Reporting under the Corporate Transparency Act

This Article is offered in: English Espanol,

Filing not currently required for U.S. companies and persons.

Note: All entities created in the United States, and their beneficial owners, are CURRENTLY EXEMPT from the requirement to report beneficial ownership information (BOI) to FinCEN, under the interim final rule released March 21, 2025.

The interim final rule takes away the requirement for U.S. companies and U.S. persons to report. Foreign companies, however, still must report if they do not qualify for an exemption under the Corporate Transparency Act (CTA), but any U.S. beneficial owners within those foreign companies are exempt from reporting. Existing foreign companies have until April 25, 2025 to make an initial BOI report, and newly registered foreign companies must file within 30 days of their registration being effective.

FinCEN is working on the final rule for the CTA and is accepting comments on the interim rule. For more information, check out FinCEN’s press release from March 21, 2025.

Due to the fact that future administrations might reinstate the CTA, the article below serves as a great reference. We do suggest that businesses keep in mind that reporting may become mandatory again, possibly with new regulations that make it a bit easier for small businesses to comply than the original regulations.

The Corporate Transparency Act (CTA) is an anti-money laundering law passed by Congress in 2021. The CTA was passed with bi-partisan support and requires most businesses to report information about their owners. This includes many types of farm businesses. This information will make it more difficult for bad actors to illegally hide assets.”

What is a beneficial owner?

A “beneficial owner” is an individual who either 1) has substantial control over a company or 2) owns 25% or more of the ownership interests of the company. Substantial control can be direct, including senior officers and any individual with the ability to appoint or remove a senior officer. However, substantial control can be indirect. Someone will be considered a “beneficial owner” if they are an important decisionmaker for the company.

The term “ownership interests” includes stock and other equity. Ownership interests can also include convertible instruments and options. The regulations seek to identify the people who have control and influence over decisions, regardless of whether or not those people have their names on the shareholder list.

Who must file?

Most companies that are business entities must report. The rule is that any business entity “… created by the filing of a document with a secretary of state or any similar office in the United States” must report unless an exception applies. A “similar office” includes Michigan’s Department of Licensing and Regulatory Affairs (LARA) and any Tribal offices where businesses are registered.

Reporting companies include:

- Limited Liability Companies, including single-member LLCs

- S corporations

- C corporations

- Cooperatives

- Associations

- Limited Partnerships

- Certain trusts

This is not an exhaustive list. When in doubt, lean towards reporting.

Dissolved companies/companies not in good standing

If a business is not up to date with its annual filings it is not considered dissolved. Rather, not having up to date annual filings means it is simply not in good standing. Businesses not in good standing still have to report by the deadline, unless an exception applies (see below). Similarly, if a company was dissolved in 2024, beneficial ownership information must still be reported unless an exception applies to that company. Only companies that have been “irrevocably” dissolved by December 31, 2023, or before can avoid reporting.

Exceptions: who does not need to file?

Importantly, sole proprietors and husband/wife proprietor businesses will not need to report. This is because proprietorship businesses are not separate entities from their owners, and so no filing is necessary to create them.

There are other exceptions. Businesses that do not need to report include:

- Large companies that have:

- More than 20 full-time employees that are employed in the United States AND

- More than $5,000,000 in gross receipts or sales from sources within the United States on its previous-year’s tax return

- 501(c) tax-exempt entities – note that the tax-free status must be current with IRS

- Heavily regulated companies (banks, credit unions, public utilities)

For more details on reporting and a complete list of exceptions, see the Small Entity Compliance Guide on the FinCEN’s Beneficial Ownership Information website.

When to file

For businesses that already exist, the Beneficial Ownership Information (BOI) filing can be made starting January 1, 2024. Filings must be made by January 1, 2025, to avoid civil and criminal penalties. We recommend not waiting until the last day! Plan to file by the end of December to avoid any website issues.

Companies that are created on or after January 1, 2024, must file within 30 days of receiving notice that they are registered. In Michigan, LARA’s Corporations Division is planning to provide new filers notice of their responsibilities under the CTA.

When to update

After the initial report is made, any changes to beneficial ownership information need to be filed within 30 days after the date of the change. Some examples of when information needs to be updated:

- A beneficial owner changes their name or address

- A new manager is hired

- There is a change in ownership interest – for examples:

- A new member is added who has a 25% interest or more

- A member’s interest increases to 25% or more, by purchase, sweat equity, or gift

- The company’s physical address changes

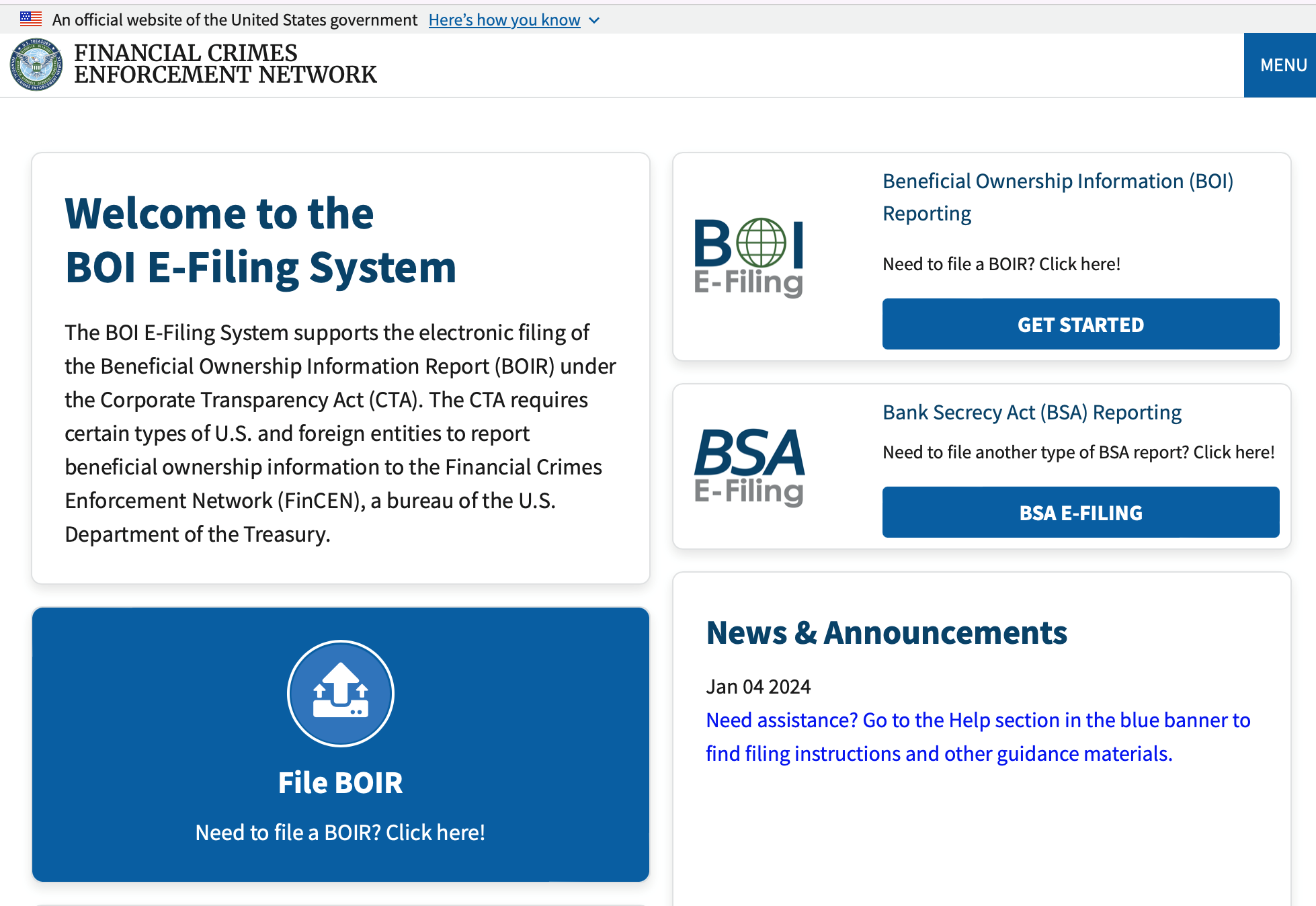

Where to file and tips for filing

The Financial Crimes Enforcement Network (FinCEN) is the federal agency implementing the CTA. Filing is done online via FinCEN’s website and there is no fee. To file, visit the FINCEN website at this link. The website works relatively smoothly, but here are a few notes that may be helpful. First, select the “Get Started” tab in the Beneficial Ownership Information Reporting tab. At the next page, most small business filers will want to File Online BOIR, the second option.

The Reporting Company information page is fairly straightforward. For existing companies, check box #16. However, when you get to Part III, Beneficial Owner Information, the steps for adding multiple owners are not necessarily obvious. Once you have put in the information for Beneficial Owner #1 (including a picture of their driver’s license or passport), go to the top right of the page and click “Add Beneficial Owner” to add another owner’s information. Then, after you are done putting in information for all the necessary people in your business, click “Next” at the bottom right of the screen. This will bring you to the final submission page.

What information is required?

The information that will need to be reported is:

- The company’s legal name

- Any trade names (“doing business as” and “assumed names”)

- Current address

- Where the company was formed/ its jurisdiction (for example, Michigan)

- Tax Identification Number

The information that will need to be reported about each of the beneficial owners:

- The individual’s name

- Date of birth

- Residential address

- An identifying number from an accepted ID document (passport, U.S. driver’s license), name of the issuing state or jurisdiction, and an image of the ID document.

Companies that are created on or after January 1, 2024, will additionally need to supply information about the “company applicants” Company applicants are individuals who directly filed the document to register the company (often attorneys) and the individual primarily responsible for directing the filing.

Penalties for not reporting and late reporting

FinCEN is taking this very seriously. A failure to report could result in up to $500 a day in civil penalties until corrected. Additionally, criminal penalties of up to 2 years imprisonment and $10,000 could result. These penalties apply to fraudulent reporting as well, for example providing a fraudulent ID for a beneficial owner.

FinCEN may provide some initial flexibility for correcting mistakes within 90 days of the deadline for filing the original report.

MSU Extension is here to help

We are holding a webinar on December 3, 2024, at 6 p.m. to explain many of the topics mentioned above. We will walk through a sample filing online, with a focus on tips for navigating the FINCEN website. The webinar is free and you can register at https://events.anr.msu.edu/CTAFilingTipswPC/. We will work to get a recording of the webinar up on the MSU Extension website by mid-December.

If you are unclear about whether you need to file, please contact Chris Bardenhagen at bardenh1@msu.edu or 231-256-9888, or another member of the Farm Business Management Team at Michigan State University Extension.

Talk to your attorney

Many owners involved in complex businesses, or situations involving business interests held by trusts, will need to work with their attorneys to determine whether, and how, to file. We do recommend that all company owners contact their attorney to ensure they are reporting correctly and plan for making any changes that need to be reported.

Print

Print Email

Email