Soybean sidekicks: Microbes to the rescue (sometimes)

Interest level in agricultural biological products is at an all-time high, but have research results shown their profitability?

Agricultural biological products was a $17 billion market in 2024 and was projected to increase by nearly 14% annually through the rest of this decade according to one report. A 2024 farmer survey, “Biologicals: Row-Crop Farmer Value, Perception and Potential,” was conducted by Stratovation Group and funded by Syngenta, Pivot Bio, Meristem Crop Performance and other groups. The report found that 87% of farmers in the U.S. are aware of the term agricultural “biologicals” and 45% say they are currently purchasing or using them to boost yields, enhance profitability and provide soil health benefits. If you have attended a trade show or picked up a popular ag magazine recently, you know that, clearly, interest in these products has grown in recent years.

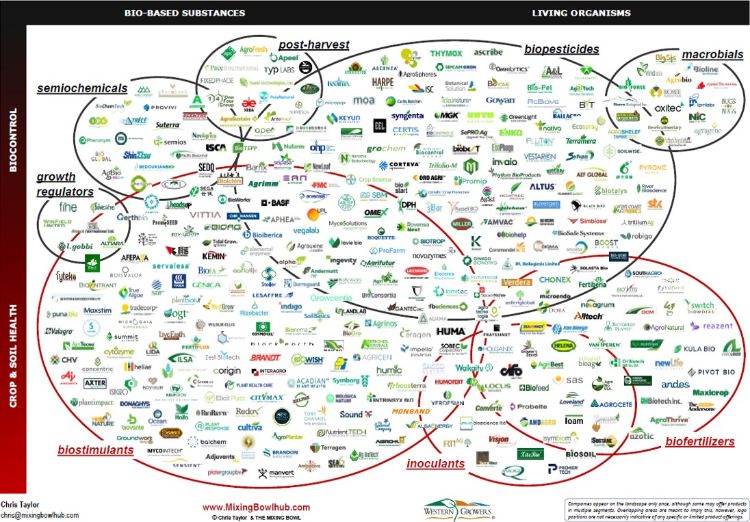

What are biological products? The word biologicals can mean different things:

- Biologicals: Living microbes that help plants grow.

- Biostimulants: Natural extracts from microbes.

- Plant growth regulators: Natural hormones that affect plant growth.

- Biopesticides: Natural pest control products.

Some people use these terms differently, but in this article, we’ll use biologicals to mean all of them, but most references will be to true biologicals.

The Science for Success team of university soybean specialists studied numerous soybean biological seed treatment products and collected over 5,000 data points across 101 site-years and 21 states in 2022 and 2023. In 2023, they found that Bradyrhizobium—the inoculant responsible for root nodulation and nitrogen fixation—increased yields by 1.6 bushels/acre on average. Across the entire study, they found some of the other treatments produced as much as a 3 bushel per acre increase over the control, but they observed this response only 25% of the time.

Between 2011 and 2024, several foliar-applied biological products were tested in the Michigan Soybean On-Farm Soybean Research (formerly SMaRT) program (Table 1). Although treatments resulted in a significantly higher yield than the control at six out of 106 locations, there were no significant differences when averaged across locations and years for each product.

Why do university research results often differ from those presented by companies? It could be that some companies do not perform statistical analysis on yield data and show only average yields whereas university results include statistics to show true differences apart from the “white noise” of in-field and between-farm variability. Companies may be testing their products in fields where specific factors are present (or absent) and the beneficial impact of the product is strong. And, unfortunately, it could be that some companies may not be as forthcoming with their results as we would like them to be.

Numerous factors play into whether a given product will produce significantly higher yields in a field in any given year including weather, presence of a given stress, timing and method of application, and possibly even variety. Michigan State University Extension and the Michigan Soybean On-Farm Soybean Research program believe the science has shown that some products have the potential to increase soybean plant health and yield as shown in controlled-environment studies, and we are committed to continuing to test more products in on-farm trials in the future to see whether this potential can be realized at field-scale. If you have any products you have used that have been beneficial on your farm, please let us know and we will consider testing them in future trials.

Table 1. Results with foliar-applied biological products in the Michigan Soybean On-Farm Research trials from 2011-2024.

|

Product |

Year |

Stage applied |

Rate (oz/ac) |

# Locations |

Yield |

Income |

||

|

Control |

Treatment |

Control |

Treatment |

|||||

|

Ratchet a,b |

2011-2014 |

V2-R1 |

4 |

17 |

50.1 |

51.8 |

$633 |

$639 |

|

ProAct c,d |

2012-2014 |

V4-R3 |

1 |

11 |

56.3 |

56.5 |

$716 |

$694 |

|

SumaGroulx e |

2013 |

PRE or R1 |

128 |

2 |

32.6 |

33.4 |

$396 |

$354 |

|

Blackmax 22 f |

2015 |

V3-V5 or R1-R3 |

128 |

13 |

50.6 |

51.2 |

$466 |

$452 |

|

Radiate g |

2016 |

V3-V5 |

2 |

18 |

62.0 |

62.2 |

$570 |

$568 |

|

Nutrio Unlock (+ Puric Prime Max in-furrow) h |

2020-2021 |

IF |

16 |

14 |

58.9 |

59.2 |

$713 |

$710 |

|

Stimulate i |

2022-2023 |

V4-R1 |

8 |

17 |

52.8 |

52.9 |

$681 |

$676 |

|

ArchiTech j |

2023-2024 |

V4-R1 |

32 |

14 |

57.4 |

57.1 |

$620 |

$605 |

|

a included Optimize 400 (2011), Stratego YLD fungicide (2012, 2013); b lipo-chitooligosaccharide (LCO); c harpin protein; d included Stratego YLD (2012); e microbes, humic acid; f humin, carbohydrates, humic and fulvic acids; g IBA (indole butyric acid), kinetin; h microbes + humic acid; i microbes; j gamma-aminobutyric acid (GABA), nutrients |

||||||||

This article was originally published in the Michigan Soybean On-Farm Research In-Season Management Guide.

Print

Print Email

Email