The heads and tails of Coronavirus Food Assistance Program (CFAP) guidance for livestock and wool producers

Navigating CFAP for livestock producers.

Current as of 05/30/2020

From March 26, 2020 through August 28, 2020, farmers are able to sign up for financial assistance under the Coronavirus Food Assistance Program (CFAP). Cattle, hogs, sheep (lambs and yearlings only), and wool are included as eligible commodities. This article explains the eligibility requirements and program benefits to livestock producers under CFAP and provides a series of step-by-step examples for how to complete CFAP applications.

CFAP Eligibility Requirements

- Eligible producers: A producer (either a person or a legal entity) must have an average adjusted gross income of less than $900,000 for tax years 2016, 2017, and 2018. The $900,000 limit does not apply to producers for which 75% or more of adjusted gross income comes from farming, ranching, or forestry.

- Eligible commodities: Commodities that did not experience a price drop of 5% or more are ineligible for CFAP payments, though the USDA may reconsider excluded commodities in light of credible evidence of a 5% price decline. Livestock presently eligible for CFAP include:

Hogs

- Pigs (< 120 lbs.), and

- Hogs (≥ 120 lbs.).

(Note that a contract grower who does not own livestock is eligible if the contract allows the grocer to have price risk in the livestock.)

Cattle

- Feeder Cattle (< 600 lbs.)

- Feeder Cattle (≥ 600 lbs.)

- Slaughter Cattle: Fed Cattle

- Slaughter Cattle: Mature Cattle

- All Other Cattle (not including livestock used, or intended for, dairy production)

Sheep

- Lambs and yearlings less than two years of age.

Wool

- Graded, clean basis

- Non-graded, greasy basis

Payment Calculation

Livestock producers will receive a single CFAP payment, which consists of two components: a Coronavirus Aid, Relief, and Economic Security (CARES) payment component and a CCC payment component.

- For hogs, cattle, and sheep producers, these components are calculated as follows:

- CARES Payment Component: the number of animals sold between January 15, 2020 and April 15, 2020 multiplied by the CARES payment rate per head (Table 1), and

- CCC Payment Component: the highest inventory number between April 16, 2020 and May 14, 2020 multiplied by the CCC payment rate per head (Table 1).

- For wool producers, a single payment will be made based on 50% of the producer’s 2019 total production or 50% of the unpriced 2019 inventory as of January 15, 2020 (whichever is smaller), multiplied by the commodity’s applicable payment rates (Table 1).

|

Table 1: CFAP Livestock Payment Rates |

||

| Eligible Livestock | CARES Payment Rate | CCC Payment Rate |

| Hogs | (Per Head) | (Per Head) |

| Pigs (< 120 lbs.) | $28 | $17 |

| Hogs (≥ 120 lbs.) | $18 | $17 |

| Cattle | ||

| Feeder Cattle (< 600 lbs.) | $102 | $33 |

| Feeder Cattle (≥ 600 lbs.) | $139 | $33 |

| Slaughter Cattle: Fed Cattle | $214 | $33 |

| Slaughter Cattle: Mature Cattle | $92 | $33 |

| All Other Cattle | $102 | $33 |

| Sheep | ||

| Lambs and Yearlings (< 2 years old) | $33 | $7 |

| Wool | (Per Pound) | (Per Pound) |

| Graded, clean basis | $0.71 | $0.78 |

| Non-Graded, greasy basis | $0.36 | $0.39 |

Payment Limitations

- Payment Caps: The total amount of CFAP payments is limited to $250,000 per person or legal entity across all eligible commodities. Corporate entities (corporations, limited liability companies, and limited partnerships) may receive up to $750,000 based on the number of shareholders, up to three at $250,000 per shareholder. To qualify, a shareholder must be contributing at least 400 hours of active person management or personal active labor.

- Payment Structure: Producers will initially receive 80% of their estimated total payment.

- The remainder of the payment may be paid at a later date, depending on available funding.

Application Guidance

- Farm Service Agency: Producers should apply through their local Farm Service Agency Center, and applications can be submitted electronically.

- USDA Payment Calculator: The USDA has developed an online CFAP Payment Calculator (under the CFAP application heading) to assist with the application process. The Calculator allows producers to auto-populate the application form. The USDA has also created a video explaining how to use the CFAP Payment Calculator.

- For further information, visit the USDA CFAP livestock page, or view the USDA CFAP livestock factsheet.

Cattle Operation Examples

There are five groups of cattle covered under CFAP (Table 1). Payment rates for cattle sold between January 15, 2020 and April 15, 2020 vary by type, while payment rates for April 16, 2020 through May 14, 2020 inventories are a flat $33 for all unpriced cattle (i.e. not under a forward contract). Note that beefalo, bison, and animals owned for dairy production are excluded (with the exception of dairy cull cows).

- Cow-calf producer example

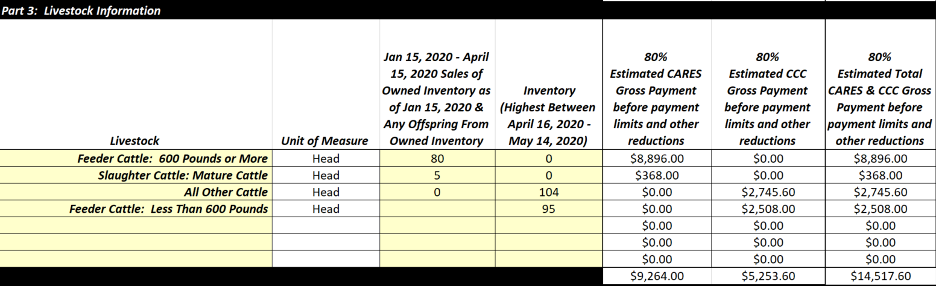

Assume a cow-calf producer, Farmer McKendree, owns a cow-calf operation and more than 75% of her adjusted gross income (AGI) comes from ranching. She is the single owner. Therefore, Farmer McKendree’s maximum payment is $250,000. Assume that Farmer McKendree’s operation sold 80 weaned calves weighing on average 750 pounds on March 16, 2020 and five cull cows for slaughter on April 1, 2020. The maximum inventory on the farm between April 16, 2020 and May 14, 2020 consisted of 100 cows, 95 unweaned calves, and 4 bulls.

Figure 1 demonstrates how Farmer McKendree would fill out the CFAP calculator. The weaned calves are classified as “Feeder cattle: 600 Pounds or More” and the cull cows as “Slaughter Cattle: Mature Cattle.” The cow and bull inventory are grouped together under “All other cattle” and unweaned calves as “Feeder Cattle: Less Than 600 Pounds.” Farmer McKendree is eligible for $18,147 total; $11,580 under CARES and $6,657 under CCC. However, only 80% of this amount is paid initially, or $14,517.60 --- this value is reported by the CFAP calculator.

- Feedlot example

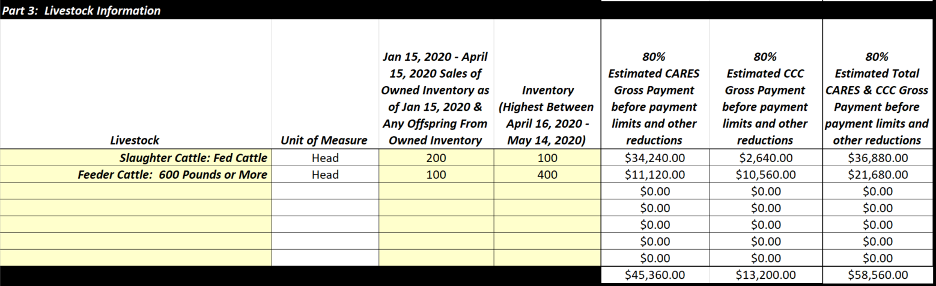

There is a weight restriction for fed cattle. Two important definitions from the CFAP final rule (pages 26-28) are:

- “Slaughter Cattle—fed cattle means cattle with an average weight in excess of 1,400 pounds which yield average carcass weights in excess of 800 pounds and are intended for slaughter.”

- “Feeder cattle 600 pounds or more means cattle weighing more than 600 pounds but less than the weight of slaughter cattle-fed cattle as defined in this section.”

Assume Farmer Schaefer owns a feedlot. Between January 15, 2020 and April 15, 2020 he sold 200 fed steers weighing 1,450 pounds each and 100 fed heifers weighing 1,250 pounds each. These cattle would be eligible for CARES payments, with fed cattle weighing over 1400 pounds receiving a payment of $214/head and those weighing between 600 – 1,400 pounds a payment of $139/head. Farmer Schaefer’s highest inventory of cattle between April 16, 2020 and May 14, 2020 was 500 fed cattle with 100 weighing 1,450 pounds and 400 weighing less than 1,400 pounds. All 500 head would be eligible for the CCC payment of $33/head. Figure 2 shows the CFAP calculator for Farmer Schaefer. His total payment would be $73,200, but he is only eligible for $58,560 initially.

For more resources related to the COVID-19 pandemic, please visit the Michigan State University Extension website.

Print

Print Email

Email