How will the Inflation Reduction Act impact forest and carbon management?

Graham Diedrich, FCCP graduate research assistant, has written an analysis discussing the Inflation Reduction Act of 2022 titled, "How will the Inflation Reduction Act impact forest and carbon management?"

How will the Inflation Reduction Act impact forest and carbon management?

Graham Diedrich, Michigan State University Forest Carbon and Climate Program

Overview

The recently signed Inflation Reduction Act of 2022 (IRA) represents the largest single climate investment in U.S. history, with approximately $386 billion allocated for new energy and environmental spending– a 329% increase compared to spending for climate programs in the American Recovery and Reinvestment Act of 2009.1 14 Three independent analyses conducted by Rhodium Group2, Princeton University’s REPEAT Project3, and Energy Innovation4, conclude that the IRA is expected to play a significant role in reducing emissions by approximately 40 percent below 2005 levels by 2030, given key assumptions regarding industry and consumer participation in proposed incentive programs.

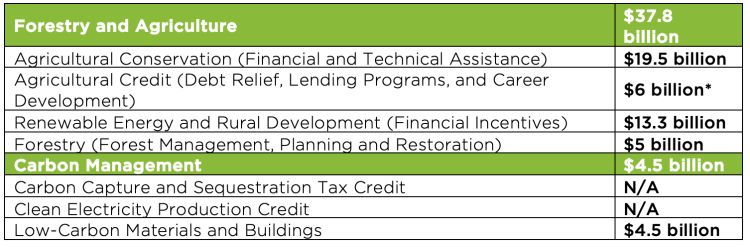

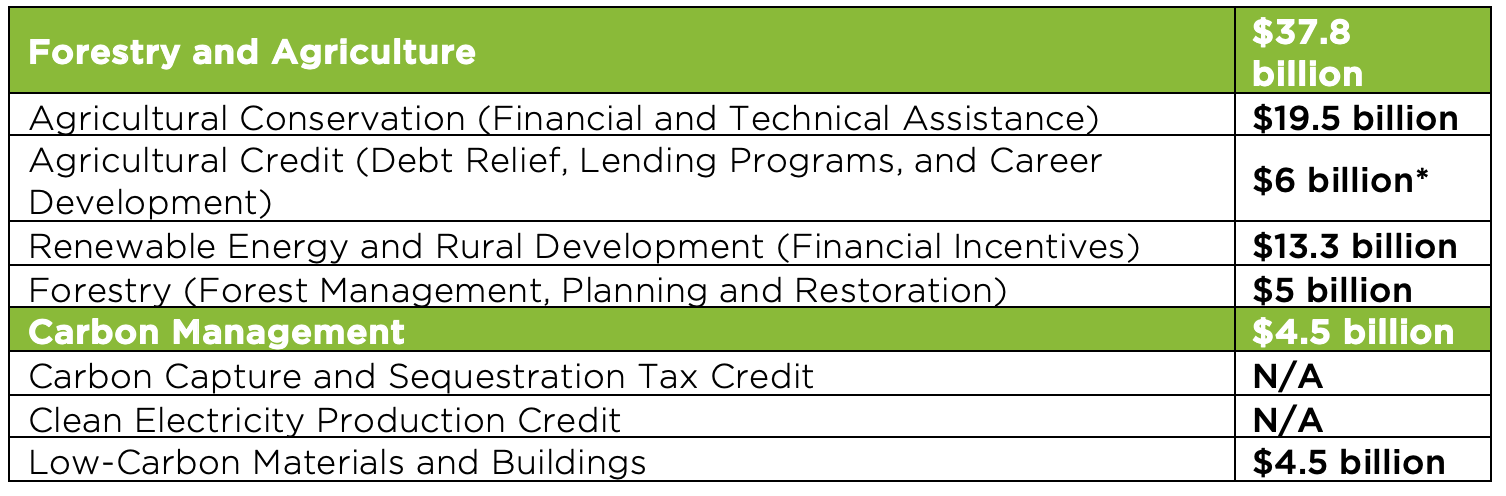

In addition to broader energy and climate programs, the bill includes nearly $38 billion for agricultural conservation, agricultural credits, renewable energy, rural development, and forestry.5 Table 1 highlights key forestry, agriculture, and carbon management priorities, which are lower than the House-passed Build Back Better Act of 2021 that proposed $27 billion dollars for forestry alone.5

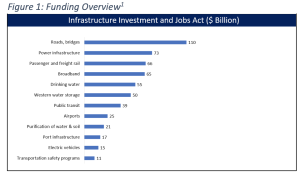

Table 1. Overview of IRA Budget Allocation. Assessment compiled/calculated from multiple data sources: Congressional Research Service (2022),5 Elliot et al (2022),6 Bipartisan Policy Center (2022),7 *Additional funds rescinded/repurposed funds from the American Rescue Plan Act of 2021 (ARPA) and not included in the 37.8 billion total.

The package is projected to have a consequential impact on forest carbon management and the adjacent sectors in the U.S. This article details how the federal government– through tax credits, financial incentives, and technical relief– plans to allocate the funding associated with each category. It puts these numbers and expected impacts into historic context and illustrates the opportunities as well as concerns associated with the reconciliation package.

Forestry and Agriculture

Agricultural Conservation

The IRA provides $19.5 billion for agricultural conservation, much of which is directed to existing farm bill conservation programs. For instance, $8.45 billion is being directed to the Environmental Quality Incentives Program (EQIP) for practices that improve carbon storage in soil or decrease greenhouse gas emissions.5 This represents an almost 40% increase in EQIP’s budget authority between 2019-2029. $4.95 billion is being directed to the Regional Conservation Partnership Program (a 105% increase), $3.25 billion to the Conservation Stewardship Program (a 21% increase), and $1.4 billion to the Agricultural Conservation Easement Program (a 28% increase).5 An additional $1 billion is being provided for conservation technical assistance, as well as $300 million for a carbon sequestration and greenhouse gas emissions quantification program.5

Agricultural Credit

$6 billion in rescinded or repurposed funds from the American Rescue Plan Act (ARPA) will provide debt relief, financial assistance, and other aid to underserved farmers, ranchers, and forest landowners.5 $3.1 billion of that has been allocated for debt mortification and forgiveness for distressed borrowers, while $2.9 billion is earmarked to aid underserved farmers, ranchers, and foresters.5 The latter amount targets landowners who have experienced discrimination and includes financial assistance, technical assistance, land loss assistance, as well as agricultural education scholarships and career development opportunities at historically Black, tribal, and Hispanic colleges.5 6

Renewable Energy and Rural Development

The IRA sets aside $13.3 billion for Farm Bill Energy Title programs, which have aided farmers and rural landowners in purchasing renewable energy systems since 2002.5 9 This represents an almost 800% compared to total discretionary spending authorized in the 2018 Farm Bill. Of that, $9.7 billion in loans and grants will be provided to rural electric cooperatives to purchase renewable energy systems and adjacent technologies.6 The Rural Energy for America Program (REAP), which provides guaranteed loan financing and grant funding for renewable energy systems or to make efficiency improvements, will receive $2.22 billion.6 10 A further sum, $1 billion in loan subsidies, has been approved and authorized under the Rural Electrification Act.6 $500 million has been allocated for competitive grants for biofuel infrastructure improvements.6

Forestry

The bill provides $5 billion for forest management, planning, and restoration activities on federal and nonfederal forest lands, including other public lands as well as private and tribal lands. $2.15 billion is being directed to the National Forest System for hazardous fuel reduction projects, vegetation management projects, to strengthen USFS NEPA reviews by setting maximum timeline requirements, and to bolster forest inventory data on US Forest Service old-growth and mature forests.6

Additionally, $2.75 billion has been set aside to fund grants and financial assistance for nonfederal forest management, including $700 million for states and $1.5 billion through the Urban and Community Forestry Assistance program for local governments, tribes, and nonprofits.5 6 A total of $550 million for grants under the Cooperative Forestry Assistance Act will be distributed for underserved foresters to invest in climate mitigation and resilience, participate in private forest carbon markets, and develop innovative wood products.6

Carbon Management

Carbon Capture and Sequestration Tax Credit

The tax credit under Section 45Q, known as the Carbon Capture and Sequestration Tax Credit, has existed since 2007 and provides an incentive for corporations to capture and store carbon underground.8 The bill enhances and increases the credit amount and minimum electricity plant size thresholds, as well as extends the deadline for construction of carbon sequestration technologies to 2033.7 As a result, existing cost prohibitive activities– such as direct air capture (DAC), enhanced oil recovery (EOR), and the use of saline geologic formations– will likely see increase in participation.

Clean Electricity Production Credit

The emissions-based, technology-neutral Clean Electricity PTC replaces the Renewable Electricity PTC after it is phased out in 2024.7 Taxpayers receive a credit of 1.5 cents per kWh of electricity produced, sold, or stored that contributes zero or negative emissions.7 A 10% bonus is applied for projects in energy communities, projects that meet domestic manufacturing requirements, and projects that are located in low-income communities or on tribal lands.7 Notably, facilities may utilize carbon capture and store to fulfill emission requirements.7

Low-Carbon Materials and Buildings

In total, $4.5 billion has been appropriated to support the procurement of low-carbon materials used in federal buildings and projects. Of that amount, $2.15 billion is to be allocated for use by the General Services Administration (GSA) to require and install low-carbon materials in federal facilities. Another $2 billion will go to the Federal Housing Administration (FHA) for the procurement of low-carbon materials, provided that they cost the same (or incrementally more) than traditional products.7 $350 million has been given to the Environmental Protection Agency (EPA) to support the development of an environmental products declaration of greenhouse gases associated with construction, as well as to identify and label low-carbon materials.7

Concerns

Despite these benefits, the IRA is far from perfect. Under the bill, the Interior Department is barred from issuing any new permits for renewable energy development until 2032, unless the department also offers 20 million acres of land and 600 million acres of ocean area for fossil fuel leasing.11 However, it is unclear whether oil and gas companies will take the government up on its offer to develop these new facilities, as the industry has slowly begun to shift away from federal lands and offshore sites like the Gulf of Mexico.12

Additionally, there are environmental justice concerns regarding the reliance the bill places on tax credits rather than direct investment. As such, the IRA may reinforce existing socioeconomic and racial barriers faced by many consumers seeking to install renewable energy systems and to incorporate other clean technologies.13 For instance, residential tax credits are not refundable, meaning that almost 40 percent of households with little or zero federal income tax liability (who are disproportionally people of color) will be excluded from installing rooftop solar and other clean energy modifications.15

Conclusion

The IRA represents a historic investment in U.S. forests and carbon management activities, with billions in loans, grants, tax incentives, and conservation programs that seek to transition landowners towards climate-smart technologies and clean energy alternatives. The reconsolidation package represents an opportunity for the U.S. to take actionable steps towards its goal of 50 percent emissions reduction from 2005 levels by 2030, and should be applauded as the first major American climate bill to be enacted due to its potential to reinvent the energy sector and combat climate change.14However, concerns about concessions to fossil fuel extraction and environmental justice should be considered when discussing what the IRA has and has not achieved.

Over the next decade, participation in these programs is key to achieving projected carbon and environmental benefits. The IRA is not a completed task, rather, more work is needed in research and outreach to ensure that these funds are spent wisely in the pursuit of action on climate change and forest carbon management.

Sources

- Committee for a Responsible Federal Budget. (2022). What's In the Inflation Reduction Act? Retrieved from https://www.crfb.org/blogs/whats-inflation-reduction-act

- King, B., Larsen, J., Kolus, H. (2022.) A Congressional Climate Breakthrough. Rhodium Group. Retrieved from https://rhg.com/research/inflation-reduction-act/

- Jenkins, J.D., Mayfield, E.N., Farbes, J., Jones, R., Patankar, N., Xu, Q., Schivley, G. (2022). Preliminary Report: The Climate and Energy Impacts of the Inflation Reduction Act of 2022. REPEAT Project. Retrieved from https://repeatproject.org/docs/REPEAT_IRA_Prelminary_Report_2022-08-04.pdf

- Mahajan, M., Ashmoore, O., Rissman, J., Orvis, R., Gopal, A. (2022). Modeling The Inflation Reduction Act Using The Energy Policy Simulator. Energy Innovation. Retrieved from https://energyinnovation.org/publication/modeling-the-inflation-reduction-act-using-the-energy-policy-simulator/

- Congressional Research Service. (2022). Inflation Reduction Act: Agricultural Conservation and Credit, Renewable Energy, and Forestry. Retrieved from https://crsreports.congress.gov/product/pdf/IN/IN11978

- Elliott, N., Viola, B., Coulter, H., Lane, I., Odintz, J., Franco, M., Armstrong, C., Jorgensen-Earp, E., Goldsmith, R., Nicholas, K., Carroll, K., Towle, C. (2022). The Inflation Reduction Act: Summary of Budget Reconciliation Legislation. Holland & Knight. Retrieved from https://www.hklaw.com/media/files/insights/publications/2022/08/080822inflationreductionactsummary.pdf?la=en

- Bipartisan Policy Center. (2022). Inflation Reduction Act Summary: Energy and Climate Provisions. Retrieved from https://bipartisanpolicy.org/blog/inflation-reduction-act-summary-energy-climate-provisions/

- World Resources Institute. (2022). Carbon Capture, Utilization and Storage (CCUS) Tax Credit Amendments Act of 2021 and Negate Emissions to Zero (NET Zero) Act of 2021. Retrieved from https://www.wri.org/update/45q-enhancements

- Congressional Research Service. (2022). Farm Bill Primer: Energy Title. Retrieved from https://crsreports.congress.gov/product/pdf/IF/IF10639

- S. Department of Agriculture. (2022). Rural Energy for America Program Renewable Energy Systems & Energy Efficiency Improvement Guaranteed Loans & Grants. Retrieved from https://www.rd.usda.gov/programs-services/energy-programs/rural-energy-america-program-renewable-energy-systems-energy-efficiency-improvement-guaranteed-loans

- Marks, A. (2022). Inflation Reduction Act: Faustian Bargain Could Jeopardize Offshore Wind, Renewable Energy On Federal Lands. Forbes. Retrieved from https://www.forbes.com/sites/allanmarks/2022/08/03/inflation-reduction-act-faustian-bargain-could-jeopardize-offshore-wind-renewable-energy-on-federal-lands/?sh=1575d66b7089

- Bittle, J. (2022). The Inflation Reduction Act Promises Thousands of New Oil Leases. Drillers Might not Want Them. Government Executive. Retrieved from https://www.govexec.com/oversight/2022/08/inflation-reduction-act-promises-thousands-new-oil-leases-drillers-might-not-want-them/375698/

- Climate Justice Alliance. (2022). The Inflation Reduction Act is Not a Climate Justice Bill. Retrieved from https://climatejusticealliance.org/the-inflation-reduction-act-is-not-a-climate-justice-bill/

- Romer, C. (2010). Impact of the American Recovery and Reinvestment Act on the Clean Energy Transformation. The White House. Retrieved from https://obamawhitehouse.archives.gov/blog/2010/04/21/impact-american-recovery-and-reinvestment-act-clean-energy-transformation

- Gleckman, H. (2021). The COVID-19 Pandemic Drove A Huge, But Temporary, Increase in Households That Did Not Pay Federal Income Tax. Tax Policy Center. Retrieved from https://www.taxpolicycenter.org/taxvox/covid-19-pandemic-drove-huge-temporary-increase-households-did-not-pay-federal-income-tax?utm_medium=twitter&utm_source=tpc_social

Click here to download this piece.

Print

Print Email

Email