QuickBooks Chart of Accounts

DOWNLOADAugust 25, 2023 - Corey Clark, Michigan State University Extension farm management team

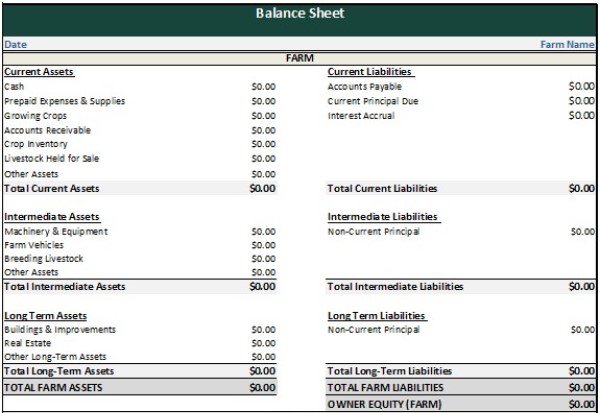

Both QuickBooks Desktop and QuickBooks Online come with a default chart of accounts for farms. But their base chart of accounts does not fully capture the information needed for tax preparers, lenders, and farm managers. No matter the type of farm you have, it is important to accurately convey your farm’s financial records to tax preparers, lenders, and your management team. Providing effective information requires keeping records that are well-designed and relatively simple to maintain.

The MSU Extension Chart of Accounts for QuickBooks provides a more complete template for farms that utilize QuickBooks for their financial recordkeeping. The list of accounts is intentionally extensive in order to encompass the diverse needs of Michigan farms. However, you can streamline the chart of accounts to your farm while still fully capturing information needed for tax preparers, lenders, and your management needs.

The best way to streamline the chart to your farm is to inactivate or delete accounts not relevant to your business. Then, use subaccounts to separate information that is needed for your farm. The MSU Farm Business team recommends that any relevant main accounts be used as specified within the chart. Using main accounts this way effectively categorizes farm transactions while staying close to IRS Schedule F tax forms. This also allows for streamlined or expanded reports as needed. For example, a tax preparer or lender might prefer a streamlined profit and loss report, while an expanded report can provide you with additional management information.

Print

Print Email

Email