Will higher reference prices yield higher PLC payments?

A review of potential changes to the Farm Bill’s Price Loss Coverage (PLC) Program.

The Farm Bill has often been a source of support to farms in managing risk. Market volatility and tightening margins have made price risk a major concern in recent years. A common request from stakeholders is to reform the Farm Bill’s Price Loss Coverage (PLC) prograillim to offer more aid against lower market prices.

The House Agriculture Committee recently drafted their version of a reconciliation bill. The draft includes proposed changes to raise statutory reference prices for PLC. The changes would be retroactive to include the current 2025 growing season. Note: It is expected that the Senate will soon provide their own version of a reconciliation bill as well. The Senate bill may include different changes to the PLC program.

The following is an analysis of the potential impact on PLC support payments using the House Agricultural Committee’s proposed changes. The analysis provides a framework for understanding impacts of any proposed or finalized changes passed by Congress.

Background on PLC Statutory Reference Prices

Current statutory reference prices (SRPs) were set in the 2014 Farm Bill. They provide support when price shocks are felt during relatively stable marketing periods. For a support payment to be made, the season-average price per bushel for a marketing year would need to be lower than the statutory reference price (SRP).

Statutory Reference Price (SRP) - Season-Average Price = PLC payment calculation

The 2018 Farm Bill kept SRPs the same at $3.70 for corn, $8.40 for soybeans and $5.50 for wheat. The bill also introduced an escalator clause to increase prices based on a crop’s Olympic average. In an Olympic average, both highest and lowest values are removed before calculating an average. For PLC, the average skips the most recent year and uses the immediate five previous years in its calculation.

Five Year Olympic Average x 85% = Escalator Clause Price

The escalator clause outlines that the payment calculation will use the higher of the SRP or 85% of the Olympic average. The price used will be referred to as the effective reference price (ERP). However, the clause also outlines that the ERP must be capped at 115% of the SRP’s value.

Statutory Reference Price (SRP) x 1.15 = Effective Reference Price Cap

The current effective reference price caps are $4.26 for corn, $9.66 for soybeans and $6.33 for wheat.

Proposed increases to Statutory Reference Prices

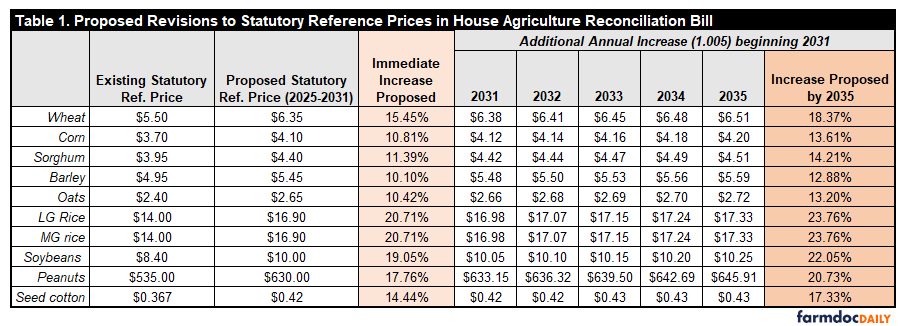

The House Ag Committee has proposed increasing the statutory reference prices in two phases. Phase one will be a set increase for marketing years 2025 through 2030. Phase two would see SRPs increase 0.5% each year up to 115% of the 2025-2031 SRP value. The changes are outlined in the table below from University of Illinois Farmdoc.

Table 1: Proposed revisions to Statutory Reference Prices in House Agriculture reconciliation bill

To understand the impact of these increases, a comparison to estimated season-average prices provides a measure of potential support. A common resource for estimated values is the Agricultural Baseline Projection from USDA’s Economic Research Service (ERS). Released each February, the baseline is a 10-year projection outlining expected price trends. Based on current market conditions, they provide an “if no changes occur” type of price forecast. With the exception of the 2024 and 2025 marketing years, these values are used in the following comparisons for all three commodities. For 2024 and 2025, recent USDA ERS season-average price forecast values have more up-to-date data and are used instead.

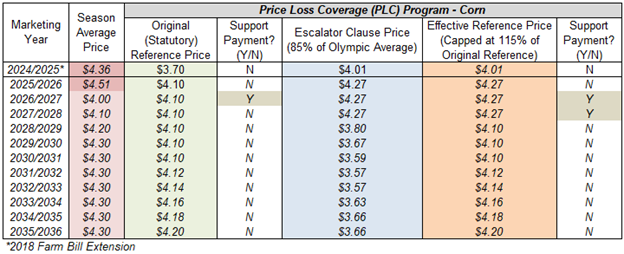

Table 2: Proposed Corn PLC Statutory Reference Prices Compared to USDA ERS Agricultural Baseline Projections ($/bu.)

Table 2 outlines that proposed SRP increases for corn would not yield consistent support. USDA’s projection estimates prices will remain too high to result in payments for all but one year. Payments would exist in two years due to the escalator clause establishing a higher ERP. Payments would be based on $4.27 per bushel for both 2026 and 2027 marketing years.

It is important to note that both years would also see payments using the current SRP of $3.70. The escalator clause calculations shown in Table 2 would still apply using current values. The difference is that with an SRP of $3.70, the ERP remains capped at $4.26 ($3.70 x 1.15). Therefore, under current guidelines, payments would be made using $4.26 per bushel for 2026 and 2027. The proposed SRP increase would net a difference of only $0.01 per bushel in benefits.

The net benefit of only $0.01 between the current and proposed SRPs highlights the limitations of the escalator clause. Calculated at only 85% of previous season-average prices, support increases with the clause are limited. For example, a proposed SRP of $4.10 would allow for a potential ERP of $4.72 ($4.10 x 1.15). However, reaching that potential requires an Olympic average of $5.55 per bushel ($4.72 ÷ 0.85). The Olympic average for 2019-2023 is only $5.03. The average included nearly record high prices of over $6.00 per bushel in two out of five years.

The limitations and possible adjustments to the escalator clause are outlined in previous articles by both MSU Extension and Illinois Farmdoc.

Table 3: Proposed Soybean PLC Statutory Reference Prices compared to USDA ERS Agricultural Baseline Projections ($/bu.)

Table 3 outlines that proposed SRP increases for soybeans would offer mixed support. USDA’s baseline projections estimate season-average prices will remain higher than proposed SRPs. Therefore, no support payments would be initiated in any of the proposed marketing years.

However, payments would be made in three years under the escalator clause, illustrating an advantage of the increase. A higher SRP increases the ERP cap from $9.66 ($8.40 x 1.15) to $11.50 ($10.00 x 1.15). The higher ERP cap makes payments available for the 2025, 2026, and 2027 marketing years.

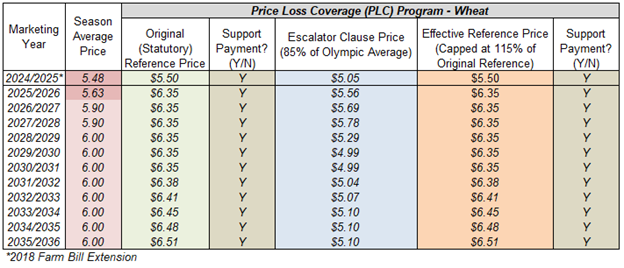

Table 4: Proposed Wheat PLC Statutory Reference Prices compared to USDA ERS Agricultural Baseline Projections ($/bu.)

Table 4 outlines a different story for wheat compared to corn and soybeans. USDA’s projection estimates season-average prices for wheat to be below the proposed new SRP of $6.35. The increase of 15% would make payments available in all marketing years and yield more financial support for wheat acres. With the current SRP of $5.50, wheat would be projected to receive a payment in only one year.

Since 2014, the PLC program has offered a mixed bag of support for different commodities. For corn and wheat, support payments were initiated almost every year from 2014-2018. For soybeans, market prices have remained high enough that no support payments have been made. Since 2018, support has been almost non-existent due to higher-than-expected market prices for all three commodities.

If USDA baseline projections were realized, wheat would be the primary beneficiary of an increased reference price. The proposed $6.35 aligns with current and projected season-average prices. However, for the same level of price protection, corn and soybeans would need higher values compared to the proposed $4.10 and $10.00, respectively. The proposed increases will simply not offer significant price support on their own. Instead, these commodities would continue to rely primarily on the escalator clause to initiate any level of support payment.

Relying on the escalator clause limits PLC as a safety net against poor market conditions. Designed as a look-back calculation, the escalator clause does reduce large swings in reference prices. However, a byproduct of that design is that reference prices are also prevented from timely adjustments when current market prices are in decline. The use of a skip-year in calculating an Olympic average further adds to the delay of timely support. To illustrate, effectively two years after a period of record high market prices, the escalator clause is just now becoming relevant and in only a limited capacity.

The next step is for both the House and Senate to propose the entirety of their reconciliation bills. A single, jointly crafted bill will then need to pass through Congress. Afterward, the bill will be sent to the President to sign into law. The discussion on improvements to PLC will continue as Congress finalizes proposed legislation.

This review continues a series of articles on potential improvements to the Price Loss Coverage (PLC) program available at the Michigan State University Extension Farm Bill website. Topics include SRPs with a flat 10% increase, SRPs matching cost of production or inclusion of a declining price clause.

Print

Print Email

Email