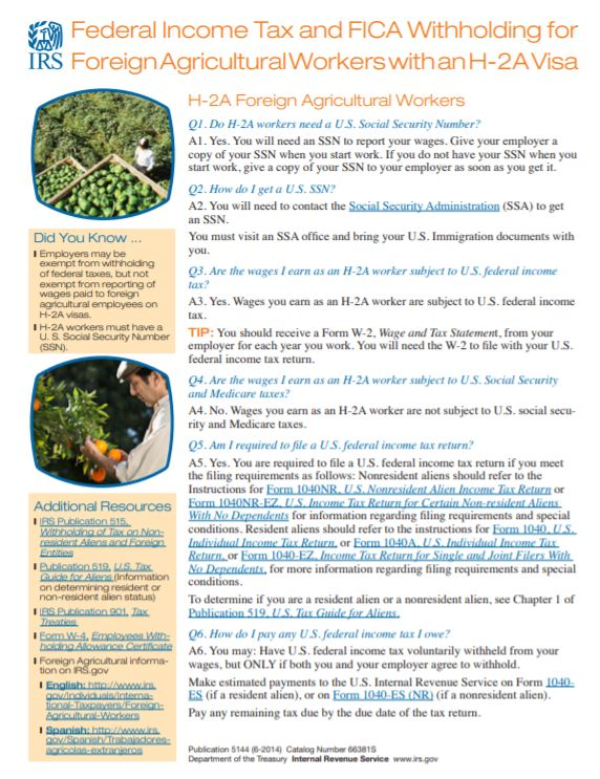

Federal Income Tax and FICA Withholding for Foreign Agricultural Workers with an H-2A Visa

DOWNLOADSeptember 20, 2020

H-2A Foreign Agricultural Workers

Q1. Do H-2A workers need a U.S. Social Security Number?

A1. Yes. You will need an SSN to report your wages. Give your employer a copy of your SSN when you start work. If you do not have your SSN when you start work, give a copy of your SSN to your employer as soon as you get it. Q2. How do I get a U.S. SSN?

A2. You will need to contact the Social Security Administration (SSA) to get an SSN. You must visit an SSA office and bring your U.S. Immigration documents with you.

Q3. Are the wages I earn as an H-2A worker subject to U.S. federal income tax?

A3. Yes. Wages you earn as an H-2A worker are subject to U.S. federal income tax.

TIP: You should receive a Form W-2, Wage and Tax Statement, from your employer for each year you work. You will need the W-2 to file with your U.S. federal income tax return.

Print

Print Email

Email