From Paper to Digital: E-Payment Benefits Local Governments and Taxpayers

The Government of Tanzania implemented a transparent, reliable and efficient e-payment system

By Elizabeth Mwambulukutu, David Nyange, Isaac Minde, and Elisabeth Paymal

From Paper to Digital: E-Payment Benefits Local Governments and Taxpayers

“With the paper-based system to collect taxes, we ran the risk of overtaxing, or taxing the wrong person. We didn’t even have a reliable database to properly identify taxpayers,” explains Juma Lidenge, a local tax collector in Ifakara, in south central Tanzania. His database often lacked the most basic information such as the tax payer’s name, nature of the business, type of service/commodity, quantity of commodity, location of payment and the amount charged.

“With the paper-based system to collect taxes, we ran the risk of overtaxing, or taxing the wrong person. We didn’t even have a reliable database to properly identify taxpayers,” explains Juma Lidenge, a local tax collector in Ifakara, in south central Tanzania. His database often lacked the most basic information such as the tax payer’s name, nature of the business, type of service/commodity, quantity of commodity, location of payment and the amount charged.

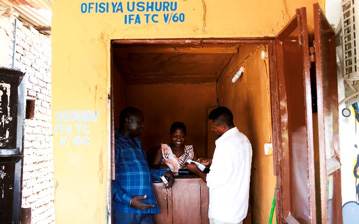

Photo: A trader (right) gets an electronic receipt from Grace Njitagu, cashier (centre) using the Point of Sale (POS) device at the Ifakara revenue collection office. Juma Lidenge (left), a local tax collector, looks at the scene. POS devices are among the instruments used to collect local revenue electronically.

For years, Tanzania’s Local Government Authorities (LGAs) had to use a paper and pen system to process taxes. It was difficult to monitor the local tax collection with a system that didn’t clearly explain tax rates and that didn’t provide accountability, reliability, nor accuracy. The system was open to corruption and possible underreporting of tax collection. And this paper record provided little reliable information for LGAs to make helpful revenue projections.

Agrifood traders like Sisqo Leonard suffered from this mode of payment: “The paper-based system lacked transparency and created rent seeking opportunities. I also recall losing my receipt which led me to being taxed twice.”

In response to these challenges, in 2014, the then Ministry of Agriculture, Livestock and Fisheries (MALF) and Prime Minister’s Office - Regional Administration and Local Government (PMO-RALG) asked Feed the Future Innovation Lab for Food Security Policy’s Agricultural Sector Policy and Institutional Reform Strengthening (ASPIRES) project to evaluate the impact of produce cess collection (a form of tax charged by LGAs on agricultural produce) and to make recommendations for a reform.

The study revealed that, nationally, LGAs collected not more than one-quarter of the revenue potentially available from produce cess charges.

ASPIRES recommended piloting an e-payment system. This experimental implementation resulted in an efficient, fair, streamlined and transparent collection of local taxes. The system allows close monitoring of transactions and thus reduces revenue leakages. The results speak for themselves: In the FY 2016/17, the Kilombero LGA increased their revenues by 21%. This huge success led to the adoption of the e-payment to over 90% of the country’s LGAs by 2017.

“I now pay taxes with confidence as I’m issued an electronic receipt. This not only curbs revenue leakages but also gives me reassurance that there is no foul play. Once I’ve paid for taxes, I show the same receipt at any inspection point on the truck’s route,” says Sisqo Leonard, a Mill Operator and Rice Farmer in Mkula village, Kilombero LGA.

In the Ifakara LGA alone, a total of 133 ‘points of sale’ devices are being used to track transactions and collect local revenue. The impact is also evident at the village level. Out of eight villages in Mang’ula ward which is within Kilombero, a total of five villages have these electronic devices. Nationwide, these are available at strategic transaction points including mills, livestock markets, abattoirs, cooperatives and farmer organizations. The e-system covers over 100 types of taxes, including non-agricultural sector related taxes such as taxi license fee, school fees, electricity, billboard fees, hotel levy, and building permits.

All data collected feed into the Local Government Revenue Collection Information System (LGRCIS). This allows LGAs to monitor fiscal devices activity such as daily revenue collection, off-line status and last seen active payer. As a result, the local taxpayer database is more accurate, and it is now possible to closely monitor revenues from local taxes and do proper budget planning.

“The e-payment system has many benefits. Undeniably, our own source of revenue has increased significantly. Through the e-payment system, we have timely and accurate information at our fingertips. We therefore know our taxpayers and are in a position to better monitor the collection of taxes including the identification of defaulters.” – said Simbeye, Deputy Director, Ifakara Town Council.

Following up on this success, ASPIRES is currently assessing the adoption of e-payment nationwide and will produce a preliminary analysis report which will include impact assessment, options for technical support, and staff training. The report will also inform PO-RALG on the current status of the e-payment and provide recommendations for addressing any possibly remaining challenges.

Print

Print Email

Email