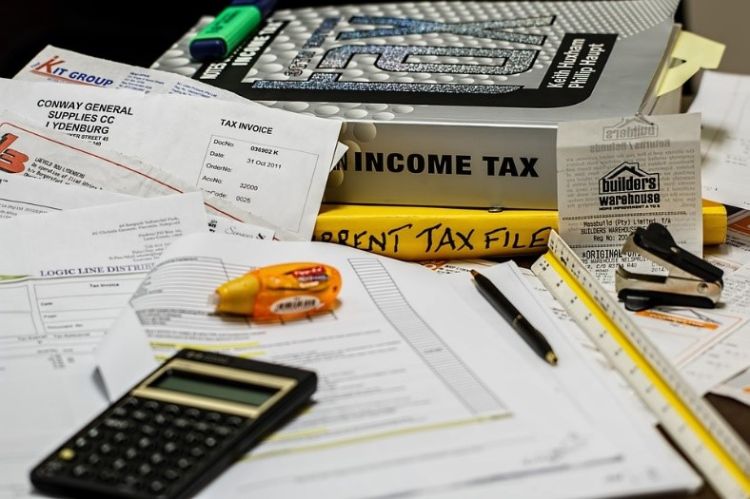

Are you withholding the right amount for income taxes?

The Tax Cuts and Jobs Act passed in December 2017 could impact the refund received by many taxpayers when they file their 2018 tax returns, to prevent surprises, do a “paycheck checkup” using the IRS Withholding Calculator.

Have you done a “paycheck checkup” this year to ensure you are having the right amount of income taxes taking out of your pay? The Tax Cuts and Jobs Act passed in December 2017 could impact the refund received by many taxpayers when they file their 2018 tax returns. If you typically receive a large tax refund, averaging around $2,800 for most taxpayers, the IRS is urging you to use their Withholding Calculator to avoid surprises because of the new law. You still have several months to make changes before the end of 2018.

Tax Cuts and Jobs Act changes that could impact tax refunds this year, according to the IRS, are:

- Reduced tax rates and changed tax brackets

- Eliminated personal exemptions

- Higher standard deduction

- Increased Child Tax Credit

- New credit for other dependents

- Changes in other deductions.

Two reasons to check your withholding are:

- Protect against having too little being deducted and receiving an unexpected tax bill or penalty next year.

- If you usually receive a large refund, you may also choose to have less tax withheld up front and receive more money in your paychecks. Use this strategy as a way to increase your take-home pay, especially if you need more income to pay bills each month.

If you are an employee and decide to change your withholding, you will need to give your employer a new Form W-4, Employee’s Withholding Allowance Certificate. For income from pensions, use Form W-4P and give it to your payer.

It is a good time to be proactive about your 2018 income taxes and check how much is being withheld before facing an unanticipated tax bill and potential penalty in 2019. Think about your current behaviors, habits and spending plan, including your income and expenses. Find more information about money decisions, setting goals, and spending plans at MIMoneyHealth.org.

Print

Print Email

Email