the farm. Knowing what goes into producing a commodity, is the property worth the price being paid?

Any time ground is being rented, farm managers must consider the condition and potential investment that would need to be made for crops to be grown. Can it produce the high-quality feed source you need for your livestock, or sufficient commercial grain yields to be profitable? Or are nutrient levels so low that higher than average amounts of fertilizer or lime will need to be applied just to get a normal yield? This helps producers decide if the agronomic or nutritional needs will require large investments that outweigh the benefit of renting the ground.

Understanding the impact of agronomic and nutritional needs is a critical part of knowing your farm’s cost of production. Understanding what drives these costs is just as important as knowing how to use that information to make decisions.

Financial Obligations (Cash Flow)

Often not thought about as a cost of production, family living, income taxes, and principal debt payments are just as much a part of running a farm business as anything variable or fixed. The importance of these cash flow considerations to the overall success and longevity of the business means they deserve a brief mention.

Most farm managers only think “financial” refers to borrowed loans or money used for operating, equipment or inventory purchases (such as feed or livestock), and even land. For a farm, those activities certainly can require borrowed funds. However, it also refers to money used for family living (such as groceries), income taxes, and possibly even personal wages from the farm business. Consider how paying for these can affect your farm’s ability to reach its goals in the following example.

As the farm manager, you decide that the business should be responsible for paying your income taxes. There will be an estimated annual payment of $10,000. Your farm consists of 800 acres of soybeans and wheat raised on a 50/50 rotation. As illustrated in Table 4, you calculate that the income tax payment is $12.50 per acre. However, your estimated operating profit (after variable and fixed costs) on soybeans and wheat is expected to bring in an average of $13.50 per acre between the two enterprises.

Table 4. Net Return to Cover Cost

|

Cash Flow Activities |

|

Cost Per Acre |

|

Average Operating Profit (soybeans & wheat) |

+ |

$13.50 |

|

Income Tax ($10,000 payment/800 acres) |

- |

$12.50 |

|

Net Return to cover debt |

= |

$1.00 |

Cash-flow considerations are also part of running a farm business.

The table illustrates that by covering a portion of the income taxes, the farm is left with only $1 per acre or $800 total for other financial costs (debt). Should the farm still be expected to cover the same amount of income taxes? If the farm pays a smaller portion, how will the rest of the taxes be paid?

Marketing and Break-Evens

Knowing the cost of production really starts to pay off when you make marketing decisions for the operation. Marketing occurs when the farm sells its products to a consumer for a given price. The goal is to receive a high enough price that more than covers all costs the farm needs to pay. If the prices received are only enough to meet those needs, the farm is considered to have marketed at its break-even level.

Every farm wants to sell their products for more than break-even. They want to have additional dollars left over to use elsewhere. Without knowing the cost of production, there is no way to know that the market price being offered will provide a profit beyond the operation’s break-even.

Break-even calculations should include not only the cash transactions in a year, but also pre-paid inputs or other inventory adjustments on the farm. These accrual adjustments give you the actual cost that needs to be covered for that input in a given year. When you have done these for all input purchases, you can then calculate what price is needed to cover the expected costs.

Farm business managers have many types of break-even numbers to think about when marketing their products. This publication will focus on three of the most common:

- Net return (operating)

- Repayment capacity (cash flow)

- Capital retainment (net worth)

Net Return (Operating) Break-Even

Much of a growing season is focused on variable and fixed input costs. That is why the net return to operating tends to be the most common break-even that farm managers think about. To obtain a break-even price to cover operating costs, simply divide the total operating expenses by the expected production. To find the break-even for yield, divide the total operating expenses by the expected price. The formula for the net return (operating) break-even price follows:

|

(Variable + Fixed Costs) ÷ Expected Production Level = |

Capital Retainment (Networth) Break-Even

As a farm manager, you want your business to be worth more tomorrow than it is today. The increase of value or capital retainment (or net worth) of your business is a sign that it is doing well and considered a success. Increasing net worth is mainly accomplished through the generating of additional dollars or retained cash that the farm can use later. Reinvestments may be in the form of purchasing newer equipment, upgrading or adding facilities, or even the purchase of land. These dollars are also used to offset the depreciation in value of those same investments.

These capital activities make the net worth break-even one of the most important to calculate as a farm manager. What does the market price need to be to cover operating and financial costs as well as cover the lost value of depreciable assets? The formula for the capital retainment (net worth) break-even is shown below:

|

(Variable + Fixed Costs + Financial Obligations) ÷ Expected Production Level = Capital Retainment (Net Worth) Break-Even Price |

Repayment Capacity (Cash Flow) Break-Even

The break-even for repayment capacity (or cash flow) is the number that your lender will want you to focus on. In cash flow, the farm covers not only the variable and fixed costs, but also the non-operating or financial obligations for the year. This includes any family living cost, property taxes, and term debt payments the farm is expected to pay. The formula for the repayment capacity (cash flow) break-even follows:

|

(Variable + Fixed Costs + Financial Obligations – Economic Depreciation) ÷ Expected Production Level = Repayment Capacity (Cash Flow) Break-Even Price |

Economic depreciation is subtracted in this break-even as it focuses on actual dollars spent.

Knowing what the different break-even prices are is important in your role as a decision-maker on the farm. The cost of production will ultimately determine if your business is successful as a whole and can also be applied to individual enterprises within the business.

Farm Records, Planning, and Decision-Making

Farm records are the most important part of finding the farm’s cost of production. They are the source of all knowledge related to the business and where current, past, and even future data is stored. But poor data storage and organization habits can keep critical pieces of information hidden.

To aid producers in maintaining good records, the Farm Financial Standards Council (https://ffsc.org/) annually publishes guidelines on how to maintain uniform and accurate farm records. The MSU Telfarm program (https://www.canr.msu.edu/telfarm/) also provides accounting and financial analysis support to farmers across Michigan. You can find additional tools and resources at the MSU Extension Farm Management website, including the Farm Records Book for Management (E1144) (https://www.canr.msu.edu/resources/farm_records_book_for_management_e1144).

As a beginning farmer, you will be challenged with trying to decide what direction you want to take your business. Measuring the past, current, and potential success of the goals you set for your farm is a vital part of being a farm manager and decision-maker. Following these guidelines will further help you understand the farm’s strengths and weaknesses and shape the farm’s business future. Spend time today finding your farm’s cost of production and then using it for continued growth and success!

Print

Print Email

Email