Bulletin E-3427

Bulletin E-3427 Introduction to Renting Farmland

DOWNLOAD

March 30, 2023 - Jonathan LaPorte

After your knowledge as a farmer, land is arguably your farm’s second most vital asset. Whether you raise crops or livestock, all production activities can be traced back to the need for land. This need makes securing access to farmland a critical part of managing your business.

For beginning farmers, renting farmland is a common method of establishing a farm business. Compared to purchasing farmland, renting is often much more affordable and is a good fit for farmers with limited startup funds. Renting also allows you to trial your enterprises without the high investment and long-term commitment required for purchasing.

But negotiating to rent farmland can be challenging and overwhelming. Other farms may be competing for that same property. Landowners may not fully understand production activities or the ways they influence land values. Market trends might create pressure to offer high rent payments. You may also feel uneasy about sharing details of your farm business.

This publication offers guidance about how to navigate through the rental process and how to reduce the anxiety that often comes with it. We’ll review starting points for determining value, factors affecting farmland value, ways of finding average county rental rates, and types of lease agreements. We will also review how to approach rent negotiation with landowners, from preparing for first-time meetings to setting the stage for easier renewal conversations.

Farmland Rental Agreements & Arrangements

A wide range of types of rental agreements or arrangements can be pursued. The type of agreement is usually based on how involved a landowner wants to be in crop production activities. Some landowners don’t want to have any production or market risk or to be involved in making production decisions. Some want to own part of a crop and even be able to market their share. There is great flexibility in agreements based on what fits landowner and tenant needs. A basic summary of farmland rental agreements follows.

Fixed Cash Rent

The most popular and frequently used farmland rental arrangement is fixed cash rent. The landowner agrees to a fee to be paid regardless of crop price or yield. Landowners are not usually involved in making any management decisions nor pay for any inputs. Normally these agreements are ongoing for multiple years based on a simple written agreement. A cash rent arrangement can be as short as one growing season in length, which then requires renewal each year.

Every cash rent agreement can have different terms and conditions depending on negotiations between landowner and farmer-tenant. Agreements should establish a rental rate, payment schedule, length of agreement (beginning and ending date), and any crop or other restrictions. Putting agreements into a document that both landowner and renter sign is always a recommended practice. This option is good for landowners who want to eliminate uncertainty and risk, which a set, flat rate provides. Additional resources on cash rent leases:

- Cash Farm Lease (North Central Farm Management Extension Committee, 2011): aglease101.org/wp-content/uploads/2020/10/NCFMEC-01A.pdf

- Land Rental Issue checklist (Michigan State University [MSU] Extension, 2012): https://www.canr.msu.edu/farm_management/uploads/files/Rental%20Issues%20Landlord%20Checklist.pdf

- Landlord Farm Land Rental Worksheet (MSU Extension, 2008): canr.msu.edu/farm_management/uploads/files/1_Rental_Landlord_wks.pdf

Crop Share Lease

Crop share is considered a proportional agreement in which a landowner and a tenant split income from crops being grown in a pre-established ratio or percentage. A common share agreement would be 25% to landowner and 75% to tenant of the harvested grain crop when a landowner does not share in any production costs. In other cases, a 1/3 to landowner and 2/3 to tenant agreement may be used. Using a 25/75 split as an example, landowners would commonly be expected to pay for 25% of seed, fertilizer, and chemicals cost toward crop production. If land productivity were to increase, it would be common to expect a landowner’s percentage of production costs to also increase. This is different from a cash rent agreement in that prices paid to a landowner are based on income, not a fixed amount. Income levels are influenced by crop yields and prices, which affect rent received. When yields and prices are up, rent received will be up. When yields and prices are down, rent received will be down. Additional resources on crop share leases:

- Crop Share Rental Agreements for Your Farm (North Central Farm Management Extension Committee, 2011): aglease101.org/wp-content/uploads/2020/10/NCFMEC-02.pdf

- Illinois Crop-Share Cash Farm Lease (University of Illinois Extension, farmdoc, 2006): farmdoc.illinois.edu/publications/crop-share-lease-form-pdf

Cash With Bonus Lease

A cash rent with bonus agreement is a way to share the risks and rewards of a crop production system. Often a formula used is to promise a base cash rent price with a possible bonus at harvest. The base cash rent is often paid in advance, while any bonus is determined after calculating gross revenue (yield times price). Cash with bonus rent landowners may receive much higher rents, possibly better than cash rents in their area. However, in poor revenue years, farmer-tenants are only obligated to pay an established base cash rate.

This option tends to see more popularity in years when commodity prices are increasing to higher than expected levels. Additional resources on cash with bonus leases:

- Iowa Farm Lease (a cash rent with bonus agreement) (Iowa State University, Revised 2016): extension.iastate.edu/agdm/wholefarm/pdf/c2-12.pdf

Flex Rent Agreements

A flex rent agreement calls for a landowner to receive cash rent equal to a specified share of a farm’s gross crop revenue. The use of a percentage means actual rent paid will go up or down as yields and prices change year to year. For example, cash rent may be equal to 30% of gross crop revenue. If actual corn yield is 150 bushels per acre and actual price per bushel is $6, then gross crop revenue is $900 per acre. The landowner would receive 30% or $270. A key consideration of rent being connected to yield and prices each year is that payment amounts can change without any guarantee. The use of flex agreements provides a landowner with potentially large payments, but also exposes them to market or yield risk. The comfort level of risk influences a flex rent decision, as some landowners prefer a guaranteed amount for cash rent. Additional resources on flex rent and cash plus bonus:

- Flexible Farm Lease Agreements (Iowa State University, Revised 2021): extension.iastate.edu/agdm/wholefarm/pdf/c2-21.pdf

Fixed Bushel Rent Lease

An alternative to share crop arrangements is a fixed bushel agreement. The rent payment is based on a set number of bushels per acre. For example, a corn rent might be 40 bushels of corn per acre. The bushels are delivered to a local elevator in a landowner’s name, which means they have an opportunity and responsibility to market those bushels. When corn prices are high, rental income to a landowner increases, while in lower price years, rental income will go down. The landowner’s marketing ability can significantly affect this income. The tenant and landowner will need to establish a schedule of crops to be grown and bushels that will be considered as rental payment. In this agreement, the landowner does not have production risk but does have marketing risk.

Multiple Choice Flex Leases

Some flex agreements offer a fixed price per bushel multiplied by an average yield for that field. This relieves a landowner of marketing and production risk but ties any rent price to a field’s productive capacity. If there are concerns about production potential of a field, this agreement is favorable to the tenant. The following is an example of this type of agreement: $1 times the average yield of 150 bushels per acre of corn. This calculation produces cash rent of $150 per acre.

These types of leases also provide an opportunity to showcase your farm management skills. If yield significantly increases during a lease period, those increases are due to your management decisions. Those decisions directly connect to increased rent payments a landowner receives. Positive results that benefit both you and the landowner make lease renewal or re-negotiation discussions easier to navigate.

Common Starting Points for Determining Value

The U.S. Department of Agriculture (USDA) National Agricultural Statistics Service (NASS) has county-level data for cash rental values. Since these values are based on survey results, they are not intended to serve as a price floor for rent negotiation. Your field’s individual factors and county location may mean USDA’s average is not a perfect fit for your farmland, but it can be a good place to start. It can also be helpful to see the rental rates in neighboring counties and consider differences in agriculture being produced in those locations. The data can be accessed on the USDA NASS website (www.quickstats.nass.usda.gov/).

|

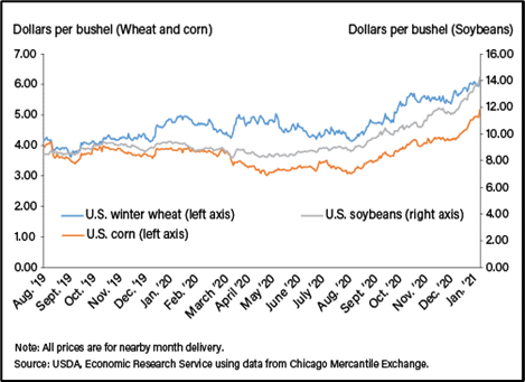

Figure 1. U.S. Grain Futures Prices Aug 2019–Jan 2021 Source: USDA, Economic Research Service’s January 2021 Wheat Outlook, Oil Crops Outlook, and Feed Outlook reports: https://www.ers.usda.gov/data-products/chart-gallery/gallery/chart-detail/?chartId=100440 |

MSU Extension prepares an annual report of USDA’s survey results specific to Michigan farms. The report provides 10 years' worth of average rental values to assist landowners and farm producers in understanding local trends. To download a copy, visit www.canr.msu.edu/resources/usda-farmland-cash-rental-rates.

Another resource is MSU’s Michigan Agricultural Land Values and Leasing Rates. This is an annual survey conducted by MSU that asks producers, landowners, and market organizations to share rent values being paid for farmland. Based on responses within a specific area, a district average for both land values and rents paid is collected. The most recent survey report, as well as past surveys, can be found at www.canr.msu.edu/telfarm/land-value-reports/.

|

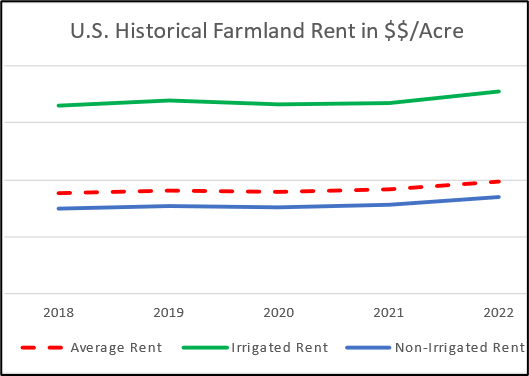

Figure 2. U.S. Farmland Rent 2018–2022 Source: USDA, National Agricultural Statistics Service, Quick Stats: https://www.nass.usda.gov/Quick_Stats/ |

A second approach for establishing land rent values is looking at prices on commodity futures markets. Historically, farmland values have been correlated with commodity prices and perceived farm profits. As prices go up, farmland values trend upward and rents paid increase. However, as those same commodity prices fall, farmland rent values tend to remain steady (see figures 1 and 2). Farm economists consider use of longer term lease agreements to be one reason for a lack of downward movement with markets.

Land rent is not the only production cost that follows commodity prices. As prices received go up, other farm input costs (such as fertilizer, chemicals, and fuel) tend to follow a similar trend. When commodity prices shift downward, costs of farm inputs react similarly to rent values. The major difference is that farm input costs will eventually trend downward but at a significantly slower pace. For example, during high demand for ethanol in 2012 and 2013, corn reached a record value of $6.89 per bushel. In July 2013, corn prices fell to $4.46 per bushel following a decline in ethanol demand. Corn prices continued downward toward pre-ethanol levels, whereas fertilizer prices took an additional 18 months to decline on a similar trend. This makes understanding the impacts that rental prices have on cost of production vital to a farm’s overall success.

Investments in Land Improvements

The definition of reasonable when describing the costs of land rent is often helped by understanding efforts made to increase or maintain productivity. In many cases, farmers will make improvements to land including installation of tile drainage, removing fencerows, and installing irrigation systems. All of these improvements lead to higher long-term yields, which tend to help support higher land rental rates. However, during times of lower commodity prices, you can expect that money invested in these improvements by farm producers will be reduced.

Landowners looking to maintain current rental rates may consider taking on investments for land improvement. Historically, landowners that have not made efforts to assist in maintaining farmland or invest in improvements generally receive lower rental rates. On average, rental rates received on these farms are 25% to 30% lower than other properties in a local area. This presents an opportunity to discuss what improvements are needed and how they will be implemented to maintain yields and profitability. Having good communication between landowner and farmer-tenant is an important first step in establishing a win-win farmland rental agreement.

How Much Is Too Much to Pay?

Another consideration on reasonable land rent is what producers can afford to pay. For your farm, develop a budget outlining expected cost of production minus any rent payments. The budget should include a reasonable amount of profit to cover debt payments. The maximum amount of rent to pay should be a number that causes revenue to equal cost of production and debt. This is known as cash flow breakeven. MSU Extension Farm Business educators can help direct you to resources and answer questions on creating a cash flow budget. To contact a member of the MSU Farm Business team, visit www.canr.msu.edu/farm_management/experts.

Also consider that the USDA Farm Service Agency (FSA), GreenStone Farm Credit Services, and most other lending institutions require at least one year of management experience to obtain an operating loan. While considerations for education and military service can help meet this requirement, most first-year farms are self-funded. Self-funding can create a positive or negative impact to both family and farm businesses simultaneously. As you lease property, you should consider what you need to operate and how much is reasonably affordable.

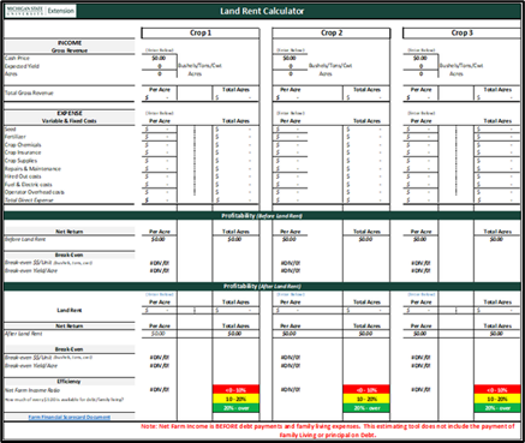

To assist in comparing the impact of land rent payments against potential profits, MSU Extension offers a land rent calculator (see Figure 3). By inputting estimated income and expenses, a producer can determine whether land rent is reasonable or if a discussion, or even a possible re-negotiation, of an agreement should take place. For new leasing opportunities, it provides a starting point for discussions of proposed rental rates.

If a discussion with your landowner is needed, use a land rent calculator printout to review challenges and potential impacts to a farm's production and profitability. This tool is available at MSU Extension’s Farm Management website: www.canr.msu.edu/resources/land-rent-calculator

What Factors Affect the Value?

A number of factors affect land rent values including productive capacity, accessibility, and competition for land. Twelve items to consider when evaluating an amount that should or could be charged for cash rent follow:

- Nutrient content of soil – Do you have a recent soil test?

- Crop productive index – Have you compared soil productivity to other soil types by using the USDA Natural Resources Conservation Service soil survey? (https://websoilsurvey.nrcs.usda.gov/app/)

- Cropping history – What has previously been planted on a field? What base acres and yields have been reported to USDA FSA?

- Crop production level (yields) – Can you document what the actual yields have been over a period of time (for example, the last 10 years)?

- Herbicide application history – Does previous herbicide use restrict immediate or future crop rotation?

- Drainage tile – Is tile in good working condition? What spacing? What type? When was it installed? Do you have a map of tile lines and outlets?

- Surface drainage – Do you have grass waterways? Are they in good repair? Are there any washouts?

- Irrigation – Is irrigation in good working condition? Is it low- or mid-elevation? Who is responsible for energy costs?

- Field size – How many tillable acres? Small fields (less than 40 acres) are generally discounted.

- Access/obstructions – Are there telephone poles, stone piles, a narrow drive, buildings, fences? Is it near a school, on a busy road, in a rural area?

- Proximity to wildlife cover – Are there concerns of potential deer or other wildlife damage?

- Location – Is the site near a city or in a region with high land values?

Not all of this information is easy to obtain. However, there are resources available to help you begin to identify factors about your farm, including Computing a Cropland Cash Rental Rate from Iowa State University, Revised 2021 (www.extension.iastate.edu/Publications/FM1801.pdf).

Return on Investment Method

Another factor affecting rental rates is a desired return on investment. Owners of assets should always have an expectation to receive a return on their investment. Land is no different. Landowners may use this method to get a ballpark price to use when negotiating with a farmer-tenant. Valuing rent on a return on investment does not take soil productivity and land improvements into account, but it can be a place to start. To use this method, estimate a desired return from farmland; determine a fair annual return rate, then multiply (See Table 1). A common interest rate used is a 20-year U.S. Treasury Bond rate that can be accessed at the U.S. Treasury Department Resource Center (https://home.treasury.gov/policy-issues/financing-the-government/interest-rate-statistics?data=yield). On December 1, 2022, the 20-year yield rate was 3.85%.

|

Land value ($/acre) |

$3,000 |

$6,000 |

|

Rate of Return |

3-4% |

3-4% |

|

Rental Rate ($/acre) |

$90-120 |

$180-240 |

Table 1: Example of Return on Investment Method

A helpful resource for this method is Kansas State University’s interactive dashboard to help assess farmland values. The dashboard is an index of farmland values using USDA NASS's “ag land including buildings asset value per acre” data. The index can be used to estimate a value for a given year using a known value for farmland from another year. The value of farmland is used in a multitude of farm management decisions, including determining a rental value. To access this resource, visit agmanager.info/land-leasing/land-buying-valuing/using-usda-nass-farmland-values-farm-management-decision-making.

Impressions vs. Reality

Land rent should be based on real numbers not coffee shop talk. Land rent prices are highly variable and depend on many factors. Just because a neighbor has one field renting at a high price doesn’t mean that all land is worth that same value. Be sure you do your homework.

The basic rule is that over time a cropping system put in place must generate a net revenue above cash and land costs. Many farms are now looking at total land cost across all acres and using that calculation to determine cash rents. Total land costs help to determine if cash rents are reasonable, especially if a farm is also attempting to support land being purchased. The bottom line is as farm income decreases, farmers will have to carefully evaluate their cost of production and may have to renegotiate land rents that are affordable to them.

Setting the Stage for Negotiations

Negotiating farmland rental rates can be challenging. Generally, landowners and farmer-tenants want to be fair with each other. Neither party wants to be taken advantage of. Landowners need to cover costs associated with owning land, such as a mortgage payment, insurance, and taxes. Farmer-tenants need land to grow a crop and generate income. Most landowners and farmers alike want an easy way to determine fair rent prices. However, if market prices become volatile, it can complicate that process. When prices and yields are favorable, farmers can afford to pay more for rent, but when relative commodity prices recede, the ability to make higher rent commitments is eroded.

Preparation for Negotiations

Negotiations for farmland rental should be treated like any business meeting for your farm. Successful business meetings involve discussing how to achieve goals and working through any challenges that may arise. To ensure a successful meeting, preparation ahead of time is essential.

Confirm property meets your farm’s intended production needs.

If land is being pursued, define the equipment required to prepare, plant, manage, and harvest any crops. If buildings are needed for livestock, decide the equipment required to maintain animal health. Maintaining animal health includes necessities, such as feed, water, and removal of manure. The key is to determine if the available capital assets you have are a good fit to rented property or if there are additional needs.

Not all property is created equally. Yield potential is determined by soil type and health. Requesting a soil test can provide up-to-date information and reduce costs associated with fertilizer management. If landowners have prior yield or other management data, ask if they would be willing to share it. These steps help to ensure intended crops are suitable to available ground and soil conditions. Remember, just because property is available doesn't mean it's right for your farm business.

Prepare to talk about challenges and risks to your farm operation.

Many factors outside of your control can affect your farm, such as market conditions and unexpected weather. You should express how these risks affect your business without appearing to complain. Complaints about challenges create a negative impression of how you view and manage risk. Landowners need to understand that production and profits are not guaranteed, so you should share your plans for managing risk. This information can help establish why rent payments need to remain reasonable given your operation’s circumstances. By outlining how you will meet a landowner’s needs when challenges occur, you can establish your value as a tenant.

Know your cost of production and break-even points.

Negotiating a rental agreement requires an understanding of your farm’s potential profits. Knowing your production costs can tell you if a proposed rent is more than you can afford. More importantly, you can effectively convey to a landowner why that rent is too much for your operation, especially if you combine expected costs with potential risks. This information allows you to offer a reasonable counterproposal and a maximum rental value as you finalize negotiations on price.

Identifying if a rental agreement is reasonable also includes any additional costs that may arise. For example, landowners may have specific requirements to rent their property. These may include tree trimming on field edges, soil health maintenance, and more. You should understand any costs and time involved to meet requirements, especially if they affect farm activities. Those costs should be discussed in the negotiation process. Before agreeing to any additions, be certain they are achievable, and that renting property is still affordable to your operation.

Rehearse with someone how you will respond to pushback.

Remember that landowners are looking for rent income to cover their own costs. They also have expectations for how their property is to be maintained. Because of these reasons, you may encounter challenges to your production activities in addition to costs or risk assessments. Practicing how to respond to these discussions before a negotiation can ensure that you respond respectfully and productively. It can even be helpful to prepare short responses to show your empathy for their situation, too. Demonstrating your understanding of how declining revenues impacts a landowner is important, especially if you expect them to understand how similar situations affect your farm.

Don’t be afraid to share details, but avoid oversharing.

There is often a concern that sharing any details opens your farm to scrutiny, from how you spend money to even making day-to-day business decisions. Scrutinizing your management decisions can negatively influence negotiations. For these reasons, be cautious and avoid oversharing details that can detract from reaching an agreement. For example, avoid discussing labor or farm debt in any great detail. How you manage your workforce or finance your farm is not necessary information a landowner needs to know. While costs are important to production, too much attention on costs creates doubt about you as a potential renter.

Focus on details that help to build confidence that you are a trustworthy steward of their property. Provide information on production goals, market strategies, or uses of insurance programs. These details describe your profit-generating efforts and management of risks. Be sure to include any government farm programs that you participate in, especially if your participation would include a landowner’s property. Many farm programs are designed to operate similarly to insurance policies and can further demonstrate your efforts to retain profits.

Review factors that influence property value, especially if they limit productivity.

This publication has outlined a number of factors that affect a land’s value for farming purposes. These factors include production capacity, accessibility, and local competition for land. Productivity potential of a property is important for both you and a landowner. You need to evaluate what is a reasonable value for you to offer when renting. Landowners need to understand if their asking price matches their farm’s production potential, especially if they are seeking an increase in rent income.

Be flexible and consider alternative leasing options.

The most common type of rental agreement is a cash lease. A landowner is paid a set amount each year regardless of your farm’s production or profit achievements. However, different types of rental agreements should be considered during negotiations, especially if an alternative type of agreement offers a better means of each party reaching their desired rental goals. When preparing to discuss alternative lease agreements, be sure to understand risks, rewards, advantages, and disadvantages of each option.

For example, a flexible cash lease agreement retains a set amount of cash rent, but also provides a bonus payment at harvest. A bonus is paid only if certain achievements are met, such as production and prices equaling an established gross revenue. If achievements are not met, only a cash rent is paid. A flexible cash lease allows property owners to share in risks and rewards of production activities while taking their comfort level of risk into consideration.

Initial Meetings & First Impressions

The key to negotiations starting out positively is to make a good first impression. Begin by establishing a good rapport. Offer your appreciation for having an opportunity to farm their property. Even a simple thank-you demonstrates respect for not only an owner’s property but also for their time.

Building Relationships

You can build a successful and sustainable relationship around a “good neighbor” mentality of friendliness and appreciation.

Reputations precede any farm rental discussion.

Your reputation as a farm manager is another important aspect of establishing a good first impression. How you and your farm are viewed by other businesses and your community can affect whether you secure an agreement. Are you well respected? A well-respected farm is defined as one that is trustworthy, honest, and dependable, and one that effectively communicates in its business relations. If that definition describes your farm, it implies a good relationship between tenant and landowner should be expected. If that definition does not describe your farm, chances are a landowner will have concerns about entering into an agreement.

Emphasize how renting benefits your farm’s goals.

After providing background, shift to talking about their property directly. Outline your crop plan and the crops that will be grown. Describe tillage practices, seed to be planted, pesticide uses, and the way crops will be harvested. If any work is custom hired, share details on whom you hire for those tasks and why.

Invite landowners to ask questions about your plan and any concerns they might have. They have a right to know who will be on their property and what will be happening on it. They may have concerns or requests about production activities. Discussing your crop plan provides an opportunity to showcase how you’ll manage their property. By inviting questions, you demonstrate your willingness to communicate and share information.

Communication can make or break a lease agreement.

Establishing trust is essential to maintaining a successful lease agreement between a tenant and a landowner. Building trust begins with effective and honest communication about expectations. Landowners want to know what to expect if you are farming their property, so provide background about your farm business and its goals. This can include production, financial, or business achievements you've set for your farm. If you've rented other land, share how you've managed those properties. Describe how additional farmland will help you advance those goals. This shows how you will value and take care of the property. Landowners need to feel confident that their property will be well treated.

In addition to discussing your crop plan, outline your expectations for managing their farm property. Share what that management looks like to you. For example, do you need to leave equipment on the property, access gates or roadways, or limit access at certain times? Encourage landowners to ask questions and share their expectations, too. They may not understand farming and may have concerns about something you describe. By encouraging discussion, you can work through potential disagreements and establish open communication for a successful leasing relationship.

Take notes and review all important line items discussed.

Negotiations can involve discussions across many topics. Each topic may include several details or requests from either you or a landowner. Taking notes throughout your meeting can help to ensure all important items have been discussed. Notes also help to provide a summary of details needed for any pending written agreement.

An agreement to rent may not happen in your first meeting.

It’s okay if you need to table discussion and resume negotiations later. An honest, healthy discussion of needs and expectations between you and a landowner can reveal a lot of information for either party to consider. You may need to reassess what is being asked to maintain a property and not just a rent price being proposed. A landowner may need to consider how any counterproposals you’ve made affects their own goals.

If the discussion is tabled, establish a tentative date and time for a follow-up meeting. You want to establish your continued interest while each party considers what has already been discussed before continuing forward. It also lets you consider whether both parties are suited to a rental relationship.

Determine if you and property owner are compatible.

Shared values, goals, and expectations on property management are crucial to a long-term leasing relationship. Avoid entering into an agreement with someone that you don’t feel is compatible with your values. If strong disagreements are not resolved during an initial negotiation, they will likely persist. That persistence may cause problems during a lease agreement or make future renewals more difficult to achieve.

Take care when considering assistance from other farms.

Many established farms may offer to help new farmers get started. Their eagerness to help is often well intentioned and can be of great benefit. However, if an established farm is helping to negotiate a rental agreement, their reputation can bring with it expectations that may be difficult for you to meet. Ensure that negotiations are between you and property owners. If landowners have expectations, discuss what they involve and whether they can be reasonably met. Discussions should focus on your farm, its goals, and ways you intend to achieve them.

Family farms can offer access to farmland, just ensure your farm maintains its own identity.

Often, family farms will offer to sublet (rent out) rental or owned property to help next generation farmers get started. They may also offer to help purchase inputs, providing an opportunity to take advantage of discount prices. The challenge this type of assistance presents is being able to distinguish between two farm businesses, especially if operating plans between businesses are similar.

Make extra efforts to ensure that both farms are identified and treated separately. This includes each manager developing their own goals for their respective farms. The rental process between businesses should be handled identically to those held with individual property owners. That process should include drafting and signing a rental agreement between all parties. If a family farm will assist with inputs purchases or marketing, a means of identifying and tracking how much belongs to each business needs to be created. MSU recommends having an agreed-upon tracking method drawn up into an agreement and signed by all parties.

Remember, a first impression starts with your choices about properties and any decisions to lease them. Identifying your operation needs before entering into a lease agreement is crucial to a successful start.

Reaching Agreement

Successfully concluding negotiations means you’ve come to an agreement. A rental value or method of establishing it has been outlined. Property maintenance has been defined. Most importantly, both parties understand what is expected to fulfill their portion of this new rental relationship. Now you need to solidify this relationship and ensure it has an opportunity to last.

The Written Lease

Ask for a written lease. A written lease provides both parties with protection and a reference for each other’s responsibilities. This reference should be more than just rent values or methods of establishing them. Written agreements should contain all negotiated points that have been agreed upon and the persons responsible to carry them out. Agreements can also include guidance on how to resolve any disputes that arise. If recorded at your county’s Register of Deeds, written leases can even protect your rights if landownership changes (to heirs or purchasers). Alternatively, an oral lease offers little protection and provides more opportunities for disagreement. For your farm, protection is limited to harvesting any planted crops. Multi-year investments, such as lime or fertilizer, are not protected and would be lost dollars to your operation.

Good Rapport & Renewal

Written agreements also provide good rapport toward rent renewal. With each party carrying out their respective duties, everyone benefits from an existing arrangement. At renewal time, you can discuss having fulfilled everything outlined in an agreement. You can also highlight how that provided positive experiences for both parties and has established a good rental relationship. This helps when discussions around changing rent values arise and you need to demonstrate your value as a tenant, especially if a proposed rent value is too much for you to afford and needs to be reduced. Demonstrating that value is also useful when landowners are approached by other farms about renting their property. They can review a written agreement with you and know what to expect by keeping you as their tenant.

Elements of a Farmland Lease Agreement

Identifying which type of lease agreement works best is just one part of a renting process. The next part is deciding what information needs to go into that agreement. The following section offers suggestions on items to include in a written lease.

Legal Description of the Property

A detailed description of farmland should be stated including the state and county. The section number and position within the section along with maps, geographic coordinates, and aerial photographs are also useful (Griffin, 2011). The idea is to include information that accurately identifies which property is being rented.

Payment Due Date

For any type of lease agreement, a date when payment is expected should be included regardless of how payments are made. For cash rental leases, multiple lease payments may be made per year. In cases of crop share agreements, a landowner may opt to market their share separately from your share. Landowners may also choose for you to market both shares together and receive money once their crop is sold (Griffin, 2011).

Length of Lease

The time period of a lease should include beginning and ending dates. Many farmland leases are written for one year, while others can be for multiple years. Although both parties tend to prefer maintaining long-term relationships, a farmland lease does not have to be long term. Shorter term leases force both you and a landowner to either continue with a current arrangement or re-examine a previous lease. This examination helps to review any aspect that may need to be updated, even if a prior lease was considered appropriate. Changes in production practices, technology, government policy, and commodity prices may influence a need to revise a new agreement.

Additionally, when a new relationship between you and a landowner is being developed, one-year leases minimize some problems in cases where a relationship does not appear to last. In other words, one year may be too long to deal with someone that is not compatible with you as a business partner (Griffin, 2011).

Repairs and Maintenance to Improvements & Irrigation Systems

Comprehensive farmland leases include provisions for any improvements made to farmland. These improvements may include buildings, grain storage facilities, irrigation systems and wells, or other structures. Some landowners require that you maintain existing structures. Part of your negotiations should include determining who is responsible to repair or replace improvement, such as irrigation equipment (Griffin, 2011).

Termination of Lease Agreement

Conditions for terminating a lease agreement before the original end date should be stated. There should also be a description of allowable reasons for early terminations. The following situations should be discussed and included in the lease terms: if the land is sold to another party, if the farmer ceases to farm, if either party dies, or if the landowner chooses a new tenant (Griffin, 2011).

Rights of the Landowner

In practice, a farmland lease gives you, as a farmer-tenant, complete control of rented farmland for the length of a lease. However, the rights of a landowner should also clearly be outlined in that lease agreement. For example, a landowner may wish to have access to farm data generated from a field. This data can include as-applied fertilizer data and even yield monitor data. Landowners may even want to visit a field unannounced. Situations like this may lead you to feeling imposed upon or as though a landowner is checking up on you. In most cases, a landowner may be interested in modern farming operations for their own education. They may also simply wish to ride on a tractor or in a combine if you would agree to that. Specific language in a lease agreement that describes what each party feels is acceptable can help avoid miscommunication. This language also provides an opportunity for both parties to fully reach their level of satisfaction with a rental relationship (Griffin, 2011).

Although many times a farmer maintains complete autonomy in farm management decision-making, depending on which type of lease agreement you use, landowners can have increased decision-making privileges. These decisions can include choice of crop and even crop production practices. Part of your negotiations should include identifying who has a right to choose what crops will be planted (Griffin, 2011).

Hunting & Recreational Uses

The farmer-tenant typically has full rights to rented property unless otherwise agreed upon. These rights can often include whether landowners have any entrance or hunting rights. Lease agreements need to use explicit terminology to state what rights will exist for a landowner, farmer-tenant, and other potentially involved individuals (Griffin, 2011).

Options to Purchase & Right of First Refusal

A right of first refusal provides an option to lease or purchase rented farmland in the future. If a landowner receives an acceptable lease offer from another farm, current tenants have a right to match it. The same scenario applies when a landowner has received an acceptable purchase offer.

The concern with a right of first refusal is that current tenants are not involved in negotiation of a final price. Tenants essentially are given an option to match someone else’s offer in a “take it or leave it” scenario. With high demand for farmland, such scenarios could lead to higher rent payments or loss of farmland. These options should be used only when farmland is of significant long-term importance to your operation and landowners are unwilling to provide an option to purchase.

An option to purchase provides an opportunity for tenants to buy rented farmland. The sale terms are often very specific and must be met within a defined time period. Most leases with an option to purchase are called an option contract. They contain a specific clause identifying terms as well as when a tenant can exercise an option to purchase. The clause normally defines a selling price or tells how a final selling price will be defined. In some cases, clauses may offer an opportunity to use rent payments as installments toward a final purchase. The total purchase price at time of sale would subtract rent paid from a final sale amount.

An attorney should review a lease agreement with an option to purchase or right of first refusal. An attorney can ensure that appropriate language exists so that these options are enforceable under state law. Key items for inclusion in a lease agreement include a) precise trigger events when either party can exercise their option, b) a period of time in which a party is allowed to exercise their option, c) a step-by-step process for making or responding to any options, and d) steps to follow when an option is not accepted.

Include information in the lease about what to do if there is a disagreement or problem.

While a written lease can reduce potential misunderstandings, it can’t prevent them entirely. In the event that a disagreement does occur, it helps to have a method for resolution outlined in your lease.

One method is to have a “common grounds” discussion to better understand the other person’s perspective. These types of meetings provide an opportunity to ask questions and learn more about why a misunderstanding may exist. It’s helpful to use “I” statements to express your feelings and share exactly how a disagreement affects you.

If an attempt to have discussions do not work, another approach is for both parties to write a letter. A letter provides an opportunity to share each party’s understanding of a situation and any suggestions toward resolution. The use of “I” statements are recommended here as well and can be helpful in framing a written letter.

As a last resort, written leases should contain a method of seeking nonbinding arbitration, also known as mediation. Mediation involves working with a neutral, third-party individual to help resolve disagreements. These mediators facilitate discussion to create understanding, establish common ground, and identify possible solutions. The Michigan Agricultural Mediation Program is a free mediation service available to Michigan farmers to help in dispute resolution. For more information, visit www.northernmediation.org/agricultural.

Signatures & Date Signed

Once parties reach terms that are considered appropriate, they must sign an agreement. Be sure to include dates with all signatures. Dates verify when an agreement was reached and the effective date a lease contract begins (Griffin, 2011).

Bottom-Line Considerations

Regardless of which type of lease arrangement is used, all parties concerned should seek advice of their legal counsel. An attorney can ensure that an agreement meets all local and state laws. They can also provide additional guidance ensuring each party's rights and responsibilities are clearly stated in an agreement’s final draft (Griffin, 2011).

To identify additional elements to include in a farmland lease agreement, visit Michigan Farm Bureau’s Farmland Rental Contract Checklist at new.michfb.com/sites/default/files/2021-05/farmland-rental-contract-checklist-1.pdf.

Renewal Potential

Renewal potential begins at agreement signing. Demonstrating your value as a returning tenant starts when your first agreement begins.

Maintaining Relationship

You need to establish a positive relationship with your landowner and maintain it throughout a leasing period, regardless of whether a period is one year or multiple years. Your relationship with a landowner is crucial to maintaining their acres as part of your operation.

Keep communication open.

Just as in negotiations, questions from a landowner should be encouraged during a leasing period. Remember, property owners may not understand a lot about farming or activities they’ll see on their land. Encouraging questions helps to build education on practices or significant changes that may be seen, especially if practices are different from what was discussed during negotiations.

Provide landowners with a production update.

Updating landowners on farm activities at various points of a growing season helps to build a good rapport. Production updates should include information on crop conditions, market activities, or any activities you have planned such as planting, spraying, or harvest. Landowners often like to stop by when they see activity on their property. They may also visit when you are not there. Keeping them informed helps them to understand what they are seeing or what to expect when they visit. Be sure to always inform a landowner if a problem occurs or an activity limits access to their property, such as re-entry intervals from chemical spraying.

Providing production updates is a good way to educate landowners on farming practices and significant changes. Landowners should know about changes in cropping plans or market conditions, especially if they affect profitability. This is a good opportunity to explain any circumstances that may affect rent payments, now or in the future. Avoid complaining about negative situations. Instead, focusing on facts and numbers illustrates your farm’s current environment as well as how you are adapting your plans to work through it. This will help build trust and establish a successful leasing relationship.

Schedule annual meetings.

Schedule annual meetings with your landowner. They can be formal, established dates or informal dates held during a certain time frame each year. For example, you may informally plan to have a meeting sometime in December or January, and then contact your landlord ahead of time to schedule a specific date.

Recognize all owners whenever possible.

Building a good rapport and strong rental relationship should include recognizing a landowner and their family. Recognition can start with simple things, like acknowledging important life events, such as a 50th wedding anniversary or child’s college graduation. You can also recognize a landowner by inviting them to events where your farm may be receiving an award, especially if their property contributed toward an award’s reception.

When appropriate, begin including future generations in any passive communications or production updates whenever possible. However, be sensitive to established lines of communication within a family. A rental agreement is often between your farm and a single individual. Any communication or involvement of family members should be discussed with your landowner before moving forward.

Thorough Yet Flexible Agreements

What does the future look like for land rent? You will want to hold on to farmland as long as possible. It is hard to make a living if you don’t have any land to farm.

Market prices will continue to be a driving factor in discussions on establishing rental values. If markets are trending downward, you may need to renegotiate rent and the type of rental agreement being used. Consider how to address periods of lower net farm income where additional risk exists to your farm business.

You may want to share some of that risk with landowners by shifting to a different type of lease agreement, especially if a new agreement allows rental prices to reflect when crop prices are good, but adjust rental values when prices are down. Negotiation and identifying which type of agreement to use involves you and a landowner understanding each other’s needs. Communicating these needs is key to a successful “win-win” agreement.

Rental agreements are also a contract. Contracts need to be built on openness and trust. These agreements need to thoroughly address any major concerns that exist for both parties. However, preparing for every situation that might happen on a farm property is impossible. Flexibility can be constructed into any agreement by establishing an open process of how to help work through unexpected situations. An open process encourages respectful and productive communication. It also establishes that all information about a circumstance be provided to both parties. Sharing of information allows everyone to understand what is going on and how to develop a workable solution forward. Disagreements are also less likely to occur or will be short lived as you move forward. Most importantly, an open process empowers both you and a landowner to continue benefitting from your rental relationship.

Reference

Griffin, T. (2011). Elements of an Arkansas farmland lease [unpublished document]. University of Arkansas.

Print

Print Email

Email