Starting the Process

The last few years have been disappointing for many farmers with decreasing revenue. It has been particularly devastating for dairy producers as milk prices and profit levels have remained low. This devastating downturn has led many dairy farmers to consider exiting the dairy business. Dairy farmers are having to consider a number of life changing decisions that they never thought would come. Liquidating farm assets can complicate the process due to potential tax liabilities that arise when selling farm assets.

These are difficult decisions to make and the process can be daunting. We will attempt to explain some of the potential tax liability issues that may arise when selling dairy farm assets as there are significant tax consequences that need to be managed.

Once you begin to consider getting out of dairy farming you need to communicate with your lender. There may be clauses within loan documentation that will allow the bank to call in any debt you owe if they feel that:

1) you are divesting of property the bank may hold in collateral or

2) you are divesting of assets they feel are pertinent to the continuation of the business not allowing the farm to produce the cashflow necessary to pay the loans back.

Before you begin the sale of farm assets it is imperative that you communicate with the bank and with tax and legal professionals that understand agriculture and tax code. If your local Extension has Farm Management agents/educators, they may also be available to help answer some questions, explain the potential issues and provide analysis of the situation.

It is important to understand that each farm and situation is unique so this short article will discuss points in general terms. A particular farm situation may be very different than is discussed in this article. Please seek the advice from trusted legal and tax practitioners familiar with these situations.

Business Structure(s) and Balance Sheets

Just like many other businesses, farms may be set-up in one or more business structure(s). The business structure may play a role in the potential tax liability of the farm. Some of the business structures include:

1) sole proprietorship (single owner)

2) partnership (two or more owners)

3) LLC (taxed as a sole proprietor or partnership)

4) subchapter S corporation, or

5) a c-corporation.

Many farms may have multiple business structures that “own” a variety of the assets of the farm. It is important to identify how you are structured.

Once you have identified your business structure(s) you should develop a detailed balance sheet. A detailed balance sheet should be developed for each business entity. The balance sheet will contain the assets (and debt) that each entity owns and this detail will assist in analyzing potential tax liability on the sale of any assets. This article will focus on the potential tax liability for sole proprietor, partnership, and LLC’s. There are typically fewer farms that have Corporations such as a subchapter -S or C-Corp that can potentially add additional complications. Due to the Tax Cuts and Jobs Act (TCJA) “the new tax law” C-corporations are typically going to have a single tax rate of 21% for the sale of assets which is different than how many other business structures will be treated.

It is important to understand that there are different types of taxes and each will have its own set of code or “rules” and associated tax rates. Some of the more common tax types that would be associated with farm asset sales include:

1) Ordinary/earned income

2) short and long-term capital gains and

3) depreciation recapture.

Understanding the different tax types, asset disposition associated with a tax type and the corresponding rates will assist a farm owner to take a more measured approach to when and how to sell or lease/rent an asset to limit tax liability.

Capital Gains

When some assets are sold for a profit, a capital gain/(loss) is generated. Profits or gains are taxable income. How much you’ll pay depends on a number of factors. Factors include the current tax brackets, the tax basis of the asset, as well as other variables.

The sale of both raised breeding livestock and purchased breeding livestock as well as other assets can create two different types of capital gain (short-term or long-term), each have very different tax consequences.

Short-term capital gains are taxed at your ordinary income tax rate for assets generally held less than a year. Long-term capital gains are gains on the sale of assets that were held for more than a year. Breeding cows, bulls and horses are an exception and must be held two years to generate long-term capital gain.

Short-Term Capital Gains Rates

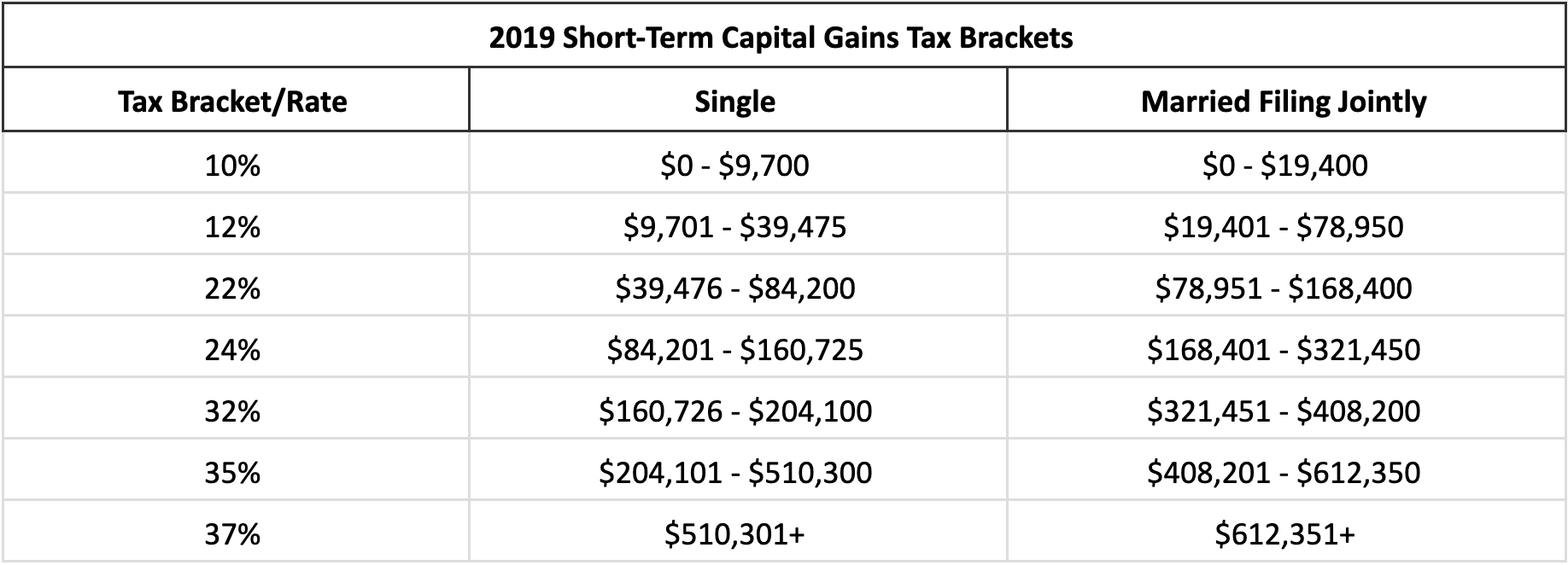

Short-term gains are for assets held for one year or less and two years or less on breeding cattle and horses. Tax rates for short-term gains are 10%, 12%, 22%, 24%, 32%, 35%, and 37% through the end of the 2025 year.

2019 Long-Term Capital Gains (LTCG) Rates

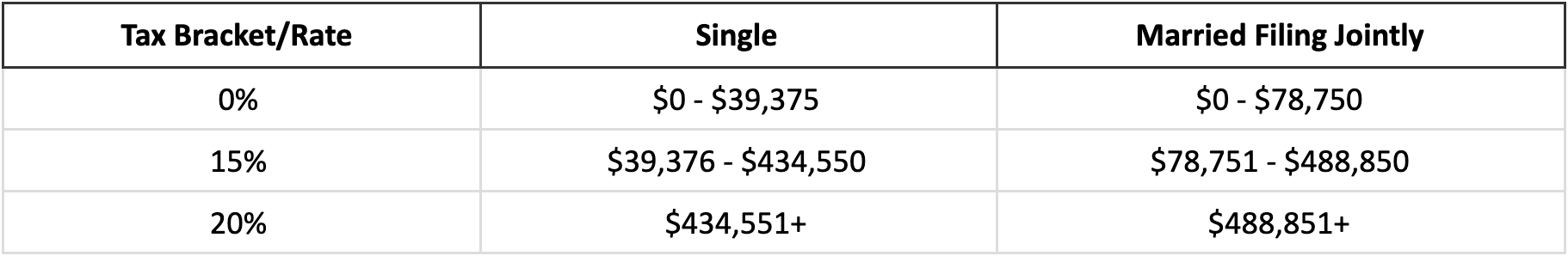

Long-term capital gains on most assets used in a trade or business are taxed at only three rates: 0%, 15%, and 20%. Rates are generally significantly lower than the ordinary rate at the same income level.

Machinery & Equipment and Single Purpose Building Sales

The sale of machinery, equipment and single purpose buildings & improvements with a GDS class life of 15 years or less are covered by IRS 26 U.S. Code Sect. 1245. Gain from dispositions of certain depreciable property, “depreciation recapture”.

“Depreciation recapture” is deemed ordinary income “gain” and is taxed at short-term capital gain rates. The sale price of an asset minus the current tax-basis equals the gain. If the asset is sold for more than its original cost the seller may need to pay different taxes 1) the ordinary gain rate for the recaptured depreciation and 2) long-term capital gain for the amount received above the original cost. Often the gain on the sale of machinery and equipment will be recaptured depreciation and taxed as ordinary gain.

Special note on Trade-ins: Sale amounts above the original acquisition price or basis will also be considered as depreciation recapture on post-1999 traded-in items used in the sold asset’s acquisition before long-term capital gain will be allowed.

In lieu of the higher tax liability usually generated on machinery and equipment sales, leasing the machinery and equipment may be an option to consider. Renting or leasing the equipment will not trigger depreciation recapture and will allow for a continued income for years to come.

Building & Improvement Sales

The sale of buildings and improvements with a 20-year depreciable life or longer are covered by IRS 26 U.S. Sect. 1250. Gain from disposition of certain depreciable realty.

All of the gain or profit on a sale is treated as long-term capital gain if the asset was depreciated using the straight-line depreciation method, long-term capital gain receives a more desirable lower tax rate treatment. Ordinary gain is only generated on depreciation taken that is accelerated or faster than the straight-line depreciation method’s dollar amount over the asset’s life. This “accelerated” amount is deemed recaptured depreciation and is taxed as short-term ordinary gain. The remainder of the gain on the sale is treated as a long-term capital gain.

Raised Breeding Livestock Sales

Raised breeding livestock such as cows and bulls that are older than 24 months of age are assets defined in IRS U.S. Code Sect 1231. Property used in the trade or business and involuntary conversions. These animals usually carry a zero tax-basis since the cost of raising them has been already deducted as a normal farm expense if you are a cash-basis taxpayer on Form 1040 Schedule F. Late bred close-up heifers if over 24 months of age may also be included under Section 1231.

The sale of these raised cows and bulls are taxed as long-term capital gain, which is taxed at a lower tax rate. The entire sale amount is taxable since the tax-basis is zero and is entered in Part I of Form 4797.

The sale of younger raised breeding livestock, heifers and bulls, that are less than 24 months of age, are taxed as short-term gain at the ordinary income tax rate and entered in Part II of Form 4797. Being raised livestock they also have a zero tax-basis so the entire sale amount is taxable.

Purchased Breeding Livestock Sales

The sale of purchased breeding stock (heifers, cows and bulls) are covered by IRS U.S. Code Sect. 1245. Gain from dispositions of certain depreciable property. This type of property is treated similar to machinery & equipment for tax purposes. The gain is considered depreciation recapture and taxed as ordinary income (self-employment tax is not initiated with 1245 property) as long as the sale price is less than the purchase price. If the 1245 property is sold above the purchase price, the sale price above the original purchase price will be taxed at long-term capital gain rates.

Crops, Feed, Milk and Supply Sales

For a cash-basis taxpayer; crops, feed, milk, and other supplies will normally have a zero cost-basis as the cost of these assets has usually been deducted as a cash expense. Therefore, the sale of feed and crop inventory, feeder livestock, milk, and supplies are all taxed as ordinary farm income and is also subject to self-employment (SE) tax which is typically at 15.3 percent up to $132,900 of taxable income.

The SE tax is actually made up of two different tax rates, Social Security and Medicare. The Social Security portion is taxed at a rate of 12.4 percent and is not payable on self-employed income above $132,900 for the 2019 year. The Medicare portion of SE is taxed at 2.9 percent for all self-employed income even above $132,900.

Land Sales

Land may have substantial equity above the mortgaged or debt amount and have unique sale procedures to be met with the creditors. The mortgagees or lien holders will have first claims on sale proceeds on the sale of the real estate. Working closely with your lenders will be important if this is a consideration.

The gain is equal to the sale price, net of selling costs, minus the cost-basis (purchase price or inherited basis less any building depreciation claimed in earlier years). The tax is calculated on the gain and is considered long-term capital gain if the land was owned for more than 12 months. This is generally a lower tax rate than what is paid on ordinary income.

Insolvency Issues

If there are insolvency issues that involve possible bankruptcy you need to work with legal and tax professionals familiar with bankruptcy tax laws. See IRS Pub 908 for the treatment of income from the discharge of indebtedness related to Bankruptcy.

Long-term issues with Cooperative equities and retains

Coop equities and retains are generally taxed in the year of issuance of the patronage dividend or product sales. They are kept back by the cooperative as equities or retains to provide capital to build and carry on business activities. The equities and retains are tax-free when distributed back to the farm in later years assuming they were taxed when issued. This may not necessarily coincide with the sale of a farm and exiting the business.

Exit Options

The variety of creative exit options can be dramatically different from one another depending on your needs, flexibility and the prospective buyer’s/renter’s needs and capabilities. Options can include the sale of everything at once to partial sales or even to the sale of some items while leasing such assets as the milking herd. Many of the options can be integrated with one another dependent on the needs and requirements of the buyer and seller.

Even having a straight sale of assets requires planning and negotiating. The sale of different assets may require coming to an agreement with the other party on how to allocation the sale amount. For example, growing crops create a taxable ordinary income for the seller and deductible basis in the crop for the buyer. The value of all assets need to be agreed upon such as tile, wells, irrigation, buildings, machinery and equipment, livestock, feed supplies, growing crops, etc.

Installment Sales – IRS Form 6252

An installment sale is a sale of property where you receive at least one payment after the year of sale. It can be used to help spread out the taxable income and may lower the tax bracket used. Installment sales of machinery & equip, and purchased breeding livestock will trigger immediate taxations of recaptured depreciation in the year that the agreement of the sale took place regardless of the repayment terms. Consideration of the installment sale treatment of certain assets and leasing of other assets based on how they are taxed may warrant some consideration.

A gross profit is calculated as the sale price minus the cost basis including recaptured depreciation on the complete sale. Then the gross profit percentage, as a percentage of the total sale, is then applied to any principal (not interest) received during the year to calculate the taxable income. Any unpaid principal is carried over to a future year and is taxed in the future. Interest received is taxed at the ordinary income rate.

Sell-all Option

One big sale or several sales in one tax year will merge all tax consequences into one tax year. It is usually more desirable if you can keep from jumping into higher tax brackets which could be avoided by spreading out the sales over two or more years. Farm income averaging (Schedule G) can be considered to fill back years lower bracket amounts and possibly keep the current year’s income from being taxed in higher tax brackets. If the sale can straddle two years it is easier to manage the potential tax liability.

Partial-sale Option

A partial sale option can be used by selling some assets that are not critical to the core business activity(ies), especially if they are not generating income. The sale proceeds can be used to pay down existing debt obligations. Another consideration would be to sell significant high value assets with equity in order to pay down debt on the remaining assets, as long as the remaining assets can still provide for a viable business.

Herd sale and Crop or Rent Land

This a good option if the remaining debt repayment obligations can be serviced with the income from cropping the land or renting the land.

Sale and lease back

Some farm sales can be leased back from the buyer. It can be a challenge to get the terms to allow a workable or feasible farming operation but is used in situations where the buyer does not want to be the day-to-day manager. Other variations of this option run from being employed back as a manager to having a multi-year lease back.

Sell Some, Keep Some

Selling some cows, which ones depend on the market outlook and when to get the best price, with the rest sold after using up the remaining feed. Assets are sold as they are no longer required such as feed inventory, machinery and equipment, etc. Sell the machinery and equipment that are used to make hay and silage once you have enough feed inventory on-hand for the remaining livestock. Once the feed inventory is reduced the remaining herd may be sold and then you may consider selling or renting the land as it is no longer required. This will spread out the sale’s taxable gains and use up the remaining feed inventory. But this technique should only be done if it is financially feasible and does not place the operation into further debt or loss situations.

Winding Down

Modify what you plant and harvest as you wind down. This will allow you to shift to a different type of farm and manage the tax liability while maintaining income and cash flow. Stronger asset sale values will be maintained as they will not be sold at “distressed sale values”.

How you wind down is dependent on the financial position, strength and liquidity or working capital along with what the creditors will agree to. Keeping lenders well informed of the plans is always a must.

Long-Term Lease/Rent

Many farmers will stop farming but continue to rent land and other assets for a long period of time. The rent income typically can offer needed stable income for years to come. The Net Investment Tax issue may arise (assuming there is not a change in tax law) when the owner decides to sell assets such as land long in the future. If the owner has not participated in farming or a trade or business there is a point that those assets will no longer be considered an asset used in a trade or business. Assets that are not used in a trade or business when sold may trigger additional taxes on top of long-term capital gains when specific thresholds are met. These taxes include a 3.8 percent Net Investment Income Tax and the .9 percent Medicare tax. It is important for an owner to give these issues consideration when planning for the future.

Concluding thoughts

Addressed in this article are some critical areas with the major tax consequences if the decision is made to sell a dairy farm. This is not an exhaustive treatment of all potential tax law effects – just the “high” points, if that’s possible. Any farm sale is inherently complex and the topics are interrelated. The decisions made to change one area can affect many other areas. It is strongly advised to work with your trusted legal and tax professional as soon as you begin serious consideration to a farm sale or conversion.

Have courage to look to a new future with new challenges. Ask for help, there are many individuals and agencies willing to assist. The farming life has always been a highly respected occupation, but not easy.

Print

Print Email

Email