Resources

More Resilient Michigan Event Materials

-

Net Flow of Federal Funds to States and Counties

Published on October 30, 2025

As part of the More Resilient Michigan event hosted by the MSU Extension Center for Local Government Finance and Policy, this presentation explores the net flow of federal funds to states and counties. -

Water System Finance in Michigan Municipalities

Published on October 30, 2025

As part of the More Resilient Michigan event hosted by the MSU Extension Center for Local Government Finance and Policy, this presentation shares key information related to public water system finance in Michigan. -

State Banks and Public Infrastructure Investment

Published on October 30, 2025

As part of the More Resilient Michigan event hosted by the MSU Extension Center for Local Government Finance and Policy, this presentation shares insight on state-level banking and public sector finance options. -

Federal Reconciliation and the State of Michigan

Published on October 30, 2025

As part of the More Resilient Michigan event hosted by the MSU Extension Center for Local Government Finance and Policy, this presentation shares information on the federal reconciliation process for the 2026 budget and the state of Michigan. -

Housing Shortages and Short-Term Rentals

Published on October 30, 2025

As part of the More Resilient Michigan event hosted by the MSU Extension Center for Local Government Finance and Policy, this presentation shares key information related to housing and short-term rentals in Michigan. -

Statewide and Lansing Area Economic Forecast: 2026

Published on October 30, 2025

As part of the More Resilient Michigan event hosted by the MSU Extension Center for Local Government Finance and Policy, this presentation shares a statewide and Lansing-area economic forecast for 2026. -

Artificial Intelligence and Infrastructure Management

Published on October 30, 2025

As part of the More Resilient Michigan event hosted by the MSU Extension Center for Local Government Finance and Policy, this presentation shares key information related to artificial intelligence in public infrastructure management. -

Inflation Perceptions in Michigan

Published on October 30, 2025

As part of the More Resilient Michigan event hosted by the MSU Extension Center for Local Government Finance and Policy, this presentation shares information on inflation perceptions in Michigan. -

Building Trust in Local Institutions: Lessons from County Canvassing Boards

Published on October 30, 2025

As part of the More Resilient Michigan event hosted by the MSU Extension Center for Local Government Finance and Policy, this presentation shares insight from a survey of Michigan county canvassers to better understand local oversight.

Municipal Fiscal Distress – Financial Condition Analysis, Early Warning Systems, Municipal Bankruptcy

-

A Standing Counter-Cyclical Fiscal Policy Mechanism for State and Local Aid

Published on August 22, 2022

The GRS and the SLFRF are examples of counter-cyclical fiscal policy for state and local aid under different economic and political contexts. Targeted use could assist local governments experiencing socio-economic distress (high unemployment and poverty). -

Does Lansing Township Have Too Much Debt?

Published on August 15, 2022

For reasons both political and practical, Lansing Township’s large debt level is unlikely to result in filing for bankruptcy or merging with nearby cities. Still, these are possibilities, and it is important to explore the ramifications for either. -

A Greater Detroit

Published on February 19, 2021

Should Ecorse, Hamtramck, and Highland Park approach the brink of insolvency in the future, the State should consider responding not by canceling local democracy, but by requiring that a vote be held on dissolution and consolidation into Detroit. -

Michigan's Local Financial Emergency Manager Law: Considering the Alternatives

Published on May 30, 2018

MSU Extension gathered stakeholder feedback on the feasibility of possible alternatives to PA 436 of 2012 to determine which alternatives have the most support within the group. -

A Review of Michigan's Local Financial Emergency Law

Published on May 10, 2017

The paper outlines the four versions of local emergency manager law, and discusses pros and cons of PA 436 of 2012. It outlines four major alternatives to the way Michigan addresses local financial emergencies. -

Beyond State Takeovers: Reconsidering the Role of State Government in Local Financial Distress ...

Published on November 11, 2015

This report’s practical recommendations are aimed at assisting the C.S. Mott Foundation, state and local officials, and Michigan residents in identifying a more effective policy and legal approach to local fiscal crises. -

Flint Fiscal Playbook: An Assessment of the Emergency Manager Years (2011-2015)

Published on November 11, 2015

This case study seeks to understand the economic and fiscal trends that led to state receivership and analyzes the impacts of the emergency manager policy on the city’s fiscal health. It updates trends presented in a previous case study. -

Knowledgeable Navigation to Avoid the Iceberg: Considerations in Proactively Addressing School District Fiscal Stress in Michigan

Published on June 20, 2015

This paper proposes a proactive, evidence-based financial health indicator system that may prevent many school districts from severe fiscal crisis. Fifty-seven Michigan school districts ended 2014 with a deficit or projected deficit. -

Developing an Early Warning System for Michigan's Schools

Published on January 21, 2015

This paper examines district deficit and predictors of distress in the proposed early warning system, finding a weak correlation. It suggests alternative fiscal measurements with stronger correlation. -

Frequently Asked Questions About the New Michigan Local Financial Emergency Law [Public Act 436 of 2012]

Published on January 30, 2013

When Michigan voters struck down Public Act 4 (commonly known as the "Emergency Manager Law"), the Michigan legislature passed a new law concerning cities and school districts in fiscal crises. -

Detroit Consent Agreement and Emergency Manager Laws

Published on August 20, 2012

Detroit Consent Agreement and Emergency Manager Laws -

The Suspension of the Emergency Manager Law and its Implications

Published on August 14, 2012

This FAQ document will outline many of the questions, identify some sources of guidance during this period of confusion, and will serve as a platform for better understanding the challenges in addressing local government financial crises. -

City of Detroit: City Employment Terms

Published on August 14, 2012

This FAQ outlines the events leading to the CET, discusses the implications, and lays out further questions to consider as the city continues to address its financial crisis. -

City of Detroit: FY 2013 Budget

Published on June 12, 2012

This FAQ explores issues related to the City of Detroit's Fiscal Year 2013 budget, including those issues that directly affect residents and taxpayers. -

The City of Detroit's New Revenue Forecasting Process and Multi-Year Budget

Published on June 12, 2012

This FAQ outlines the City of Detroit's decision to adopt multi-year budgeting, which also serves as the city's official deficit-elimination plan. -

City of Detroit Financial Stability Agreement

Published on May 19, 2012

This FAQ outlines the Detroit Consent Agreement including what a consent agreement is, Public Act 4, the Financial Advisory Board, the revenue conference, and compares Detroit’s with New York City and Philadelphia. -

A Proposed City of Detroit Consent Agreement and Public Act 4 of 2011

Published on May 19, 2012

This FAQ was developed before the official Detroit Consent Agreement was drafted. It deals with legality issues surrounding Public Act 4, which gave the state authority to conduct a financial review of the City of Detroit's finances. -

Chapter 9: Municipal Bankruptcy

Published on May 9, 2012

Introduction to Chapter 9 municipal bankruptcy, including eligibility, requirements, creditor negotiation tests, the plan of adjustment, Chapter 9 vs. Chapter 11 and the advantages and disadvantages of filing for Chapter 9.

Revenue – State Revenue Sharing, Proposal A & Headlee, Michigan State Budget

-

Net Flow of Federal Funds to States and Counties

Published on October 30, 2025

As part of the More Resilient Michigan event hosted by the MSU Extension Center for Local Government Finance and Policy, this presentation explores the net flow of federal funds to states and counties. -

Federal Reconciliation and the State of Michigan

Published on October 30, 2025

As part of the More Resilient Michigan event hosted by the MSU Extension Center for Local Government Finance and Policy, this presentation shares information on the federal reconciliation process for the 2026 budget and the state of Michigan. -

Michigan's Post-Recession Spending

Published on September 1, 2018

Over the past eight years, the state’s economy has seen significant improvements. Even with these increases, there remain significant concerns regarding funding for key public policy priorities in the state. -

Michigan Cities and Michigan Cannot Thrive Without Major Changes in Our System of Financing Local Governments

Published on May 25, 2018

Local government finances are primarily driven by property value growth and state revenue payments. Cities with TV per capita below $20,000 are likely to experience financial problems, particularly in a recession. -

Michigan Budget Policy for the Incoming 2019 Gubernatorial Administration

Published on April 1, 2018

This paper is intended to provide a general overview of key budgetary issues that incoming elected officials can expect to and should be prepared to tackle in the coming years. -

Michigan Tax Policy for the Incoming 2019 Gubernatorial Administration

Published on March 6, 2018

This is paper one in the ongoing Michigan at a Crossroad Series. The purpose of this policy brief is to provide a concise summary of some of the most important features of the tax system in Michigan, along with a brief guide to some policy proposals. -

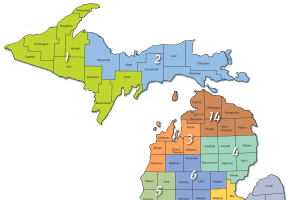

Headlee and Proposal A Explained for Michigan Counties

Published on November 1, 2017

This report provides the Michigan Constitution language and stated purpose of the Headlee and Proposal A amendments. The 2016 revenue loss due to both provisions is presented for each county. -

County Revenue Sharing Program: A Proposal for a New Formula

Published on May 8, 2017

The proposed new county revenue sharing formula levels the playing field between low and high taxable value property counties, accounts for tax effort and adjusts payments annually for inflation. -

Impact of Headlee Millage Rollback, MI Counties, 2015/16

Published on March 21, 2017

Impact of Headlee Millage Rollback, MI Counties, 2015/16 -

County Revenue Options

Published on December 1, 2016

Michigan counties have very limited revenue options other than the property tax. Additional revenue options provided to counties include general sales tax, motor fuel tax, alcohol, and tobacco tax. -

F65 Fiscal Data Portal

Published on April 9, 2013

F65 Fiscal Data Portal -

Proposal A and Headlee Rollback Talking Points

Proposal A and the Headlee Rollback provisions explained. These talking points highlight issues of concern with each provision and offers solutions for consideration.

Service Solvency - Legacy Costs, Infrastructure, Public Safety

-

A Standing Counter-Cyclical Fiscal Policy Mechanism for State and Local Aid

Published on August 22, 2022

The GRS and the SLFRF are examples of counter-cyclical fiscal policy for state and local aid under different economic and political contexts. Targeted use could assist local governments experiencing socio-economic distress (high unemployment and poverty). -

Assessing Existing Local Government Fiscal Early Warning System through Four State Case Studies: Colorado, Louisiana, Ohio and Pennsylvania

Published on December 20, 2020

This report presents detailed explanations, tradeoffs and outcomes of four existing ratio indicator systems. We assert that there is no one optimal system, only the right system based on the perceived needs of policymakers in that particular location. -

Local Government Financial Vulnerability: New Tools for Identifying and Tracking Challenges

Published on December 8, 2020

The onset of a major pandemic-induced recession has presented a second wave of fiscal problems for local governments. State and local governments are seeking out new tools to assess fiscal risk and vulnerability and to chart new options moving forward. -

Pennsylvania Offers A Curious Case To Explore Alternatives To Early Warning Systems And State Intervention: Can Michigan Keep Its Horses From Wandering Off?

Published on May 5, 2020

The purpose of this report is to apply the Early Warning System (EWS) used by Pennsylvania with Michigan local government financial and socioeconomic data, as a way to assess potential fiscal distress that cities, townships, and counties may experience. -

Systems Framework for Meeting Local Government Service Solvency Standards: Case Study of the City of Flint, Michigan

Published on April 17, 2020

This white paper is a review of the financial and service challenges, issues and conditions facing the city government of Flint, Michigan as of 2019. -

Flint Community Schools: Fiscal and Service Solvency: MSU Extension Center for Local Government Finance and Policy White Paper

Published on February 3, 2020

This white paper proposes that the ability of Flint Public Schools to meet adequacy standards is severely constrained and it seems unlikely this will change under the current policy structure. -

Potential for Economic Regulation of Michigan's Water Sector

Published on November 7, 2018

Part of the Michigan at a Crossroads policy guide, this is a policy brief for the incoming 2019 Michigan gubernatorial administration on issues related to water regulation. -

Infrastructure Investment and Financing for the Incoming 2019 Gubernatorial Administration

Published on November 1, 2018

This white paper, part of the Michigan at a Crossroads policy guide, analyzes the importance of infrastructure investment, a history of infrastructure in the state of Michigan, and policy options for infrastructure investment. -

A new approach to evaluating the fiscal health of Michigan local governments: Comparing fiscal performance relative to available resources

Published on June 1, 2018

The purpose of this report is to develop a scoring system for Michigan local governments that accurately reflects their fiscal condition. -

Service Solvency: Ability of Michigan Cities to Provide an Adequate Level of Public Services

Published on June 19, 2017

Using audit reports and F-65 reports from the Department of Treasury, this report identifies Michigan cities that may be service insolvent, or on the verge of being unable to provide fundamental services to their residents. -

Service Solvency: An Analysis of the Ability of Michigan Cities to Provide Adequate Public Service

Published on May 1, 2017

Michigan has more cities under state supervision than any other state, as many of our cities are suffering from fiscal stress. -

Chapter 9 Bankruptcy: Simulation Exercise

Published on December 12, 2016

While not a cure for fiscal stress, Chapter 9 is a tool that a municipality may use to reset its financial course when all other methods fail. This paper identifies several lessons learned through a simulation exercise using live case data. -

The Lansing-East Lansing Metro Region Fiscal Scorecard

Published on May 9, 2012

This report analyzes the efficiency of the local governments in the Lansing-East Lansing metro region by comparing them to the governments in other similar metropolitan statistical areas (MSAs) throughout the United States.

Local Government Policy

-

Great Lakes Brief for the Incoming Michigan Governor

Published on October 12, 2018

The purpose of this brief is to provide a concise summary of some of the key policy debates surrounding the management and use of Great Lakes water resources. -

Michigan Health Policy for the Incoming 2019 Gubernatorial Administration

Published on August 1, 2018

This brief will provide an overview of four key and timely health policy topics: Medicaid and the Healthy Michigan Plan; the individual health insurance market; the opioid epidemic; and integration of services to address social determinants of health. -

Michigan K-12 Education Policy Brief for the Incoming 2019 Gubernatorial Administration

Published on August 1, 2018

This brief is, at best, a 30,000-feet-fly-over of the significant structural and contextual components of that system, including how schools are organized, funded, and governed, and current issues and trends that impact their success.

-

Data Center Resources

Published on February 12, 2026

This at-a-glance document provides an overview of data centers and highlights resources available to communities and local leaders as they navigate a complex landscape. -

More Resilient Michigan Event Materials: October 2025

Published on October 31, 2025

This document collects the different resources and presentations featured as part of the More Resilient Michigan workshop hosted by the MSU Extension Center for Local Government Finance and Policy. -

Net Flow of Federal Funds to States and Counties

Published on October 30, 2025

As part of the More Resilient Michigan event hosted by the MSU Extension Center for Local Government Finance and Policy, this presentation explores the net flow of federal funds to states and counties. -

Water System Finance in Michigan Municipalities

Published on October 30, 2025

As part of the More Resilient Michigan event hosted by the MSU Extension Center for Local Government Finance and Policy, this presentation shares key information related to public water system finance in Michigan. -

State Banks and Public Infrastructure Investment

Published on October 30, 2025

As part of the More Resilient Michigan event hosted by the MSU Extension Center for Local Government Finance and Policy, this presentation shares insight on state-level banking and public sector finance options. -

Federal Reconciliation and the State of Michigan

Published on October 30, 2025

As part of the More Resilient Michigan event hosted by the MSU Extension Center for Local Government Finance and Policy, this presentation shares information on the federal reconciliation process for the 2026 budget and the state of Michigan. -

Housing Shortages and Short-Term Rentals

Published on October 30, 2025

As part of the More Resilient Michigan event hosted by the MSU Extension Center for Local Government Finance and Policy, this presentation shares key information related to housing and short-term rentals in Michigan. -

Statewide and Lansing Area Economic Forecast: 2026

Published on October 30, 2025

As part of the More Resilient Michigan event hosted by the MSU Extension Center for Local Government Finance and Policy, this presentation shares a statewide and Lansing-area economic forecast for 2026. -

Artificial Intelligence and Infrastructure Management

Published on October 30, 2025

As part of the More Resilient Michigan event hosted by the MSU Extension Center for Local Government Finance and Policy, this presentation shares key information related to artificial intelligence in public infrastructure management. -

Inflation Perceptions in Michigan

Published on October 30, 2025

As part of the More Resilient Michigan event hosted by the MSU Extension Center for Local Government Finance and Policy, this presentation shares information on inflation perceptions in Michigan.

Print

Print Email

Email