Preparing your community for opportunity zones

New economic development tool to impact Michigan communities through a federal tax incentive

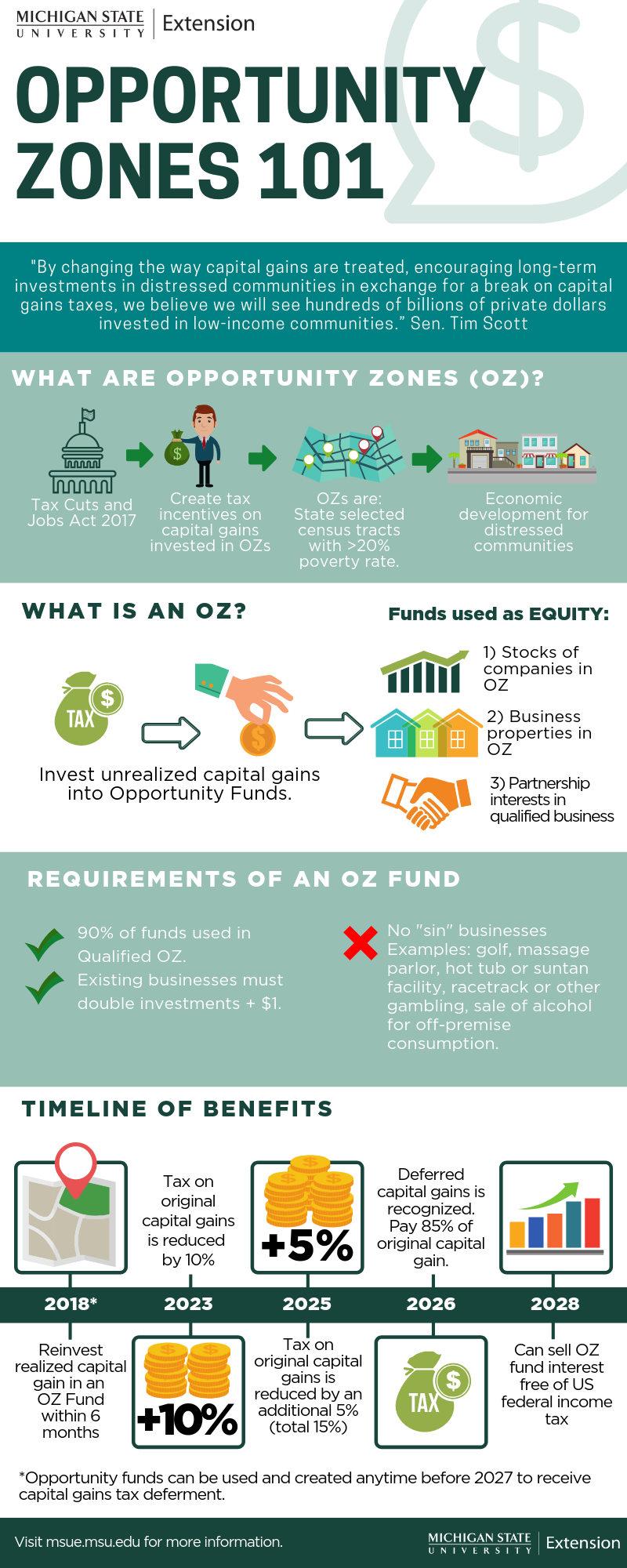

In 2017, the Tax Cuts and Jobs Act created a new economic development tool, the Federal Community Development Tax Incentive Program. The goal of the program is to encourage long-term capital investment in certain economically distressed communities called “Opportunity Zones” (OZ). The State of Michigan designated 288 census tracts as qualified Opportunity Zones in 81 counties of the state. To see a map of OZs, visit www.michigan.gov/opportunityzones.

This program provides federal tax incentives for capital gains invested in qualified OZ census tracts. Once investors establish an OZ Fund, the funds can be invested in equities in the form of company stocks, business properties, or partnership interests in qualified businesses.

There are a few guidelines for the OZ Funds such as 90% of the funds must be used in a qualified OZ, if they are investing in an existing business (prior to 2018) they must double their initial investment plus $1.00, and funds cannot be used on “sin” businesses such as golf, massage parlor, racetracks etc. It is likely additional guidelines will be released.

In order for investors to gain the benefits of tax deferment on income from their previous year’s capital gains, they must invest during the first 180 days of the following year. There are additional benefits for investors who do so before 2023 (tax is reduced by 10%) and 2025 (tax on original capital gain is reduced by an additional 5%). Investors interested in maximizing the benefit will be able to defer the capital gain until the program ends in 2026. Further, they could potentially pay only 85% of the original capital gain once the tax deferment ended in 2026. As a new program, it is expected new guidelines will be presented. The following infographic provides a visual illustration of Opportunity Zones:

With an estimated $6 trillion in unrealized (available) capital gains to be invested nationwide, there is a significant opportunity for investment to encourage the development of distressed communities in Michigan. Communities with OZs may want to take time to understand the program and the potential impact on their community.

MSU Extension recommends local leaders to:

- Learn about OZs

- Prepare a database of properties in OZs for marketing and investment tracking purposes

- Engage local stakeholders in developing a vision for OZ properties

- Streamline policies, plans, and ordinances

- Promote the OZ to potential investors

MSU Extension will be conducting trainings across the state to help communities understand and market their Opportunity Zones. Visit this link to learn more on our upcoming Opportunity Zone trainings: https://events.anr.msu.edu/OZ

MSU Extension educators are also available to assist communities in marketing their OZ. To learn more about MSU Extension and the programs offered, visit http://msue.anr.msu.edu/

Print

Print Email

Email