Identify the farm’s profitability and cash flow Part 1

Considerations for the farm business after prevent plant and delayed planting.

The severe weather this year has put a tremendous amount of pressure on Michigan farms. From delays in planting to spraying timely for weeds or diseases, each farm has felt the impact of these conditions. https://www.canr.msu.edu/agriculture/delayed-planting-resources/ The common thought is that because conditions across the state were similar that the impacts to farms would be, too. The reality is that each farm is a very different situation.

Some farms have 2018 crops waiting to be sold, planted most of their crops, and took preventative planting on the remaining acres. Other farms were unable to plant a single acre, have no grain to sell, and carry no crop insurance. While most farms are somewhere in between, concerned about the quality of what was planted and what to do about what wasn’t. Each farm has a different scenario to work through, but each one is also asking the same important question. At the end of the season, what does our farm’s situation mean when it comes to profitability and cash flow?

The first step in answering this question is to recognize that you, the farm manager, are responsible for managing your own business. Taking ownership of knowing what the state of the farm is and what its options are to still be successful is the most important part of leading the business through a challenging year.

In this segment, MSU Extension recommends the following considerations:

- Identify and document the farm’s current level of Equity, past Profitability and projected Cash Flow. https://www.canr.msu.edu/telfarm/

- Realistically evaluate this falls harvest for yields, quality, freeze potential and price/value. Are there viable alternatives if immature harvest? Livestock feed?

- Take advantage of “empty fields” to improve opportunities and reduce risk for future years.

- Get machinery maintenance completed and “ready to go” to minimize start up and down time during harvest

Profitability vs. Cash Flow

Profitability is different from cash flow. Cash flow simply shows the flow of money in and out of the business over time. It does not consider potential changes in prepaid expenses, crop and livestock inventory changes, changes in unpaid bills, value of unpaid labor or economic depreciation (versus tax depreciation). These items are needed to project or measure profitability. However, cash flow does take into account scheduled principal payments, capital purchases and sales, borrowings, and draws for family living that profit measurements do not consider. These two equally important financial measurements are often confused, intermixed and measured inaccurately.

Steps to develop cash flow projections (use your accounting records to determine headings)

- Determine expected revenues by month:

- Crops, 2018, 2019

- Milk sales

- Livestock sales

- Cull Sales

- Insurance indemnity payments

- Government programs MFP, ARC

- Other? PA116, Patronage Dividends

- Capital Sales

- Non - Farm Income

- Determine expected bills and expenses to be paid by month

- Crop and livestock inputs

- Repairs and supplies

- Supplies

- Rents and Leases

- Utility and fuel bills

- Purchased Feed

- Labor Expenses

- Taxes

- Capital Purchases

- Family Living and Income Taxes

- Principal and Interest payments

- Add up Revenues and Expenses by month to determine shortage or surplus.

- Use your current cash and checking balance and then add or subtract each month’s net value change to evaluate each month’s cash position.

- When and how much are you short on cash flow needs?

- What can you do to adjust cash flow demands?

- Timing of payments – is there two or three months that appear to be short but revenues come in later months?

- Include expected USDA program payments including MFP, DRP, ARC-Co, PLC

- Consider selling capital items that are not generating significant income. Perhaps a timber harvest, low productivity land, or excess machinery

- Delay or postpone capital investments

- Restructure Debt payments by spreading over more years

- Get current with unpaid bills by borrowing new money with appropriate repayment plan (5 to 10 years).

- Off farm income potential.

- May find that their needs to be a major change to the operation including possibly partial liquidation.

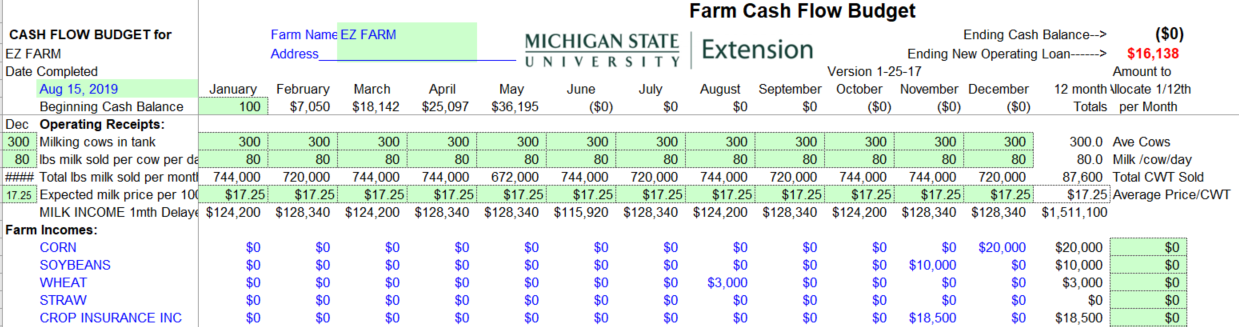

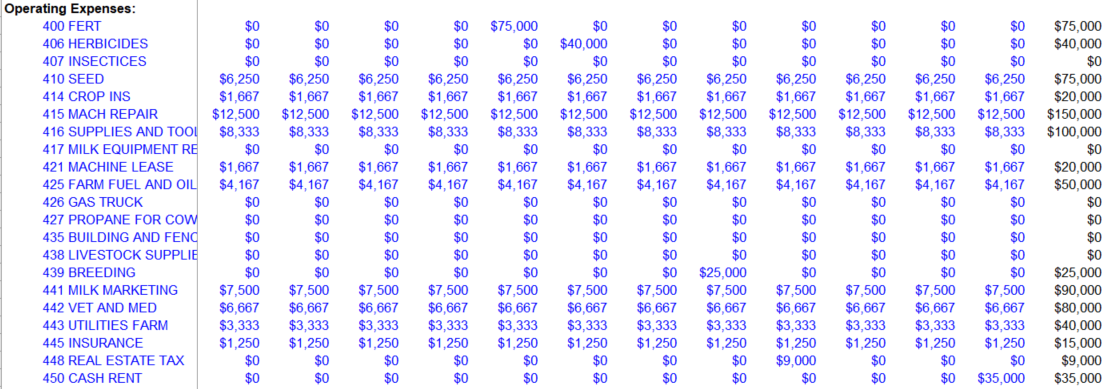

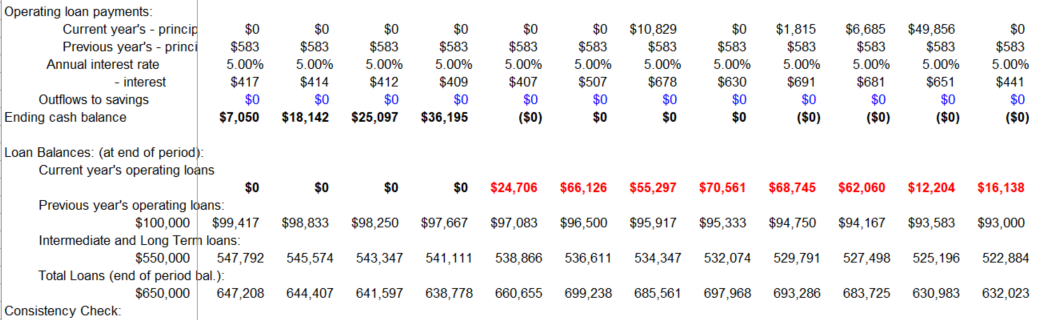

A cash flow Excel spreadsheet is available through the MSU Extension Farm Business Management website at: https://www.canr.msu.edu/farm_management/decision-tools

Tax planning considerations

The disruption of normal cash flow activity to less expenses because of prevented planting and crop insurance indemnity claims along with Market Facilitation Program payments might create an unexpected income tax problem. Crop insurance indemnity payments taxation can be delayed one year if the underlying insured crop is normally sold the following year. Tax planning for the 2019 tax year may be especially important this coming December.

Empty Field Opportunities

If you have open fields not planted because of being too wet, now is an opportunity to correct and improve this situation. Subsurface drainage with field tile is a good long-term investment. Getting standing water off through surface drainage improvements will also help soils to dry out faster enabling timely planting and less crop damage from standing water and improved yields. If you have an area that holds 2 feet of water, you may be able to take 1 foot of soil from the high area to the low area to make it level. Of course, top soil needs to stay in place for future crop production. You may have time during the summer and soil conditions are typically better for this kind of work.

- Deep tillage should only be utilized when soil conditions are dry. Spring and fall often are too wet for optimum soil shattering. Some soils that have been worked wet in the past can be improved with deep tillage. Utilize the dry soil and time available for these operations.

- Cover Crop (sell for forages) Cover crops can provide nitrogen and organic matter to the soil. https://www.canr.msu.edu/cover_crops/uploads/files/Prevented_Planting_Cover_Crops.pdf

Print

Print Email

Email