Abstract

The COVID-19 pandemic caused dramatic shifts in the agricultural economy. This article estimates the economic impact of the pandemic on Michigan agricultural production. Our conceptual model focuses on differences in five aggregated agri-food supply chains: row crops, livestock, tree fruits, vegetables, and dairy. Assuming the COVID-19 economic impact is driven by commodity price changes and changes in the relative prices and volumes of food away from home and food at home, we estimate a model of costs to the Michigan economy. Our findings indicate that the pandemic decreased the overall economic output attributable to Michigan agriculture by 18.6%, with dairy and vegetable production being the hardest hit, experiencing 25.2% and 27.2% reductions in economic output, respectively. Results from our input-output analysis suggest that the Michigan economy experienced a decline of $2,186,268,000 of primary and secondary sales due to pandemic effects on agricultural producers.

Introduction

Perhaps no external event in the past century has altered U.S. agricultural supply chains as rapidly and substantially as COVID-19. Not only did each commodity experience unique consequences associated with substantial changes in consumer behavior, but each supply chain’s ability to produce demanded items was significantly impacted by pandemic outbreaks and heightened trade uncertainty. This is especially true for states that produce an extremely diverse set of agricultural commodities. Indeed, the experiences of soybean growers is entirely unlike those confronted by dairy producers – and specialty crop producers have confronted an entirely different array of issues in the wake of this virus outbreak.

Due to the diverse agricultural production in the state, Michigan growers experienced one of the most dramatic, heterogenous shocks to their production and marketing outlets. This is especially true as essential/non-essential labor designations fostered stark changes to supply chains during critical stages (Malone, Schaefer, and Wu, 2020). Examples across the Michigan agricultural supply chain abound. The state-wide, stay-at-home order decreased demand for gasoline, causing ethanol plants to slow down production (Maltais, 2020). Dairy producers across the state scrambled to adjust to changes in demand for fluid milk when schools across the state moved to online education. A “non-essential” designation led to substantial gaps in sales for garden centers across the state in the early spring. Restaurants closures reduced sales for many food items that are more likely sold to people as a finished good – such as tart cherries for pies, chicken wings, and fish.

In this article, we estimate the economic costs of these disruptions as they relate to the Michigan agricultural industry. For parsimony, we assume two agri-food marketing channels for row crops, livestock, tree fruit, vegetables, and dairy. Each value chain comprises different base-case (before COVID-19 expected prices and volumes) and post COVID-19, expected volumes and prices for 2020. Because of the nature of the question, we are forced to aggregate within each of the five commodity lines and associated value chain breakouts. We use the most recent USDA National Agricultural Statistics Service statistics for Michigan agricultural production by commodity, and County Business Patterns to trace aggregate value chains in Michigan. Value chain shares by segment (at home and away from home segments) are based on national breakouts. While many prior studies estimate economic impacts by a generic “agricultural” sector, this is particularly important as we break out economic impacts by more granular segments.

The remainder of this article is organized as follows. First, we provide a background of how agricultural supply chains adapted to COVID-19 disruptions through varying resiliency factors. Second, we describe our empirical method, which involved tracing value chain disruptions, as producers adjust to the rapid change in consumption practices. We then describe our results, which indicate that the pandemic decreased the overall economic output attributable to Michigan agriculture by 18.6%, with dairy and vegetable production being the hardest hit, experiencing 25.2% and 27.2% reductions in economic output, respectively. The final section concludes with a discussion of the study’s limitations and recommendations for future research.

Background

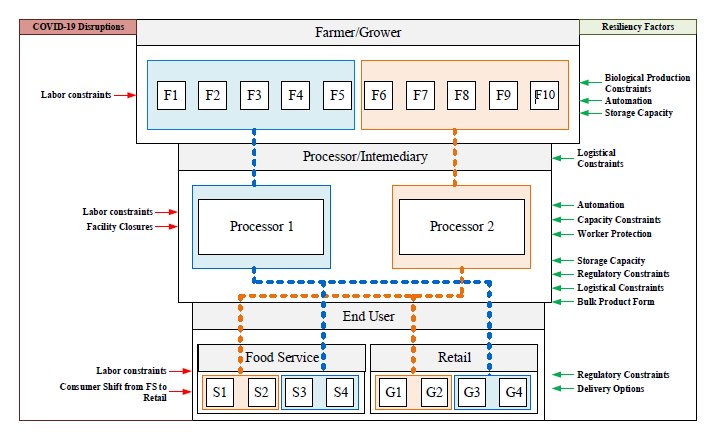

To convey the intricacies of agri-food supply chain disruptions, consider figure 1. At the farmgate, labor constraints imposed by changes in labor policy and COVID-19 outbreaks caused substantial disruptions in agricultural production. The level with which these labor constraints disrupted the supply chain were a function of grower/farmer investments in automation, storage capacity, and the biological constraints of the production system. As an example, consider the case of fruit and vegetable harvest, where migrant laborers in Michigan were required to submit to mandatory COVID-19 testing (Livengood and Walsh, 2020). Because harvest of these fresh products must occur each year in a naturally predetermined narrow window, some fruit and vegetable producers opted not to harvest to avoid the increases in labor costs and limitations on labor supply. Once the agricultural commodity left the farmgate, additional logistical constraints imposed on farm sales. In some cases, access to transportation became constrained as supply chains throughout the country tightened. In other cases, however, agricultural access to transportation improved due to reduced demand for certain transportation serves by other sectors of the economy (Gray, 2020).

Agricultural supply chains, all the way to the consumer, also experienced substantial processing disruptions at the intermediary level. Again, labor constraints caused heavy disruptions in the supply chain, even leading to closures of some major processing facilities. These production decisions became stark in late April when massive supply shocks hit meat production, signaling the second major economic shift of COVID-19. As an increasing number of employees tested positive for COVID-19, more processing facilities shuddered to contain the pandemic’s spread. These shocks were particularly intense for the heavily concentrated beef and pork supply chains as processing plant shutdowns led to 40% reductions in U.S. supply chain capacity (Saitone, Schaefer, and Scheitrum, 2020). In addition to the farmgate resiliency factors of automation and storage capacity, intermediaries were also forced to consider capacity constraints, worker protection ordinances, changes in regulatory constraints, logistical constraints, and issues with changing end-product packaging to meet a changing market.

Finally, many disruptions occurred because of changes in the end-user demand. The pandemic led to historic transitions for consumer expenditures from food away from home (FAFH) to food at home (FAH). Year-over-year consumer expenditures on food-away-from-home plummeted by 51% in March 2020, while food-at-home expenditures only increased by 18.8% over the same time, leading to a $30 billion decrease in food spending in April 2020 (U.S. Department of Agriculture, 2020). This dramatic reduction in restaurant sales led to concerns regarding a longer-term shakeup of the marketplace, including the elimination of smaller, independent options (Malone, 2020). The shift of consumption from food service outlets to grocery retail led to stockouts of major staples, including paper products, dairy milk and many shelf-stable food products. In addition to the rapid shift in end-user demand, the severity of the disruptions experienced at the food service and retail levels were a function of regulatory constraints and delivery options.

Consider the case of egg markets, which experienced some of the most notable price increases on grocery aisles. While increases in grocery demand led to spikes in shell egg prices, restaurant demand led to sharp price reductions in the liquid egg market. While the liquid egg market is mostly limited to the food service sector, both it and the shell egg markets draw from different and not-necessarily connected supply lines. In the absence of new orders and order cancellations from the food services sector, producers in that sector sought to transition to the now expanding food-at-home market. This contributed to logistical constraints associated with converting bulk restaurant orders to retail packaging but were also exacerbated by regulatory constraints that prevented the transfer of eggs across supply chains. With the removal of these regulations, prices could stabilize more quickly (Malone, Schaefer, and Lusk, 2020).

Empirical Method

The core disruption experienced by the majority of Michigan agri-food production was brought about by the abrupt change in consumer purchases from FAFH to FAH. Our empirical calculations focus on how this disruption impacted production chains and the relative rigidity in production processes hindering seamless adjustment to meet shifting demand. The logical flow of the modeling approach is presented in Figure 2. Throughout this model design, an overriding assumption is that consumer purchases of food largely remain unchanged in terms of volume, but expenditures are subject to wide swings, pending price responses of FAH and FAFH. That is, because FAFH usually commands a higher baseline prices, total expenditures for food declined as consumers shifted to FAH. Our empirical method also considers other factors including lost inventories caught in the shifting channels and constraints on harvest labor. Post-pandemic changes in sector prices and sales volume are used to model economy-wide economic impacts that account for re-circulation of dollars flowing to agricultural producers.

Using national statistics on commodity price and volume impacts, modified by insights from in-state specialists, we estimate Michigan changes in prices and volumes in response to COVID-19. We simulate changes in national flows and prices because national statistics are more readily reported than state-level statistics. Because the law-of-one-price almost certainly holds for most commodity products, the use of national price statistics does not bias our estimates (Baffes, 1991). Furthermore, national statistics better represent the changes occurring to both the primary market for Michigan agricultural output and the national and global markets in which U.S. agricultural producers operate.

The modeling framework starts at the farmgate. For both FAH and FAFH markets, each of the five commodity markets were modeled by a simplified and aggregated relationship:

y = V * P

%∆y = %∆V + %∆P

where y is the level of commodity output by segment, measured in current dollars, V is a common measure of volume (e.g. cwt) and P is the unit farmgate price. In the second equation, %∆x denotes percent change from baseline values. The value %∆y represents the basis for impact estimates, or direct effects. Direct effects propagate larger secondary effects both up and down the value chains to final consumption. Up the value chain, the value of inputs will be partially affected by volume changes, but not price changes. Down the value chain to final consumption, we assume that both the volume and price impacts remain proportional throughout the length of the value chain. For example, if wheat output declines by 10 percent, then the volume of bread manufactured in Michigan declines proportionately by 10%. Domestic stocks, imports, and product substitutions may partially mitigate the instate supply changes. These value chain-wide impact estimates are modeled using IMPLAN Pro for Michigan.[1]

The methodological framework that we utilize largely asserts that the current situation represents a severe disruption in existing value chains, where the actual volume of agricultural products is a function of expenditures at FAFH and FAH outlets. Within short- and medium-term perspectives the assumption of stable volumes may hold, but we provide for the possibility of accounting for volume drop-off that may arise, for example from labor-intensive crops where labor resource shortages have rendered short-term losses in harvests. Despite this, the crux of the impact simulation rests on the notion that the disruption to agri-food value chains throw off intended targets of agricultural output. This is best highlighted by the shift in consumer food expenditures from just over 50% FAFH to almost exclusively FAH expenditures, and slowly recovering food away from home purchases over time. We assume that in the short-term, products intended for FAFH cannot be easily re-directed towards FAH. For example, the share of bacon consumed at home is dwarfed by that consumed away from home. As such, much of the hog production value chain is fine-tuned to supply food service sectors (Krieger, 2020). That is, producers will find it expensive (if not impossible) to change to production for retail grocery sales and in some cases, inventories built up in the value chain will not be marketable in the absence of baseline markets.

We largely rely on national trends in consumer and market patterns to set simulation targets, as state-specific data is not reported by the U.S. Department of Agriculture. Hence, we assume that many of the patterns experienced nationally in response to COVID-19, are also experienced, in proportion, in Michigan. While this shift in consumer purchases does not necessarily imply a reduction in the quantity of agricultural products consumed, it represents a significant disruption of existing supply chains and revenue. Such a disruption can be costly as processors are required to retool for consumer packaging as opposed to food service packaging. This requires replacing labels (which can be expensive) as well as investment in new machines, processes, and marketing plans for reaching consumers. Even when producers seek to substitute to alternative supply chains, regulatory constraints can prevent a fluid substitution (Malone, Schaefer, and Lusk, 2020). Efficiencies are lost in the transition and old networks breakdown. Unfortunately, we have no defensible way of assessing the economic losses to lost efficiencies and operating networks, nor of the costs of process disruptions and reinvestment. These are sources of costs that, at least for the time being, will remain unaccounted.

Shifting supply channels and disruptions to supply chains mean the volume of Michigan agricultural production was heterogeneously impacted. The economic costs of COVID-19 along the Michigan agri-food value chain are estimated based on the changes in agri-food value chain sales between consumer expenditures for FAH and FAFH expenditures along with added labor supply constraints, especially as they relate to more labor-intensive agri-food systems and lost inventories. In addition, some allowance is made for changes in farm-level productivity as a measure of impact on intermediate input constraints imposed on such items as fertilizer, seeds, and agrochemicals. Regardless, we find that most economic impacts along the supply chain arise from different values attributed along two different value chains: one for FAH and one for FAFH.

Because the value attributed to food purchases away from home entail more than the value of the meal itself, the dollar-value-to-volume metric is much higher than it is for food at home. Hence, as we observed a widespread shift in consumer purchases of food from FAFH to FAH, we saw a shift from high per-unit product values to relatively lower per-unit product values. In shifting away from FAFH, consumers reduced total food expenditures (which rolled into household savings, but largely retained the total volume of food demanded). However, this simplistic view leaves out important details in that during this transition, certain commodities became in surplus, while others became scarce. For example, certain foods like bacon are most readily consumed as FAFH. The sudden shift to FAH, along with the generally lower demand for FAH bacon pushed a glut in this market. Additionally, consumers shifted to shelf-stable goods causing goods like canned beans, and peanut butter to become in short supply. Other products experienced supply disruptions elevated by consumer runs and hording behaviors at the grocery store. In our modeling framework, a decrease in price or a decrease in volume sold will result in a decrease in farm revenues. By this logic, a decrease in volume offset by a proportional increase in price will leave total farm revenues unchanged.

Estimated changes in direct effects, measured in farm sales are used to estimate economy-wide economic impacts that account for secondary transaction, or multiplier effects. These multiplier effects recognize that revenue for one individual is an expense for another, and every lost source of revenue is a lost source of economic activity that resonates throughout the economy. That is, if one receives revenues, they will use those revenues to restock, pay business expenses, including wages to workers, taxes to taxing authorities, and payments to owners of capital. The recipient of those secondary payments will also spend, generating subsequent rounds of expenditures. The resulting economy-wide impacts will tend to be larger than the initial direct effects to the farms. In the absence of these farm revenues, those secondary transactions also disappear giving rise to economic contraction that exceeds the initial impact on farm revenues. We use the IMPLAN Pro 3.1 economic simulation model for Michigan to model the economy-wide flow of transactions. Using the IMPLAN model, each agricultural sector direct effects from COVID-19 are isolated and modeled separately (though allowed to interact with other agricultural industries) and model prices are brought up to 2019 prices.

Results

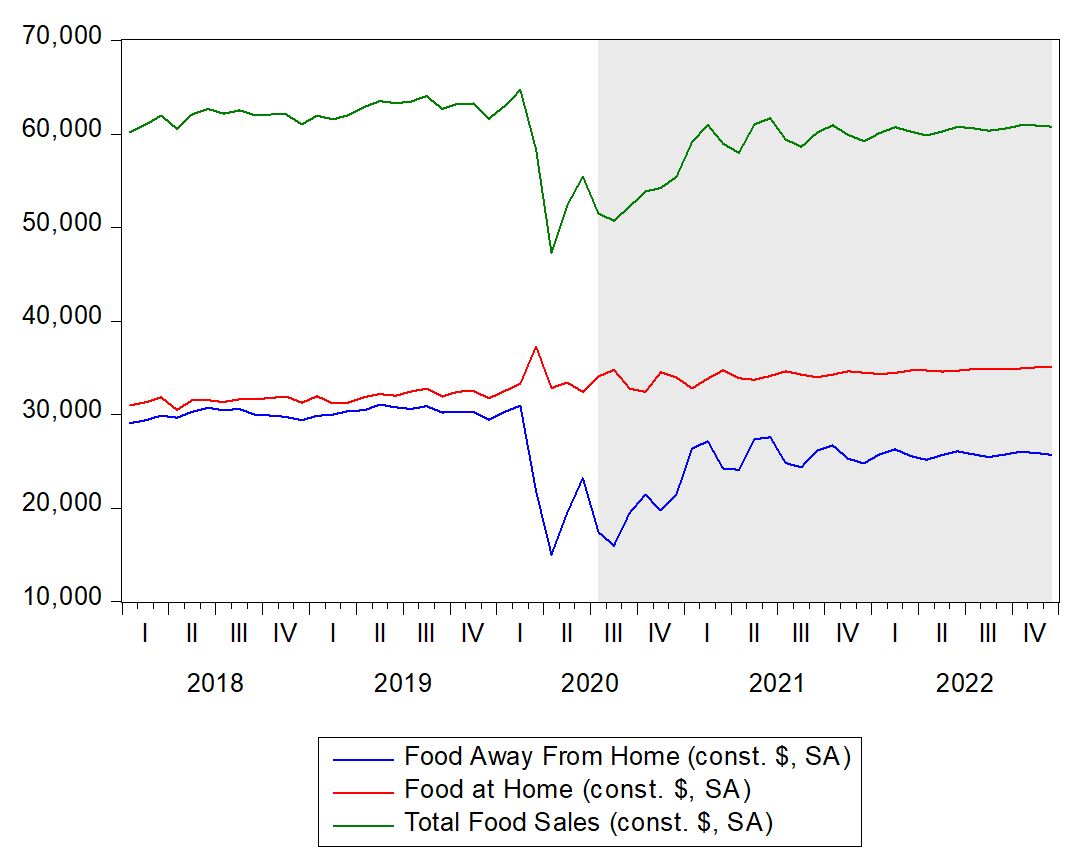

Figure 3 displays the estimates from our model of seasonally adjusted monthly food sales. We do not anticipate expenditures to reach pre-pandemic levels by the end of 2022. Prior to the pandemic, total U.S. food expenditures averaged $61.7 and $62.8 billion each month in 2018 and 2019, respectively. Our model assumes that 2020 total food expenditures will average $54.9 billion each month, and that 2021 and 2022 expenditures will rebound to $59.9 and $60.5 billion, respectively.

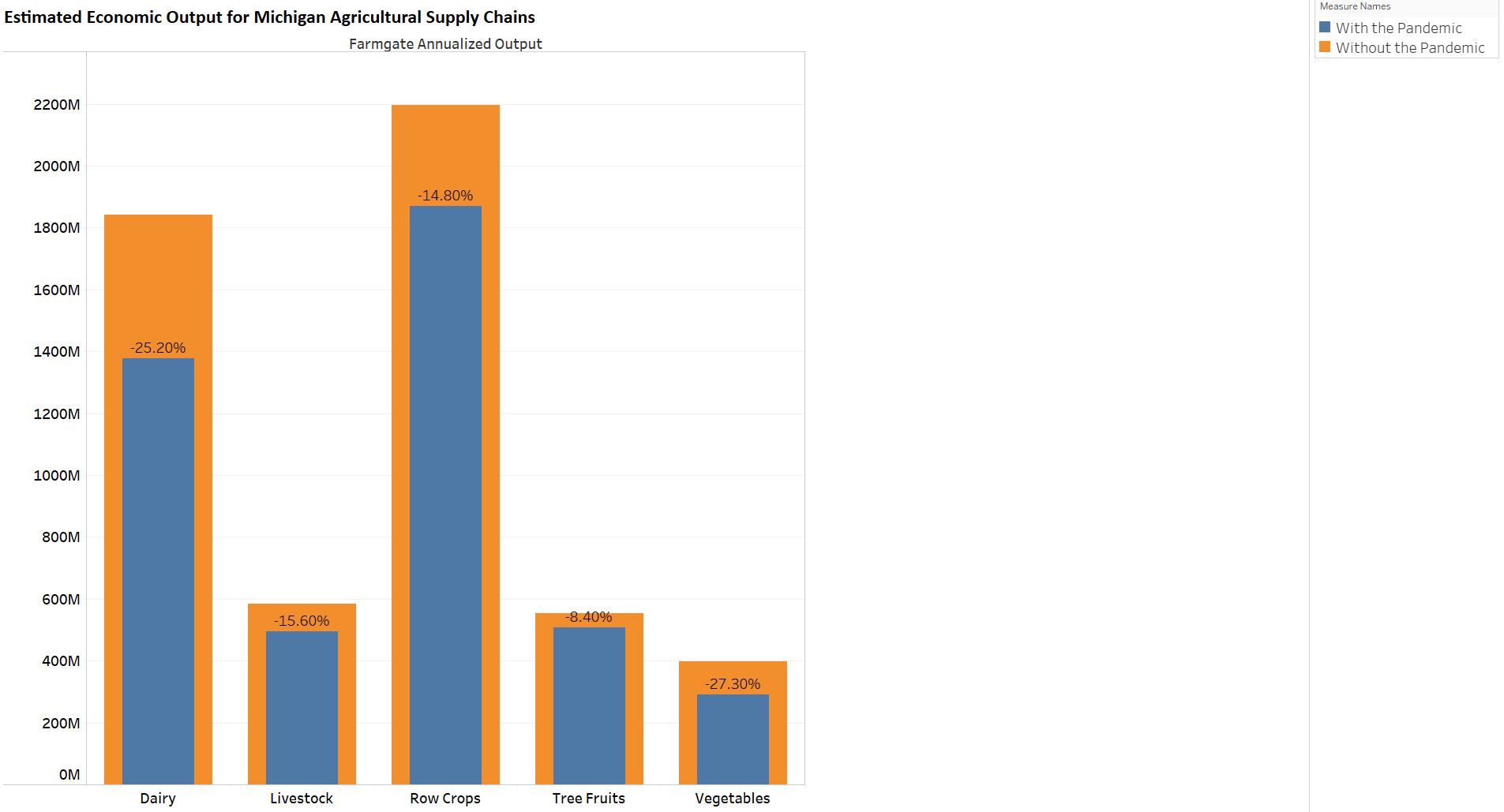

Final market sales by sector shown in Figure 3 were annualized to assess a 12-month economic impact arising from disruptions in the agri-food value chains to Michigan agricultural producers. Table 1 displays our estimates of farmgate annualized output for scenarios with and without the COVID-19 pandemic. In total, we estimate that the 2020 annualized output in Michigan would have reached more than $5.5 billion in the absence of COVID-19. Instead, our estimates suggest that farmgate annualized output slipped to slightly over $4.5 billion dollars, representing an 18.6% decline. The vegetable and dairy industries in Michigan experienced some of the largest percentage declines, with 27.3% and 25.2% drops in farmgate annualized input. In terms of dollar value, our analysis suggests that dairy and row crop producers experienced the largest total decline, losing $464 million and $325 million in total annualized output, respectively.

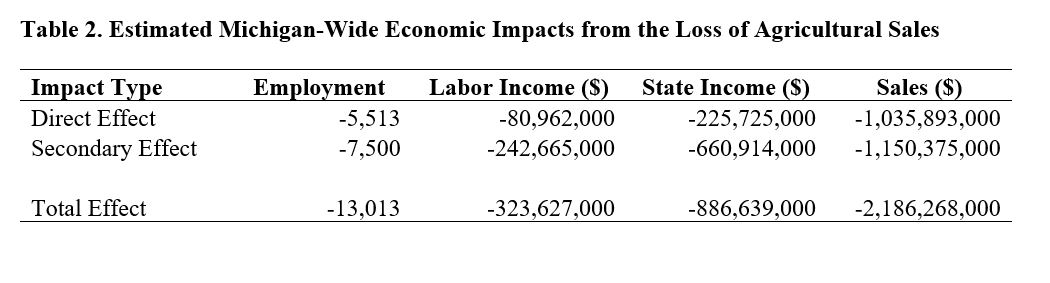

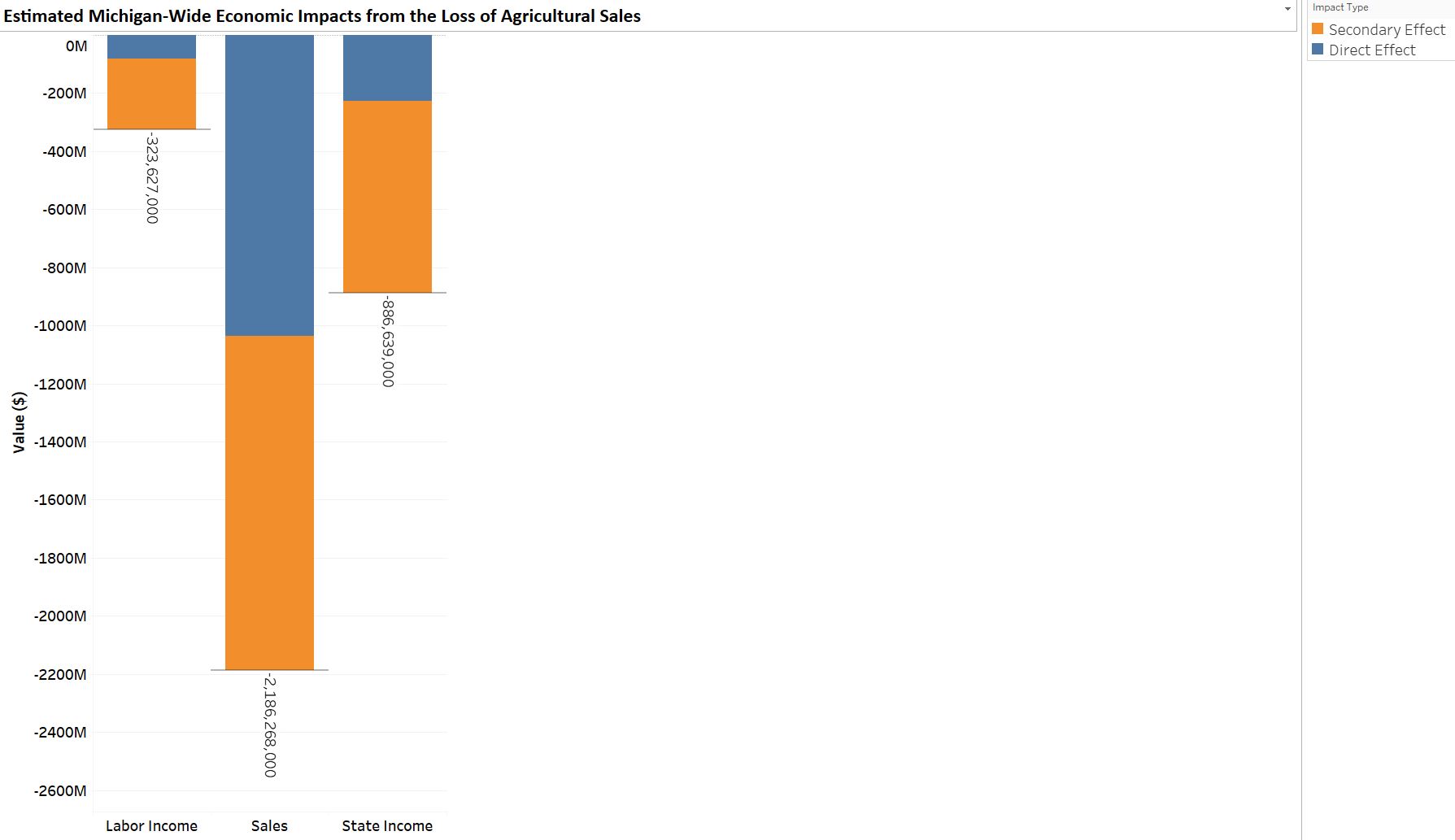

These direct effects on agricultural sectors are used in modeling the economy-wide economic impacts using IMPLAN Pro 3.1 for Michigan. IMPLAN simulation results are found in Table 2.[2] In Table 2, the $1.036 million in agricultural sales lost translates to about 5,513 direct jobs lost with annual wages of about $80.96 million. Accounting for dollar re-circulating throughout the economy, the secondary effect adds to the economic losses. An additional $7500 jobs tied to agribusiness, but not necessarily in agribusiness industries are expected to be lost because of COVID-19’s impact on Michigan’s agribusiness value chains. These lost jobs will rob workers of nearly $243 million dollars in 2020 and reduce state income (Labor and proprietor incomes and taxes) by $661 million and impose an additional $1.15 million decline in state output. The total effect on the economy is the sum of the direct effect to Michigan agricultural producers and the associated secondary effect as dollars re-circulate throughout the economy. We estimate that COVID-19 and consumer and policy responses to COVID-19 will impose a loss of 13,013 jobs in 2020, with the expectation that many of these jobs will be lost in 2021, depending on the broader recovery from the coronavirus and the efforts and successes in containing and treating it. In total, we expect that Michigan’s gross state product (State Income) will decline by just under $1 billion ($886.64 million) while the overall economy (Sales) will contract by $2.186 billion.

Conclusion

The COVID-19 pandemic created dramatic shifts in the global economy, leading to economic costs for the agri-food industry of Michigan. This study finds that the pandemic cost Michigan markets 18.6% of expected farmgate annualized output, totaling more than $1 billion in damages. Some limitations remain. Because the pandemic is ongoing, these estimates all hinge on what the “new normal” might look like. Furthermore, changes in public perceptions might increase pressure to develop new regulatory burdens on agricultural production (Kecinski et al, 2020). In addition, ongoing trade conflicts make drastic price swings in the agricultural economy even more possible, making these estimates fragile to changes in trade relationships. Our analysis overlooks the ad hoc payments that have been granted to agricultural producers, which caused some producers to anticipate positive profit margins for the 2020 year. Finally, this article focuses exclusively on the economic impacts of changes in farmgate production and sales. Future studies might benefit by calculating not only the direct, but also the indirect and induced changes in economic conditions for stakeholder communities. The costs of the pandemic are likely to be felt for some time to come, but this study provides a first step toward estimating of the economic consequences of the COVID-19 pandemic on agricultural production in the state of Michigan.

We developed economy-wide expected economic impacts of COVID-19’s impact on Michigan agricultural production. In this, once we account for how dollars re-circulate throughout the Michigan economy, we estimate that COVID-19 will impose a loss of 13,013 jobs in 2020. In total, we expect that Michigan’s gross state product (State Income) will decline by $886.6 million while the overall economy (Sales) will contract by $2.186 billion. Because we expect that consumer responses to COVID-19 will last well into 2021, some of these negative impacts are expected to carry forth, at least for the foreseeable future. However, much of it is long-term impacts depends on how consumers view dining out and travel in the wake of COVID-19 and how secure consumers feel in the presence of any treatment or vaccination that is developed to control further spread of the virus. Other uncertainties exist for 2021, and general trends for the future of Michigan remain important to consider (Malone and Schaefer, 2020). Because many Michigan acres in grain had established contracts in 2020, the presence or absence of COVID-19 had no impact on those grain-grower revenues. However, as we move into the 2021 season, a big question is how those new contracts will be impacted in 2021 and beyond.

These estimates show a material impact on the State’s economy and only represent the impact of COVID-19 through the agri-food sector. The economic impact of COVID-19 has been devastating to all industries and the estimated job loss shown here is only a component of the larger job impacts experienced in Michigan. It is through studies like these that we gain a better understanding of policy priorities and how best to respond to economic challenges brought on by this devastating pandemic.

Notes

[1] IMPLAN is a software and social accounting data system that provides a systematic accounting of transactions across industries and institutions (like households and government) in a year. It recognizes that the revenue in one category is an expense in another. Hence, it represents a system of social accounting within a double-entry accounting system that allows us to model the propagation of transactions over the course of a year.

[2] A breakdown of the secondary effects by industry can be found in the Appendix.

References

Baffes, J. 1991. "Some Further Evidence on the Law of One Price: The Law of One Price Still Holds." American Journal of Agricultural Economics 73(4): 1264-1273.

Gray, R.S. 2020. "Agriculture, Transportation, and the COVID‐19 Crisis." Canadian Journal of Agricultural Economics. 68: 239-243.

Kecinski, M., K. Messer, B.R. McFadden, and T. Malone. 2020. “Environmental and Regulatory Concerns during the COVID-19 Pandemic: Results from the Pandemic Food and Stigma Survey.” Environmental & Resource Economics. 76:1139-1148.

Krieger, A. “Economic Analysis: How Challenging Times May Impact Retail Bacon Sales. Bacon in the Time of COVID-19. April 8. Available online at:

https://www.pork.org/blog/economic-analysis-bacon-in-the-time-of-covid-19/

Livengood, C., and D. Walsh. 2020. “’Why Only Us?’ Migrant Farm Workers Push Back on State’s COVID-19 Testing Mandate.” Crain’s Detroit. September 6. Available online at:

Malone, T. 2020. “Craft Beer Revolution is in Danger Amid Coronavirus Crisis. Here’s What Can Help Save It.” USA Today. April 22. Available online at: https://www.usatoday.com/story/opinion/2020/04/22/how-save-craft-beer-industry-amid-coronavirus-crisis-column/5154202002/

Malone, T., and K.A. Schaefer. 2020. “Envisioning the Future for Michigan’s Agricultural Economy.” Michigan State University Working Paper Series.

Malone, T., K.A. Schaefer, and J.L. Lusk. 2020. “Unscrambling COVID-19 Food Supply Chains.” Working Paper. Available online at:

https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3672018

Malone, T., K.A. Schaefer, & F. Wu. 2020. “The Razor’s Edge of ‘Essential’ Labor in Food and Agriculture.” Applied Economic Perspectives & Policy. EarlyCite: 1-12.

Maltais, K. 2020. “In Another Hit for Farmers, Coronavirus Crushes Ethanol Market.” Wall Street Journal. April 26. Available at: https://www.wsj.com/articles/in-another-hit-for-farmers-coronavirus-crushes-ethanol-market-11587902400

Robertson, C.T., K.A. Schaefer, D. Scheitrum, S. Puig, and K.A. Joiner. 2020. "Indemnifying Precaution: Economic Insights for Regulation of a Highly Infectious Disease." Journal of Law and the Biosciences: EarlyCite: 1-14.

Saitone, T., K.A. Schaefer, and D. Scheitrum. 2020. “COVID-19 and Meatpacking: A Topographic Regression Approach.” Working Paper. Available online at: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3675912.

U.S. Department of Agriculture. “U.S. Food Spending in June 2020 was $12 Billion Less than in June 2019.” Economic Research Service. Available online at: https://www.ers.usda.gov/data-products/chart-gallery/gallery/chart-detail/?chartId=99193

Print

Print Email

Email