A new crop insurance design

A new crop insurance designed based on probability of loss could result in premium subsidy redistribution of $3.36 billion annually.

When it comes to crop insurance across the U.S., regions at higher risk receive higher crop insurance subsides per acre – an equity than widens on a per bushel basis.

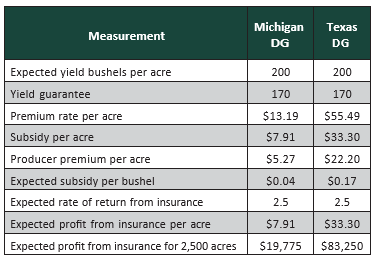

The current crop insurance design is based on a distance-based yield guarantee (DG) where subsidies are a percentage of premium rates. Comparing two hypothetical producers – one in Michigan and one in Texas – who both have a 200 bu./ac. expected yield with a 170 bu./ac. yield guarantee, but the Michigan producer has far less variability. Under a distance-based guarantee, the Texas producer receives more than four times the per acre subsidy.

Built on probability

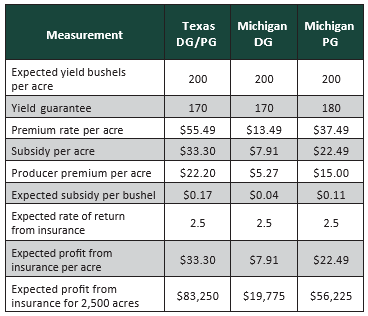

A more equitable system would be a probability-based yield guarantee (PG) that factors in riskiness of the underlying distribution. Here’s how this system would look for the producer in Michigan and in Texas:

- under a 1 in roughly 6 year probability of loss, the Michigan producer would have a 180 bu./ac. coverage

level and the Texas producer’s yield guarantee remains at 170 bu./ac.

- under the probability-based yield guarantee the Michigan producer receives 2/3 of the subsidies the Texas producer receives – that compares to just 1/4 of the subsidies under the current distance-based yield guarantee system

Tracking the impact

We simulated changes in premium subsidies by county/crop for corn, soybeans, and wheat if the U.S. crop insurance system changed from distanced-based to probability-based yield guarantees.There are several policy implications associated with a proposed new crop insurance design centered on a probability-based yield guarantee that would:

-

dramatically decrease the variability of premium subsidies across counties on a per bushel and per acre

-

reduce subsidies in riskier counties in the Great Plains and Southeast

-

increase subsidies for less riskier regions like the Corn Belt and Great Lakes region

Print

Print Email

Email