Talk financial terms with your teens – Part 1

Knowing the jargon in the financial world, such as CD, stocks and bonds, can help youth get ahead of the game.

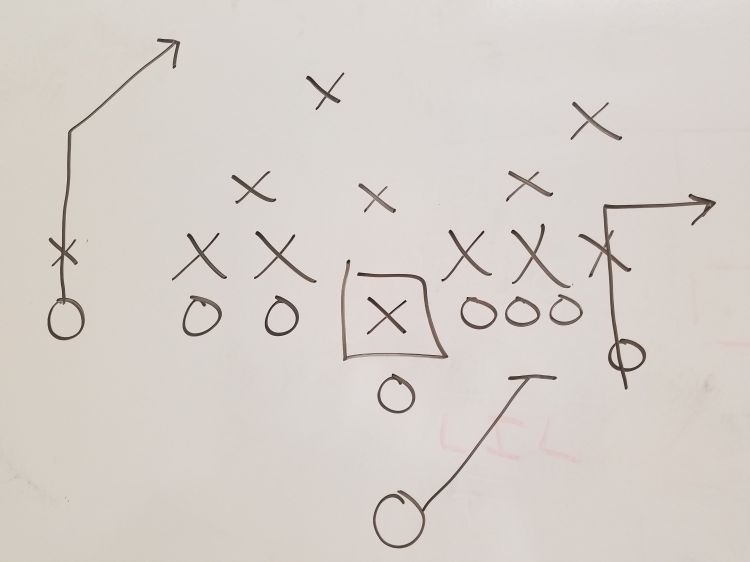

Financial terms can be related to football. Some may find it hard to enjoy or even grasp the concept of football without knowing the terms. A running back does not run backwards. A flanker can be a wider receiver or a split end and a tackle does not always tackle. Anyone viewing the game for the first time or just learning the game could get frustrated and make errors.

The same is true for learning finances or money management. It may not be enjoyable and can even be scary for youth and adults. Half the battle is using the correct terminology and knowing the meaning of that terminology. Knowing the jargon can help youth start to feel more comfortable on some complex issues or allow them to ask the right questions when faced with money issues or confusion.

These frustrations and fumbles can come when a financial advisor, loan officer or banker starts throwing out terms and vocabulary that are unfamiliar to young people. We don’t want teens to be blindsided as they are just coming onto the financial “football” field. It’s best that you cover some of these basic terms and concepts with them as they start playing in the world of money and finance.

In this four-part series, some of these basic financial terms will be covered to help you kick off the conversation and feel comfortable enough to enjoy finances.

The following are terms frequently used that you might review with your children as they start earning money and saving for the future:

- “Certificate of Deposit” or CD

- Stock

- Bond

These are by no means all the terms and topics to be covered, and this is just a brief overview. However, it will be a good start for them and will again allow you to engage in conversations about money and allow you to add your own insight.

“Certificate of Deposit” or a CD is a saving certificate with a fixed time when it is paid back to you and at a fixed interest rate. In essence, you give the bank a set amount of money for them to use for a set amount of time. They will give you a rate of interest on that money. You’re giving them permission to use your money and they will pay you for that use.

There is a penalty for you if you take that money back early, known as an early withdrawal. In other words, you’re not supposed to ask to use your money for that set time. Example, if you buy a CD for $1,000 with an interest rate of 7 percent and maturity of six months, you would get back $1,070 ($1,000 x 1.07 = $1,070) at the end of the time agreed upon, which in this example would be six months. You earned $70. At that time, the maturity date, you can use your money, all $1,070, at will.

Stocks or shares in a company is the money you give a company to use to build, expand, research, develop or do whatever they want. You give them money in hopes that they will give you back more than you gave if the company does well. Example: You buy a share, a piece of the company, at $30. You now have some ownership to that company. They use that $30 to sell more items and pay you back $30 plus dividends or earnings from the company of $6. Meaning you made a 20 percent increase on your money. Imagine if you purchased a stock in the 1980s when it was close to $3 a share. It is now worth about $106.

Each little piece you bought of that company can be sold at the going price of the day. If that price is higher, you made money. The risk is if the company doesn’t do well or goes bankrupt, you may only get some of your money back or none of it. Also, because you are part owner, you have to pay off debtors first. The key is to know what companies will and are doing well. The benefits can be great, but so can the losses.

Bonds are typically money given to a government, municipality or corporation to work on projects. Think of it as a money loan to the corporation of government. These bonds can be paid back to you at a fixed time and rate like a CD, or it can be at variable rates. Bonds are generally less risky because you are investing in a state, a government or a major project that is unlikely to default on the money you are loaning them, yet you have no ownership in the company. The benefit to you is a more secure investment. The catch is that this generally offers lower interest rates.

In Part 2, we’ll tackle more terms for teens and explore how you can put these stocks and bonds together in portfolios or funds; putting together a powerful team to help youth make the most of their money and score big points in the future.

For more information on fiscal management or youth money management, please visit the Michigan State University Extension and Michigan 4-H Youth Development websites.

Other articles in series

- Talk financial terms with your teens – Part 2

- Talk financial terms with your teens – Part 3

- Talk financial terms with your teens – Part 4

For more information, check out the “Financial Manual for 4-H Volunteers: Leading the Way to Financial Accountability” and the “Financial Manual for 4-H Treasurer: A Guide to Managing Money Wisely.” As a part of our work, Michigan State University Extension provides financial literacy programming.

Print

Print Email

Email