Bulletin E-3422 Introduction to Zoning and Taxation

DOWNLOADSeptember 2, 2020 - Brad Neumann, Michigan State University Extension

Land ownership comes with rights to use and enjoy one’s property. Those rights are limited in significant ways by federal, state, and local laws. Property rights are also held in tandem with legal obligations, such as the obligation to pay taxes on the property. Land use regulations and property tax obligations can make for a complicated web of laws for you to navigate as a beginning farmer. This article provides an introductory explanation of property rights and protections, regulations, and liabilities associated with real property ownership in Michigan. Real property refers to land and the buildings and fixtures on the land.

Zoning

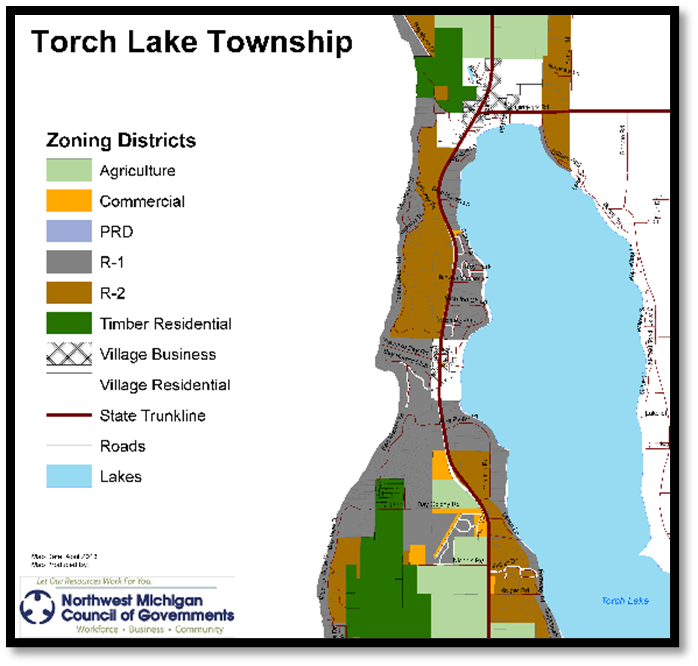

Zoning refers to local government laws that regulate the use of property and the development of buildings on the property. The intent is to prevent one landowner from using their property in a way that unreasonably interferes with another landowner’s use and enjoyment of property.

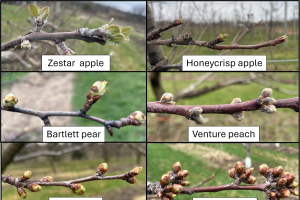

Zoning map of Torch Lake Township, Michigan.

The Michigan Zoning Enabling Act (Public Act 110 of 2006, as amended) grants all general-purpose governments (counties, townships, cities, and villages) the power to adopt and enforce a zoning ordinance. Zoning is an optional power of local government in Michigan. In some cases, county government adopts a zoning ordinance, which applies to townships within the county that do not have a zoning ordinance of their own. As a landowner, or prospective landowner, you will want to contact the local government administrative office where the property is located to inquire whether zoning applies on your property.

A typical zoning ordinance divides property within the local government into separate districts. Each district specifies different uses allowed and the development standards that apply to new construction. For rural local government jurisdictions, there is typically an “Agricultural” or a “Farm/Forest” zoning district where agriculture is allowed as a principal or main use of the property. When construction is proposed, a zoning ordinance will require you, as the property owner, to apply for a permit. The permit authorizes the use of the property and building placement and size in conformance with the standards of the zoning district. This applies to vacant land or an existing building with a proposed addition.

A given zoning district will list uses allowed by right (permitted uses) and uses allowed by special land use permit (special or conditional uses). If “Agriculture” is listed as a special land use, that means agriculture is only allowed if certain special standards can be met. In more suburban or urban jurisdictions, agriculture might only be permitted as a special land use in a low-density residential district, absent a specific agricultural zoning district on the zoning map. Often a special land use permit can only be obtained after a public hearing and decision by the local government planning commission.

Right to Farm

For some land uses, local government zoning authority is superseded or preempted by state or federal government. This is the case for local government regulation of agriculture according to the Michigan Right to Farm Act (PA 93 of 1981, as amended). The Michigan Right to Farm Act (RTFA) preempts any local ordinance, regulation, or resolution that conflicts with the provisions of the act. This includes any Generally Accepted Agricultural and Management Practices (GAAMPs) developed under the act.

According to Michigan Attorney General Opinion No. 7302, a local government ordinance cannot regulate any of the following due to Section 4(6) of the RTFA:

- Limit the number of livestock per acre,

- Require a site plan be submitted to and approved by the local zoning administrator,

- Limit manure application to fields in which the farmer owns or holds a 7-year lease,

- Specify manure application methods, or

- Require a comprehensive nutrient management plan be submitted to and approved by the local unit of government.

(Michigan Attorney General Opinion No. 7302, 2018)

In addition, there may be other provisions in local ordinances that regulate farming activities for which the Commission of Agriculture and Rural Development has developed GAAMPs. Any regulation that conflicts with the GAAMPs is unenforceable.

This means a farmer that is following state-specific industry best practices for growing or raising of farm products is exempt from certain local land use regulations. The RTFA also provides a defense to nuisance lawsuits against a farm operation that conforms to GAAMPs adopted by the Michigan Commission of Agriculture and Rural Development.

Nuisance protection and ordinance exemption only applies to “agriculture.” In order to be agriculture, the activity must satisfy three tests:

- Is the activity a “farm” or “farm operation”?

- Is it producing a “farm product”?

- Is it engaged in “commercial production”?

The terms farm, farm operation, and farm product are all defined in the RTFA. The term commercial production is not defined in the RTFA. However, we know from court cases that commercial production is “the act of producing or manufacturing an item intended to be marketed and sold at a profit” and “there is no minimum level of sales that must be reached before the RTFA is applicable” (Shelby Township v Papesh, Michigan Court of Appeals, 2005). If the answer to each of the three tests is “yes,” then the activity is “agriculture” and local zoning cannot conflict with the RTFA or any of the published GAAMPs.

There are currently eight Generally Accepted Agricultural and Management Practices (GAAMPs):

- Manure Management and Utilization

- Site Selection and Odor Control for New and Expanding Livestock Facilities

- Care of Farm Animals

- Nutrient Utilization

- Irrigation Water Use

- Pesticide Utilization and Pest Control

- Cranberry Production

- Farm Markets

Each is reviewed annually by an expert committee and presented to the Michigan Commission of Agriculture and Rural Development for adoption. View current GAAMPs at: https://www.michigan.gov/gaamps

In 2014, the Michigan Commission of Agriculture and Rural Development amended the Site Selection and Odor Control for New and Expanding Livestock Facilities (Site Selection) GAAMPs to create a siting category where local governments do have zoning authority over livestock facilities. The latest Category 4 sites are those locations where there are more than 13 non-farm residences within 1/8 mile of a livestock facility or there is any non-farm residence within 250 feet of a livestock facility. In these “primarily residential” locations, livestock production can be regulated or prohibited by local ordinance.

GAAMPs and the RTFA may not specify practices for every activity on your farm property. In these cases, local ordinances that address the permitting, size, height, bulk, floor area, construction, and location of buildings on a farm can be enforced (Papadelis v City of Troy, Michigan Supreme Court, 2007).

Contact the local zoning administrator for your area for more information about zoning regulations and what local standards and processes still apply.

Agricultural Buildings

Many farmers are familiar with the exception that buildings used for agricultural purposes do not need a building permit. This exception is provided in the Stille-Derossett-Hale Single State Construction Code Act (PA 230 of 1972, as amended), not the RTFA. The Construction Code also provides an important clarification for buildings used for agricultural purposes. If an agricultural building is used to sell farm products to the public, a building permit is required.

Contact the local, county, or state building code official (depending on building code jurisdiction for the unit of government) in your area for more information.

Property Taxation

While taxes are a certainty in life, an agricultural property tax classification does lower the property tax burden of owning real property in Michigan. If land is classified “Agricultural,” the owner will be exempt from paying up to 18 mills of local school operating taxes, identical to the principal residence exemption available in the state. A mill is one-tenth of a cent ($0.001) or one-thousandth of a dollar. A tax rate of one mill raises $1 of tax for every $1,000 of taxable value.

The classifications of assessable real property are described as follows:

(a) Agricultural real property includes parcels used partially or wholly for agricultural operations, with or without buildings […] As used in this subdivision:

(i) “Agricultural outbuilding” means a building or other structure primarily used for agricultural operations.

(ii) “Agricultural operations” means the following: (A) Farming in all its branches, including cultivating soil. (B) Growing and harvesting any agricultural, horticultural, or floricultural commodity. (C) Dairying. (D) Raising livestock, bees, fish, fur-bearing animals, or poultry, including operating a game bird hunting preserve […] and […] farming operations that harvest cervidae on site […] (E) Raising, breeding, training, leasing, or boarding horses. (F) Turf and tree farming. (G) Performing any practices on a farm incident to, or in conjunction with, farming operations.

(General Property Tax Act, Michigan Compiled Laws 211.34c[2][a])

As a landowner, you might have property being farmed, but classified differently for tax purposes (for example, “Residential”). In this case, you will need to file Treasury Form 2599 with the local assessor to request the Qualified Agricultural Property Exemption, thereby reducing the tax rate for the portion of the farm operation classified differently than “Agricultural.”

Qualified agricultural property is defined as “unoccupied property and related buildings classified as agricultural, or other unoccupied property and related buildings located on that property devoted primarily to agricultural use” (General Property Tax Act, MCL 211.7dd). A parcel is qualified agricultural property if 1) the parcel is classified as “Agricultural” on the current assessment roll, or 2) At least 50% of the parcel is devoted to agricultural use. A local government assessor is responsible for annually classifying all real property.

The classification of property has nothing to do with your ability or “right” to farm the property. Classification is for property tax equalization purposes and does not dictate the use of the property. It is common to have a parcel of real property zoned for one use (for example, “Residential”), yet classified differently for tax purposes (for example, “Agricultural”). Also, a classification other than agricultural does not necessarily mean property taxes will be higher. If there is a home on site, the property may be covered under the principal residence exemption.

Prospective buyers of farmland should be aware that the transfer of qualified agricultural property is not considered a transfer of ownership. The phrase transfer of ownership is what triggers the uncapping of taxable value. This means, if the property is to remain devoted to agriculture and the new owner files Treasury Form 3676 with the assessor, the taxable value of the property will not “uncap.” It will remain the same as for the previous owner, subject to inflation, so long as the property remains qualified agricultural property.

Review the Qualified Agricultural Property Exemption Guidelines (https://www.michigan.gov/documents/Qualified_Agricultural_Prop_139854_7.pdf) prepared by the State Tax Commission and contact the local government assessor in your area with any questions before purchasing new farmland.

References

General Property Tax Act (PA 206 of 1893, as amended). http://legislature.mi.gov/doc.aspx?mcl-Act-206-of-1893

Michigan Attorney General Opinion No. 7302 (2018). https://www.ag.state.mi.us/opinion/datafiles/2010s/op10381.htm

Michigan Right to Farm Act (PA 93 of 1981, as amended). http://legislature.mi.gov/doc.aspx?mcl-act-93-of-1981

Michigan Zoning Enabling Act (PA 110 of 2006, as amended). http://legislature.mi.gov/doc.aspx?mcl-act-110-of-2006

Papadelis v City of Troy, Michigan Supreme Court (2007).

Shelby Township v Papesh, Michigan Court of Appeals (2005).

Stille-Derossett-Hale Single State Construction Code Act (PA 230 of 1972, as amended). http://legislature.mi.gov/doc.aspx?mcl-act-230-of-1972

Print

Print Email

Email