Bulletin E3540

Integrating High-Oleic Soybeans into Farm Systems: Exploring Production, Marketing and Contracts

December 16, 2025 - Eric Anderson, Michigan State University Extension; Hanna Campbell, Michigan Soybean Committee; Teresa Crook, Phil Durst, Jon LaPorte and Martin Mangual, Michigan State University Extension

Introduction

High-oleic soybeans (HOSB) have the potential to improve human health and increase farm profits for those able to take advantage of near-term opportunities.

Farmers have an opportunity to improve profitability while meeting demand for healthier oils and livestock feed with HOSB. Developed to increase U.S. soybean oil’s competitiveness against palm, olive, corn, sunflower, and canola oils, HOSB differ from commodity soybeans. The differences are mainly in their fatty acid profiles, particularly higher oleic acid content.

Demand has grown rapidly in recent years, driven by food manufacturers and dairy farms using roasted HOSB in feed rations. This bulletin outlines the nutritional benefits of high-oleic oil, agronomic and other production practices, marketing opportunities and contract considerations for HOSB. Refer to MSU Extension Bulletin E3541 for an in-depth review of roasting, storing, grinding and feeding HOSB in a dairy operation.

Nutritional Advantages

Linoleic and linolenic acids are polyunsaturated (more than one double bond along the carbon chain), which contributes to instability in oil and reduces both fryer life and shelf life. Oleic acid, a monounsaturated fat, improves oxidative stability. Many consider olive oil to be the gold standard when it comes to healthy oils. It has approximately 75% oleic acid, while oil from commodity soybeans has only 23% (Table 1). The United Soybean Board has set industry standards for high-oleic and low-linolenic oil at >75% oleic and <3% linolenic acids (Bilyeu, 2020), respectively. High-oleic soybean oil is sometimes referred to as high-oleic, low-linolenic (HOLL) oil. Thus, HOSB oil is more stable with a shelf life 2–3 times longer than that of commodity soybean oil.

Historically, soybean oil has been hydrogenated, or partially hydrogenated, to improve its stability. However, this also produces trans fats, which are particularly unhealthy as they raise “bad” cholesterol (LDL) and lower “good” cholesterol (HDL). In 2015, the U.S. Food and Drug Administration (2024) declared trans fats were no longer generally recognized as safe (GRAS) and banned their use in 2018 with a final compliance date of January 1, 2021.

Table 1. Comparison of select oil traits of various oils and current high-oleic soybean developers.

|

|

Saturated |

Monounsaturated |

Polyunsaturated |

|

|

Oil feedstock / soybean source |

(%) |

Oleic (%) |

Linoleic (%) |

Linolenic and others (%) |

|

Commodity soybean |

15 |

23 |

54 |

8 |

|

Plenish® soybean 1 |

<12 |

75–80 |

4–7 |

2 |

|

Vistive® Gold Xtend soybean 2 |

6 |

65–74 |

17 |

3 |

|

SOYLEIC® soybean 3 |

<12 |

78–84 |

6–8 |

1–3 |

|

Olive |

15 |

75 |

9 |

1 |

|

Canola |

7 |

61 |

21 |

11 |

|

Corn |

13 |

29 |

57 |

1 |

|

Sunflower |

12 |

16 |

71 |

1 |

¹Corteva Agriscience, GMO

²Bayer Crop Science, GMO

³Missouri Soybean Merchandising Council, non-GMO

Excerpted from Oviedo-Rondon (2024) and Frankel (2005)

Development and Adoption

In the early 2010’s, the United Soybean Board invested $10 million to help DuPont Pioneer (now part of Corteva AgriscienceTM) and Monsanto (now part of Bayer Crop ScienceTM) develop their own lines of HOSB in maturity groups covering 80% of U.S. soybean acres. Pioneer first introduced Plenish® HOSB in 2012 in 13 states after a decade-long product development pipeline. Monsanto followed suit with Vistive® Gold in 2018. Both soybean lines were produced via genetic modification to increase oleic acid and decrease linoleic and linolenic acids.

In 2021, a partnership between the University of Missouri, the USDA, Missouri Soybean Merchandising Council, and the United Soybean Board created a non-GMO version of HOSB they termed SOYLEIC® (Missouri Soybean Merchandising Council, 2021). SOYLEIC® continues to be commercially available although it has been licensed by other companies including Beck's Hybrids. Michigan State University soybean breeder Dr. Dechun Wang, with support from Michigan Soybean Committee and United Soybean Board, has also developed over 1000 HOSB breeding lines called Olasoy and has 13 lines currently in the 2025 university variety trials (personal communication).

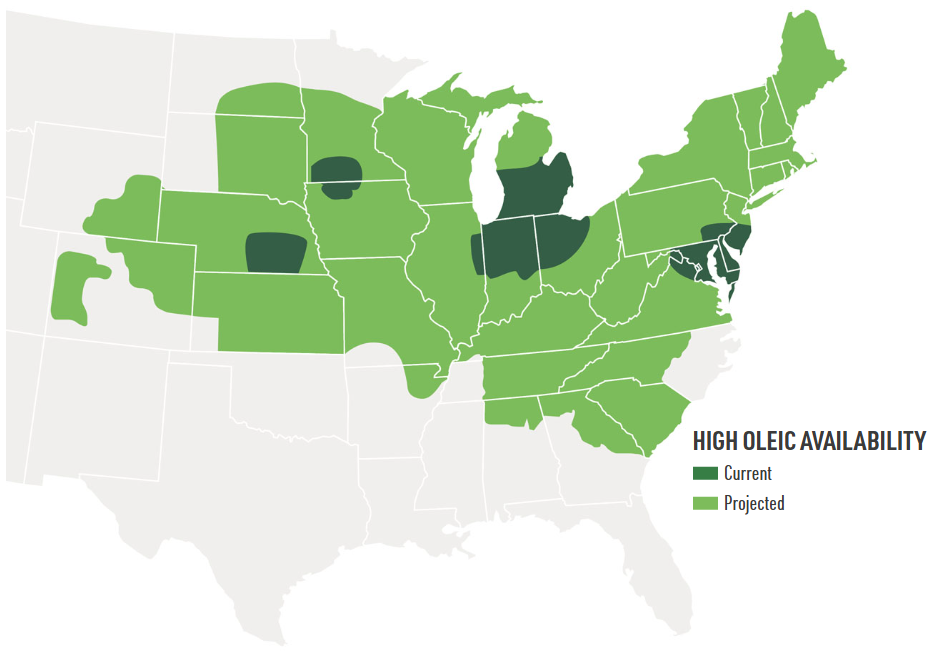

An estimated 1.4 million acres of HOSB were projected to be planted in the U.S. in 2025, with 2.9 million acres projected by 2030, according to a report prepared for the U.S. Soybean Export Council (Sanders and Tegeder, 2024). Indiana leads the production of HOSB with several processing facilities in the state and many acres of HOSB grown in the tri-state region (Figure 1).

Production Considerations

Yield Competitiveness

Between oil and dairy markets, the potential is increasing for soybean acreage and improving soybean farmers’ net income. However, some concerns have kept many farmers from growing HOSB in the past. Early accounts of a yield drag with HOSB (Spear et al., 2013) have been replaced by numerous university and industry trials showing yields are now comparable with commodity soybean varieties (Alt et al., 2018; Willette et al., 2021; Field Advisor, 2025). No significant agronomic characteristics (e.g., field emergence, disease ratings, soybean cyst nematode (SCN) resistance) are different between HOSB and commodity varieties aside from weed control. However, significant differences may exist in yield potential and agronomic characteristics between varietal germplasm sources.

Rotation

For those farmers who choose to plant HOSB in fields with no soybean growing history in the last 3–5 years—pastureland, hay fields, long-term corn silage fields—a few factors need to be considered. Seed should be treated with a Bradyrhizobium japonicum inoculant to ensure sufficient nodulation, as the bacteria will likely not be present in the soil. If the field has been heavily manured, nodulation may be poor until soil nitrogen levels are reduced, although the crop may still be highly productive due to the abundance of nutrients. It is less likely SCN will be present in these fields, but best practices should be maintained with rotating SCN resistance sources to delay potential SCN resistance. Rotating soybeans into long-term corn-on-corn fields will likely be beneficial to reduce corn pathogen and pest populations and provide more herbicide options for challenging weeds.

Weed Control

Non-GMO varieties of HOSB will require a different suite of herbicides compared with GMO varieties. Several effective herbicide options exist for all HOSB systems. Herbicide programs with layered residuals will likely be critical.

Currently, both Plenish® and Vistive® Gold have only glyphosate tolerance, consequently glyphosate-resistant weeds may pose problems in these fields. Select maturity groups of Plenish® will be available with glyphosate, glufosinate and 2,4-D tolerance (Enlist E3® varieties) in Michigan in introductory quantities for the 2026 growing season. Bayer has rebranded its Vistive® Gold as Vistive® Gold Xtend seed, which is tolerant to dicamba formulations labeled for in-crop applications (Bayer, 2022). Vistive® Gold Xtend has been planted commercially in the mid-Atlantic states and is expected to be available to Michigan farmers with select maturity groups in 2026. However, in the near-term, dicamba use will be limited to burndown applications due to uncertainty over EPA approval of labels for over-the-top dicamba products.

Identity Preservation

The main difference in production practices between HOSB and commodity soybeans is the requirement for identity preservation (IP) programs. Since HOSB have distinct genetic differences compared to commodity soybeans, they must be kept separate through the entire value chain (Pioneer, 2025). Trait stewardship includes practices such as cleaning out of planting, harvest and transportation equipment and storage bins. More stringent verification may be conducted when growing non-GMO varieties as the presence of GMO seeds produces a positive detection for the trait and can cause a load rejection. Protein- or DNA-based testing is required for detecting GMO traits.

Stewardship is also required when growing GMO varieties since inclusion of significant quantities of HOSB in conventional loads will change the fatty acid profile and nutritional value of the oil and potentially cause problems for end users. Fatty acid ratios can be measured quickly with near-infrared reflectance spectroscopy (NIRS) upon delivery to an elevator or processor or with gas chromatography. If storing grain prior to delivery, growers must have enough separate bins for the HOSB and their other grains.

Marketing and Contracts

The United Soybean Board projects the potential to grow more than 3 million acres of HOSB as human and dairy industry demand continues to grow (United Soybean Board, 2025). The initial demand spark for HOSB was created by the industry’s desire for food grade HOSB oil. Michigan farmers are positioned to take advantage of this oil market as multiple in-state processors are present.

While in the past the market signaled for strong growth of HOSB acres to be needed for human food applications, today in Michigan, the largest growth potential is seen in the dairy sector. One milking cow consumes approximately one acre of HOSB in an average ration per year (Heslip, 2025). Considering 2024 Michigan dairy herd numbers, the dairy industry could create 439,000 acres of HOSB demand in Michigan alone (U.S. Department of Agriculture, 2024). Refer to MSU Extension Bulletin E3541 for more information on feeding HOSB to dairy cattle.

Both the dairy and oil markets can add value back to soybean farmers through per-bushel premiums. This premium ranges from $0.50–$1.50 per bushel for GMO varieties and non-GMO varieties. Reaching out to your final HOSB market, either a dairy farm or third-party processor, is important to discuss premium opportunities as they change year-to-year with market conditions and demand.

Many important factors should be considered when entering into an HOSB growing contract. These factors can differ depending on whether you plan to contract directly with another farmer who will process and use the soybeans themselves, or with a third-party processor who will crush or roast the beans. Because of stewardship considerations, buyer agreements are typically on a per-acre rather than a per-bushel basis. Growers should establish the end user prior to planting HOSB.

Farmer to Farmer Contract Considerations

- Farmers must consider their capacity to grow HOSB or the acreage needed to meet the feed demands of their dairy herd.

- Many things should be considered when entering into a contract with another farmer. Always have a written and signed contract reviewed by at least one outside party (for example, an attorney or other professional).

- Make sure to include the following information, and any other important considerations in the contract:

- Premium to be paid for HOSB

- This premium can be based on premiums being paid by third-party processors. This price may also be set from local commodity soybean prices while considering possible increased input cost for growing HOSB. Make sure to consider savings on trucking and possible tradeoffs with storage or basis.

- Harvest and delivery considerations

- Include information about how the amount and conditions of the soybeans will be assessed (i.e., Will it be weighed upon delivery? What is the timing of delivery? Does a moisture test need to be conducted on each load? Who will perform the moisture testing? Is a test to verify oil content necessary? Who will perform this oil content test? Is a discount schedule in place if quality conditions are not met?) This section may also include any trucking or hauling charges to be factored into the premium.

- Storage

- Consider who will store the soybeans and if a storage premium will be paid.

- Soybean checkoff remittance

- Remember the soybean checkoff must be collected at the first point of sale. If a dairy farm is the first purchaser of soybeans, it is their responsibility to remit funds to the checkoff. Contact Michigan Soybean Committee at soyinfo@michigansoybean.org or (989) 652-3294 to learn more. Note: If a dairy farm is growing HOSB for use on their own farm, they are not subject to checkoff remittance.

Farmer to Third-Party Processor Contract Considerations

- Identify the number of bushels or acres of HOSB you may be able to grow the following season.

- Locate a third-party processor in your area and reach out to receive information about their contracting process and available premiums. This contracting process is normally completed in late summer through mid-fall for the following growing season.

- Consider the harvest and delivery stipulations in the contract and identify if you are able to meet the strict requirements. Many processors cap moisture levels between 13 and 15%.

- Most processors require you to follow some type of IP procedure. Consider if you are able to meet these IP requirements.

- Examine the available premium against your growing costs and continue with the contracting process if the value proposition makes sense for your farm.

Summary

High-oleic soybeans have proven to be beneficial both as a source of healthy cooking oil and as a high-quality dairy feedstock. Agronomic and breeding work have provided varieties and best practices to grow high-yielding HOSB crops, without sacrificing yield, which could increase net income through premiums and improved market opportunities. Markets are currently available for HOSB in Michigan and surrounding states both for oil and dairy feed, and guidance on contracting with end users is available. The potential for HOSB production and utilization can help Michigan farmers improve their bottom line and their prospects for a sustainable future.

Thanks to Mark Seamon, Research Director for the Michigan Soybean Committee, and Dann Bolinger, Dairy Specialist with Pioneer, for providing their expertise in reviewing this bulletin.

References

Alt, D., Ng, S.J., Grusenmeyer, J., Lindsey, L.E. (2018). Seed yield and quality of transgenic high-oleic and conventional soybean as influenced by foliar manganese application. Crop Science, 58(2), 874-879. https://doi-org.proxy2.cl.msu.edu/10.2135/cropsci2017.06.0391

Bayer Corporation. (2022, May 3). Bayer Collaboration with Perdue AgriBusiness to Bring Vistive® Gold Xtend Soybeans to Market. Bayer Corporation. https://www.bayer.com/en/us/bayer-collaboration-with-perdue-agribusiness-to-bring-vistiver-gold-xtend-soybeans-to-market

Bilyeu, K. (2020, May 11). High Oleic/Low Linolenic Acid Soybean Deployment. Soybean Research & Information Network. https://soybeanresearchinfo.com/research-highlight/high-oleic-low-linolenic-acid-soybean-deployment/#:~:text=The%20HO%20SOYLEIC%20third%2Dparty,Breeding%20&%20genetics

Field Advisor. (2025, July 8). SOYLEIC Varieties Deliver Competitive Yields. Illinois Soybean Association. https://fieldadvisor.org/soyleic-varieties-deliver-competitive-yields/#:~:text=Key%20Takeaway:%20All%20SOYLEIC%20varieties,and%20high%20yielding%20Pioneer%20checks

Frankel, E.N. (2005). Lipid oxidation (2nd ed.). Woodhead Publishing Limited.

Heslip, N. (2025, July 29). High oleic soybean demand likely to cause acreage shifts. Brownfield Ag News. https://www.brownfieldagnews.com/news/high-oleic-soybean-demand-likely-to-cause-acreage-shifts/

Missouri Soybean Merchandising Council. (2021). The Story Behind SOYLEIC®. https://soyleic.com/about

Oviedo-Rondon, E.O. (2024, September). High oleic soybeans and their impact on egg and poultry meat quality. AviNews International. https://avinews.com/en/magazines/avinews-september-2024/#sumario

Pioneer. (2025). Plenish® High Oleic Soybeans. Corteva Agriscience. https://www.pioneer.com/us/products/soybeans/plenish.html#anchor_4

Sanders, R. and Tegeder, D. (2024, August). US High Oleic Soybeans & High Oleic Soybean Oil Sourcing Guide for International Customers - Fourth Edition. U.S. Soybean Export Council. https://ussec.org/wp-content/uploads/2025/07/CA4347_20240807_USSEC-High-Oleic-Sourcing-Guide_2024-Update-Fourth-Edition-v4_USDAApproved-Final-1.pdf

Spear, J.D., Walter R. Fehr, W.R., Schnebly, S.R. (2013). Agronomic and seed traits of soybean lines containing the high-oleate transgene DP-305423-1. Crop Science, 53(3), 906-912. http://dx.doi.org/10.2135/cropsci2012.08.0465

United Soybean Board. (2025). What is high oleic? United Soybean Board Issue Briefs. https://unitedsoybean.org/issue-briefs/high-oleic-soybeans/

U.S. Department of Agriculture. (2024, February). Ag Across Michigan. National Agriculture Statistic Service. https://www.nass.usda.gov/Statistics_by_State/Michigan/Publications/Ag_Across_Michigan/

U.S. Food and Drug Administration. (2024). Trans Fat. https://www.fda.gov/food/food-additives-petitions/trans-fat#:~:text=In%202015%2C%20the%20FDA%20took,not%20add%20PHOs %20to%20foods

Willette, A., Fallen, B., Bhandari, H., Sams, C., Chen, F., Sykes, V., Smallwood, C., Bilyeu, K., Li, Z., Pantalone, V. (2021). Agronomic performance of high oleic, low linolenic soybean in Tennessee. Journal of the American Oil Chemists’ Society, 98(8): 861-869. https://doi.org/10.1002/aocs.12517

Print

Print Email

Email