How to grow youth financially

Gain new ideas for teaching youth about money and what they need to know to be successful.

Kids probably see money every day, from grocery shopping and expenses for the house, to filling the car up with gas and purchasing school items. Instead of just handing youth money to spend, share with them some fun and educational ideas to think about. Teaching youth about money can be an important life lesson from the very beginning.

Kids need to be given a good, solid foundation on the basics of money to help them understand that money does not grow on trees. According to Beth Kobliner in “How young is too young to teach kids about money?,” you can start talking about money with youth as early as 3 years old. Even preschoolers can learn basic financial concepts, like delayed gratification and making choices.

One of the first basic money ideas comes from being a grandparent and giving your grandchild a piggy bank. Every time a grandparent comes to visit, usually some coins or bills are given to the child to put in their piggy bank. Have kids feed the piggy bank and get them excited about saving. As they grow, so does the piggy bank. Seeing the different types of coins and bills is a good time to teach youth how to start counting money. Play games with them using the coins and have them identify what they are and how much it is worth. There are many fun board games, too, for youth to learn about money and the basic concepts of money.

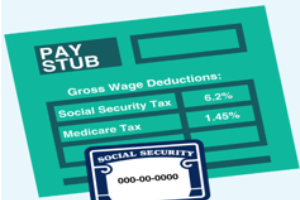

As youth get older, they can do age-appropriate chores to start earning money. This money can be added to their piggy bank, savings jar or a bank account. You can also take youth on shopping trips to the grocery store. Make a grocery list asking what foods they might need or what they would like to eat. This idea also gets the youth thinking about healthy meals and trying different foods.

In Kobliner’s article, “The most important money lesson you should teach your kids,” she talks about self-control, giving into a kid’s demands, and the most common, just saying no. She lists a few tips to help the child resist the temptation of buying, such as:

- Have a game plan when going shopping.

- Tell the child they can use their own money if they want to purchase something.

- Have kids set goals.

Michigan State University Extension and Michigan 4-H Youth Development help prepare young people for successful futures. As a result of career exploration and workforce preparation activities, thousands of Michigan youth are better equipped to make important decisions about their professional future, ready to contribute to the workforce and able to take fiscal responsibility in their personal lives.

Print

Print Email

Email